Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

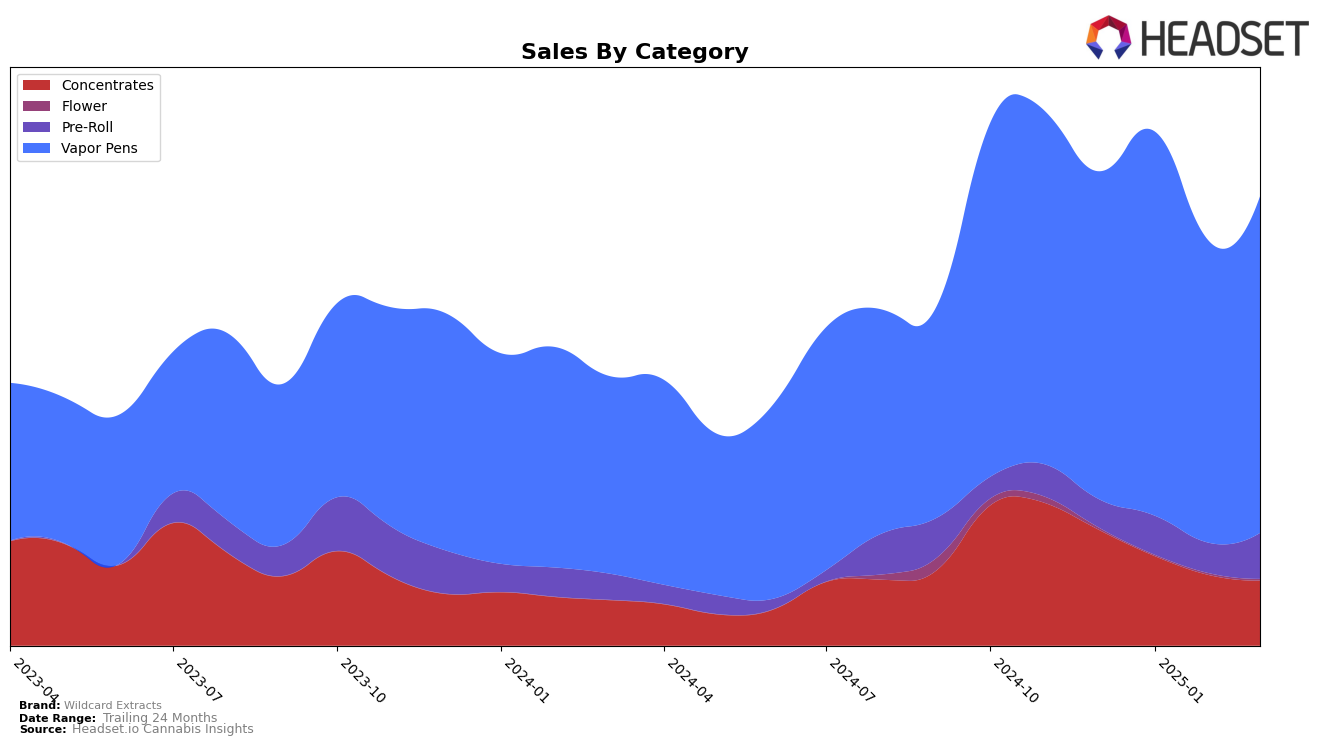

Wildcard Extracts has shown varying performance across different categories and regions in the Canadian market. In Alberta, the brand has seen some fluctuations in its rankings, particularly in the Concentrates category, where it moved up to the 29th position in January 2025 but fell out of the top 30 by March 2025. This inconsistency highlights challenges in maintaining a strong market presence. Conversely, in the Vapor Pens category, Wildcard Extracts saw a notable improvement, climbing from the 69th spot in February 2025 to 41st by March 2025, indicating a positive trend. In British Columbia, the brand maintained a relatively stable presence in the Concentrates category, consistently ranking around the 16th position from February to March 2025, suggesting a steady demand in this segment.

In Ontario, Wildcard Extracts faced challenges in gaining traction across categories. The brand's ranking in the Concentrates category improved slightly from 55th in December 2024 to 44th by March 2025, indicating a gradual increase in market penetration. However, the Vapor Pens category presented a different story, with rankings hovering in the 90s throughout the observed months, reflecting potential difficulties in capturing consumer interest in this segment. Meanwhile, in British Columbia, the Pre-Roll category saw Wildcard Extracts outside the top 30 by March 2025, which might suggest a need for strategic adjustments to boost their presence in this competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Wildcard Extracts has experienced notable fluctuations in its market position, which could influence its strategic approach. From December 2024 to March 2025, Wildcard Extracts maintained a relatively stable rank, starting at 13th, peaking at 11th in January and February, and returning to 13th by March. This suggests a competitive but stable presence in the market. Notably, Tribal has shown a significant upward trajectory, moving from 14th to 11th place, indicating a potential threat to Wildcard's market share. Meanwhile, Kolab also improved its rank from 16th to 12th, showcasing a competitive edge that could further challenge Wildcard Extracts. In contrast, Endgame experienced a decline, dropping from 10th to 14th, which might provide an opportunity for Wildcard Extracts to capture some of its market share. Overall, while Wildcard Extracts has maintained its position, the dynamic movements of its competitors suggest that strategic adjustments could be beneficial to enhance its competitive standing in the British Columbia vapor pen market.

Notable Products

In March 2025, the G Wagon Cured Resin Cartridge (1g) emerged as the top-performing product for Wildcard Extracts, securing the number one rank with sales of 1964 units. The White Mimosa Live Resin Cartridge (1g) followed closely, achieving the second rank, marking its first appearance in the rankings. The Pomelo Skunk Full Spectrum Cured Resin Cartridge (1g) maintained consistent performance, holding steady at the third rank, similar to its position in December 2024. Space Panda Live Resin Cartridge (1g), which previously held the top spot, dropped to fourth place in March. Waffle Bites Cured Resin Cartridge (1g) saw a decline in popularity, moving from the second rank in January and February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.