Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

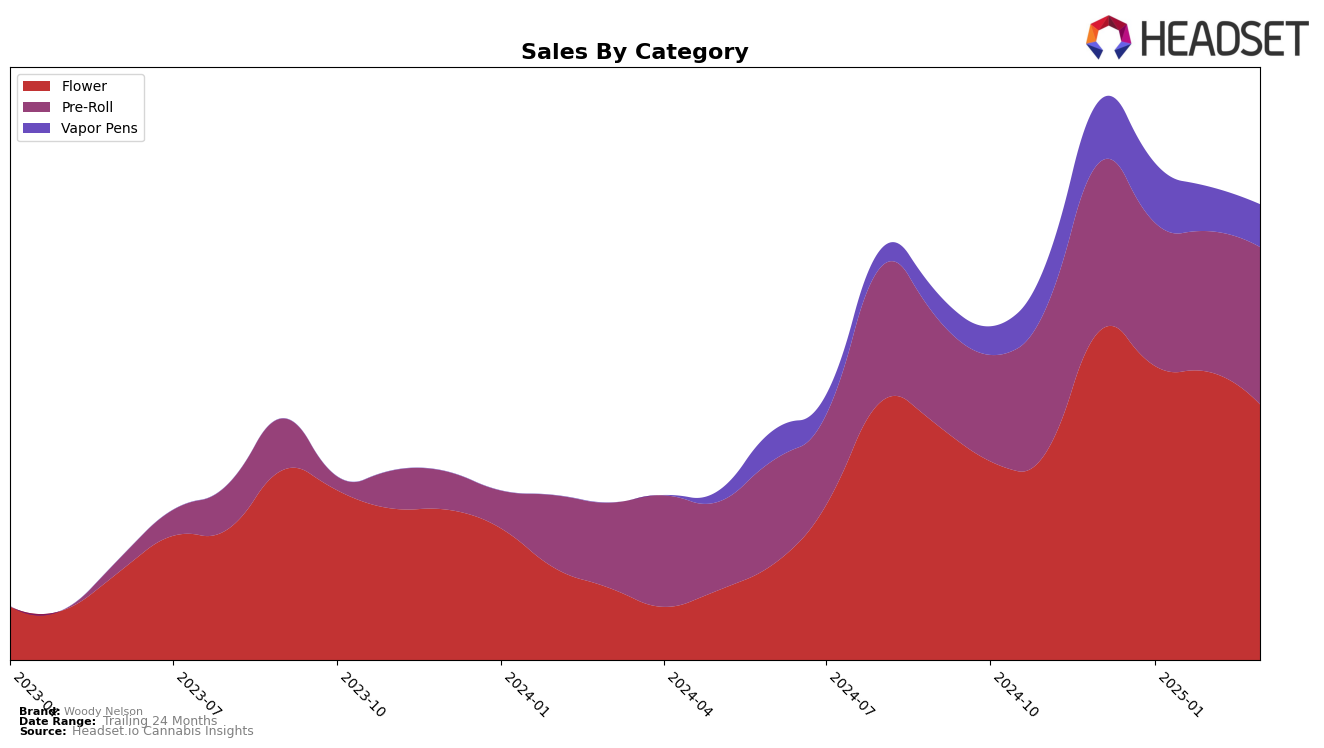

In British Columbia, Woody Nelson's performance in the Flower category has shown a slight decline in ranking from December 2024 through March 2025, moving from 13th to 18th. Despite this downward trend, the brand maintained a presence within the top 20, which is a positive sign of its competitiveness in the market. In the Pre-Roll category, Woody Nelson experienced fluctuations, dipping out of the top 30 in January before bouncing back slightly in February, only to drop again in March. This inconsistency highlights potential challenges in maintaining a steady market position. Meanwhile, in the Vapor Pens category, the brand consistently remained in the top 30, though it faced a gradual decline in rankings, indicating a need for strategic adjustments to regain momentum.

In Ontario, Woody Nelson's performance in the Flower category was more volatile, with the brand not appearing in the top 30 in December and January but making a significant leap to 30th in February, before slipping to 40th in March. This suggests that while there are opportunities for growth, sustaining high performance remains a challenge. The Pre-Roll category in Ontario also saw Woody Nelson outside of the top 50 for most of the period, though it managed to climb to 54th by March, indicating potential improvements in market penetration. The Vapor Pens category presented a mixed picture, with Woody Nelson not ranking in the top 30 in December and February, but securing the 75th position in March, reflecting sporadic engagement in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Woody Nelson experienced notable fluctuations in rank and sales from December 2024 to March 2025. Starting in December 2024, Woody Nelson held a solid 13th position, but by March 2025, it had slipped to 18th. This decline in rank coincided with a decrease in sales, which peaked in January 2025 before declining over the subsequent months. In contrast, Grasslands showed a remarkable upward trend, climbing from 23rd in December 2024 to 16th by March 2025, with sales increasing significantly during this period. Meanwhile, Tweed maintained a presence in the top 20 but saw a downward trend, ending March 2025 in 19th place. Parcel demonstrated more stability, maintaining a consistent presence in the mid-teens. These dynamics suggest that while Woody Nelson faces challenges in maintaining its rank amidst strong competition, there are opportunities to learn from competitors like Grasslands, which have successfully improved their market position.

Notable Products

In March 2025, Rainbow Driver 3.5g maintained its top position as the best-selling product from Woody Nelson, with sales reaching 4400 units. Rocketeer Infused Pre-Roll 1g climbed to the second spot, showing a notable increase from its absence in February. Flight 525 Pre-Roll 5-Pack 2.5g held a steady presence, securing the third rank, slightly up from its fourth position in January. Pink Kush 3.5g, although dropping from its December lead, settled at fourth place, indicating a consistent demand despite fluctuating ranks. Rainbow Driver Pre-Roll 5-Pack 2.5g rounded out the top five, showcasing a slight decline from its previous second-place ranking in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.