Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

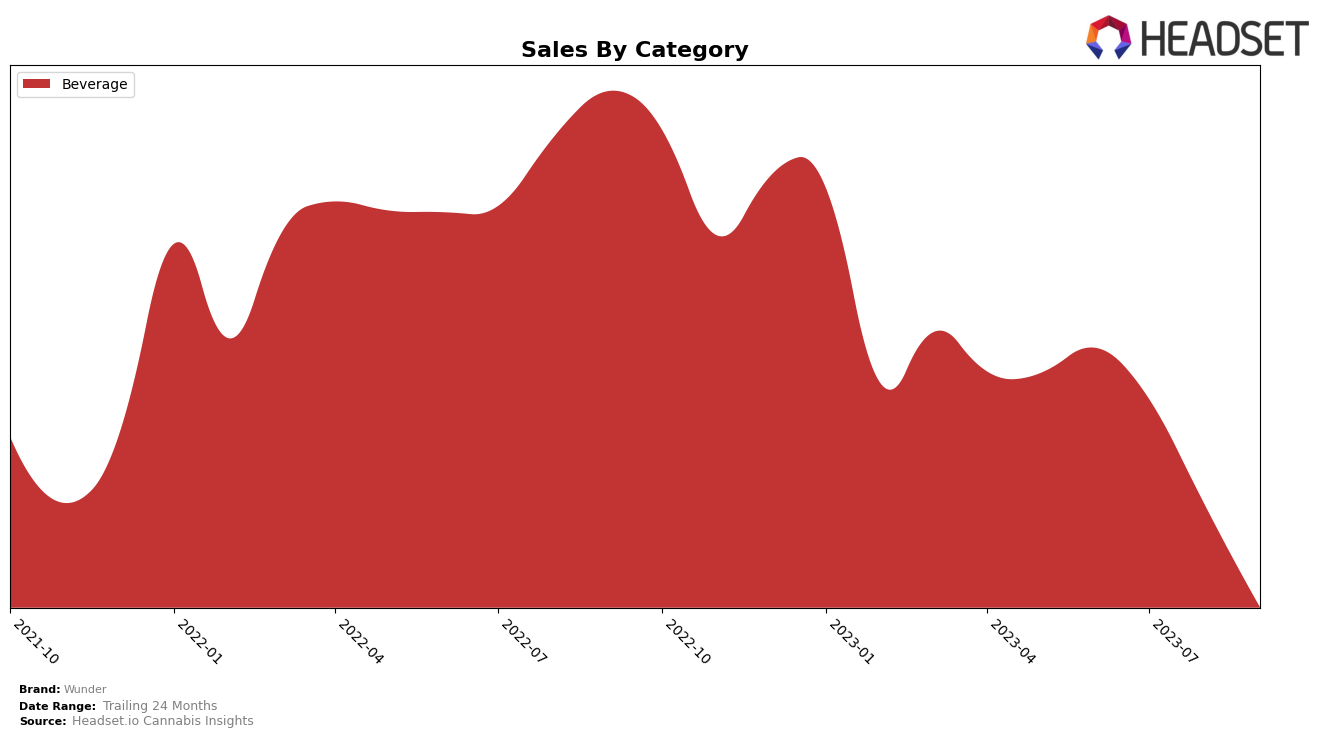

In the beverage category, Wunder has seen some significant shifts in its performance across different months in the state of California. In June 2023, the brand was ranked 6th, which is a commendable position. However, there has been a downward trend in its ranking since then, falling to 8th in July and further down to 11th in August. The most notable drop was in September when it slipped to the 15th position. This indicates a decrease in the brand's market competitiveness within the state's beverage category over this period.

When it comes to sales, there is a similar trend. Wunder's sales peaked in June 2023, with a substantial figure that is not disclosed here. However, this peak was followed by a decline in the subsequent months. The drop in sales from August to September is particularly significant, suggesting a potential need for the brand to reassess its strategies in the California market. Despite these movements, it's important to note that Wunder remained within the top 20 brands in the state's beverage category throughout this period, which is an achievement in itself given the competitive nature of this market.

Competitive Landscape

In the competitive landscape of the Beverage category in California, CQ (Cannabis Quencher) and Cannavis Syrup have maintained a steady rank over the past four months, while Wunder experienced a significant drop from 6th place in June to 15th place in September. This suggests a decrease in sales for Wunder, which is confirmed by the data, although exact figures are not provided. Meanwhile, Kan+Ade and Sip Elixirs have also maintained a relatively consistent rank, indicating stable sales. It's worth noting that Wunder's rank in June was higher than all these competitors, but its September rank was lower than all but Kan+Ade. This suggests a significant shift in consumer preference or market dynamics affecting Wunder.

Notable Products

In September 2023, the top-performing product from Wunder was the THC/DLTA-8 4:1 Godspeak - Watermelon Punch, which sold 1589 units. This product climbed from the second position in previous months to claim the top spot. The Godspeak - Blackberry Lemon Carbonated Beverage, which was the best seller in July and August, slipped to second place with 1016 units sold. The Higher Vibes 20 - Sparkling Watermelon Basil Seltzer 4-Pack maintained its third position, while the THC/Delta-8 4:1 Godspeak - Watermelon Basil Soda moved up to fourth. The new entrant to the top five was the Higher Vibes 20 - Grapefruit Hibiscus Sparkling Beverage, selling 639 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.