Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

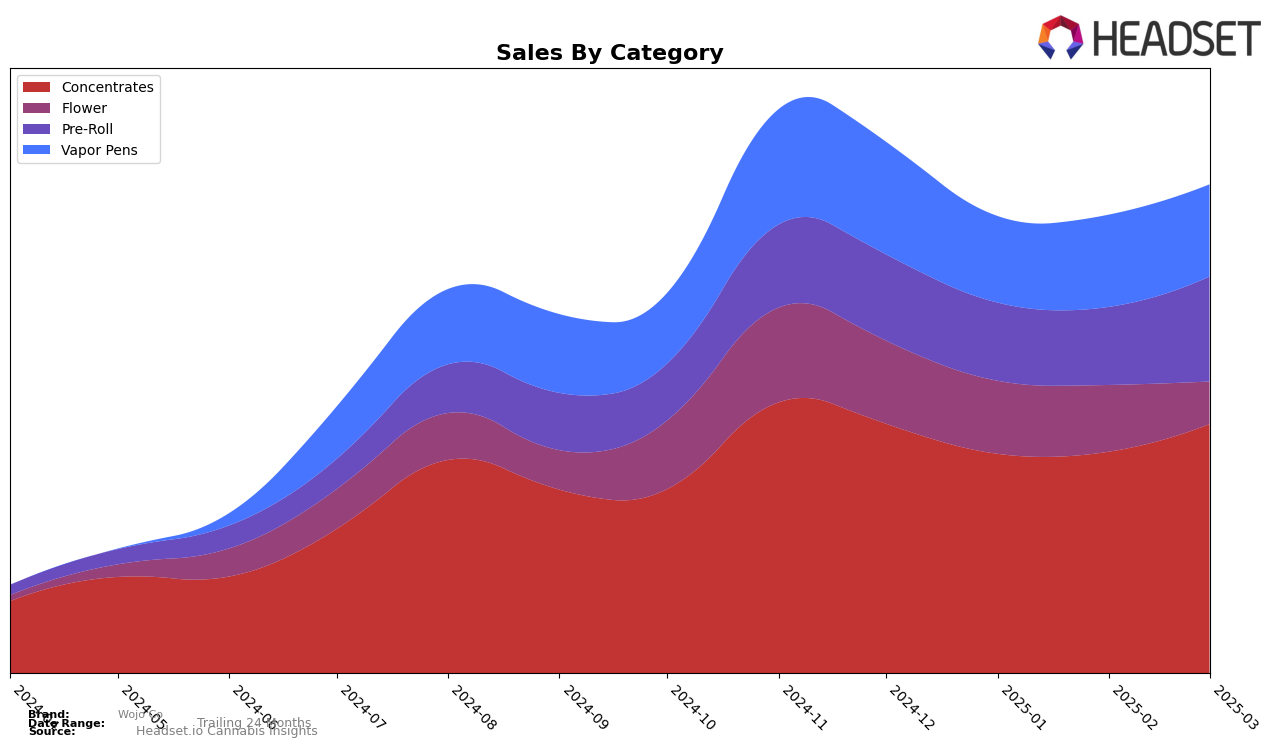

Wojo Co has shown a consistent performance in the Concentrates category in Michigan, maintaining a stable rank of 3rd place from January to March 2025 after moving up from 4th in December 2024. This indicates a strong presence and potential customer loyalty in this category. Despite a dip in sales in January 2025, the brand's sales figures rebounded by March, suggesting resilience and effective market strategies. In contrast, Wojo Co's position in the Vapor Pens category appears less stable, with rankings fluctuating between 32nd and 40th place, potentially indicating challenges in maintaining market share or increased competition.

The Pre-Roll category presents a different narrative for Wojo Co in Michigan. While the brand did not initially rank in the top 30, it showed a positive trajectory by climbing from 42nd in December 2024 to 31st by March 2025. This upward movement could be a sign of growing popularity or successful promotional efforts. However, the brand is still outside the top 30, which could be a concern if the goal is to establish a stronger foothold in this segment. Observing these trends, it becomes apparent that while Wojo Co is performing well in certain categories, there are areas that may require strategic focus to enhance their market position further.

Competitive Landscape

In the Michigan concentrates market, Wojo Co has maintained a consistent rank of 3rd place from January to March 2025, following a slight improvement from 4th place in December 2024. This stability in ranking suggests a solid market presence, yet it faces stiff competition from brands like The Limit, which has consistently held the top position. Meanwhile, Rocket Fuel has demonstrated remarkable growth, leaping from 40th place in December 2024 to 2nd place by February 2025, indicating a rapid increase in sales and market share that could pose a threat to Wojo Co's position. Additionally, Common Citizen and Ice Kream Hash Co. are also strong contenders, with ranks of 4th and 5th respectively in March 2025, suggesting a competitive environment where Wojo Co must innovate and strategize to maintain or improve its standing.

Notable Products

In March 2025, Island Zkittlez (Bulk) from the Flower category emerged as the top-performing product for Wojo Co, maintaining its leading position with impressive sales of 15,229 units. Oishii Live Rosin (1g) followed closely in second place within the Concentrates category, while Oishii Pre-Roll (1g) secured the third spot in the Pre-Roll category. Notably, DooBee - Rainbow Pave 9 Infused Pre-Roll (1g) experienced a drop from first place in February to fourth in March. Runtz Live Rosin (1g) saw a decline from its peak position in January as it settled into fifth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.