Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

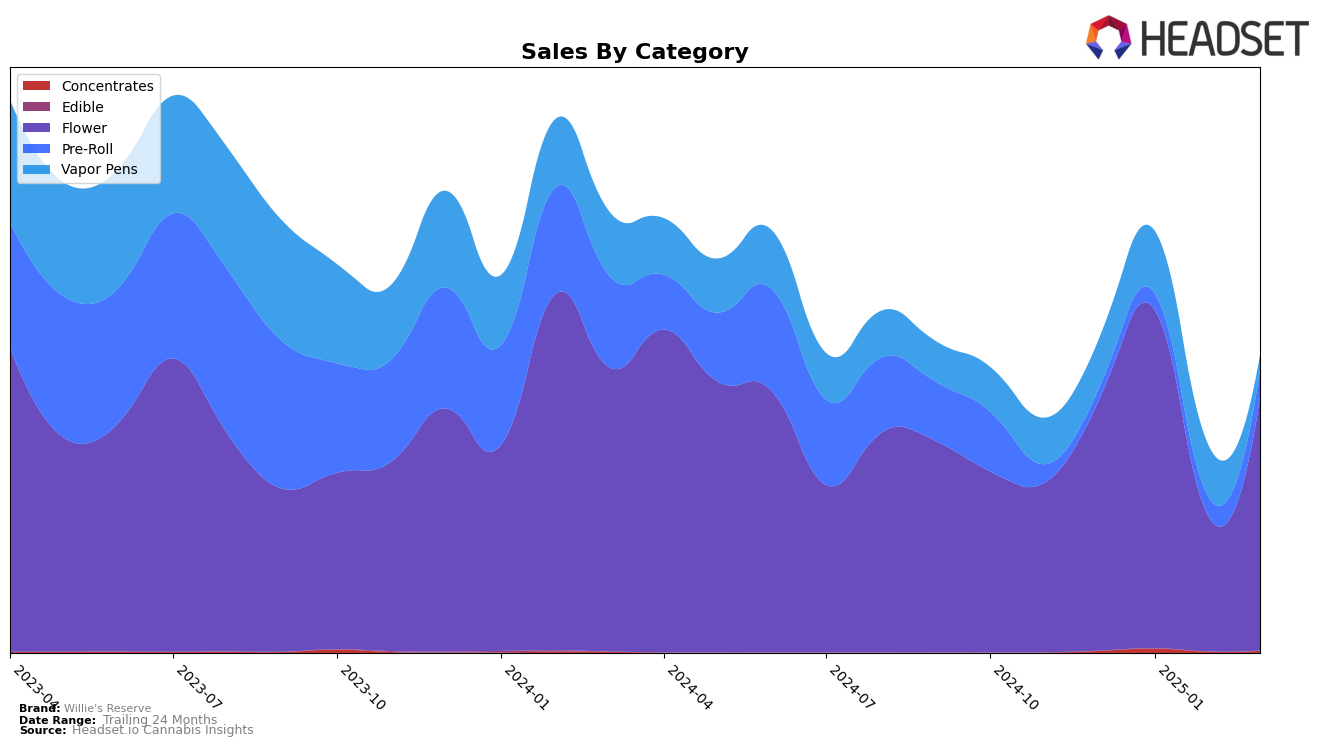

Willie's Reserve has shown varied performance across different states and product categories. In Colorado, the brand's presence in the Vapor Pens category has seen a downward trend, with rankings slipping from 63rd in December 2024 to 71st in January 2025, before dropping out of the top 30 in subsequent months. This indicates a challenging market environment for the brand in this category. Conversely, in Ohio, Willie's Reserve has maintained a relatively strong position in the Flower category, achieving a peak ranking of 15th in January 2025, although it slipped to 28th by March. The brand's performance in Vapor Pens in Ohio also saw fluctuations, with a notable drop to 48th place in March 2025, suggesting potential volatility in consumer preferences or competitive pressures.

In Michigan, Willie's Reserve made a notable entry into the Flower category, securing the 85th position by March 2025, which indicates room for growth in this market. Meanwhile, in Missouri, the brand has been more stable in the Flower category, with rankings oscillating between 36th and 48th over the months, and showing a positive sales trend in the Pre-Roll category, climbing to 52nd place by March 2025. This suggests a steady consumer base and potential for expansion in Missouri's Pre-Roll market. Overall, while there are areas where Willie's Reserve is facing challenges, there are also opportunities for growth and increased market penetration in certain states and categories.

Competitive Landscape

In the Michigan flower category, Willie's Reserve has faced notable competition, impacting its market presence and sales trajectory. As of the latest data, Willie's Reserve did not rank in the top 20 brands from December 2024 to March 2025, indicating a potential decline in market visibility. In contrast, competitors like Michigander Fire and Galenas have shown varied performance, with Michigander Fire maintaining a presence in December and March, and Galenas making a significant jump to rank 78th in March 2025. Bamn consistently ranked within the top 100, albeit with a downward trend from 54th in December to 81st in March. Meanwhile, Fly re-entered the rankings in March at 93rd, suggesting a resurgence. These dynamics highlight the competitive pressures in the Michigan flower market, where Willie's Reserve may need strategic adjustments to regain its footing and enhance sales performance against these active competitors.

Notable Products

In March 2025, the top-performing product from Willie's Reserve was GMO x Blueberry (2.83g) in the Flower category, maintaining its position as the number one ranked product with sales of 4,158 units. Lilac Diesel (3.5g), also in the Flower category, emerged as the second top performer with notable sales. Purple Dreamz (Bulk) followed in third place, indicating a strong preference for bulk flower products. The Flame Banger Pre-Roll 2-Pack (1g) and Purple Churro Pre-Roll 2-Pack (1g) secured the fourth and fifth positions, respectively, highlighting a growing interest in pre-rolls. Notably, GMO x Blueberry (2.83g) has consistently held the top spot since December 2024, while Lilac Diesel and Purple Dreamz have newly entered the rankings, showcasing a shift in consumer preferences towards these products in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.