Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

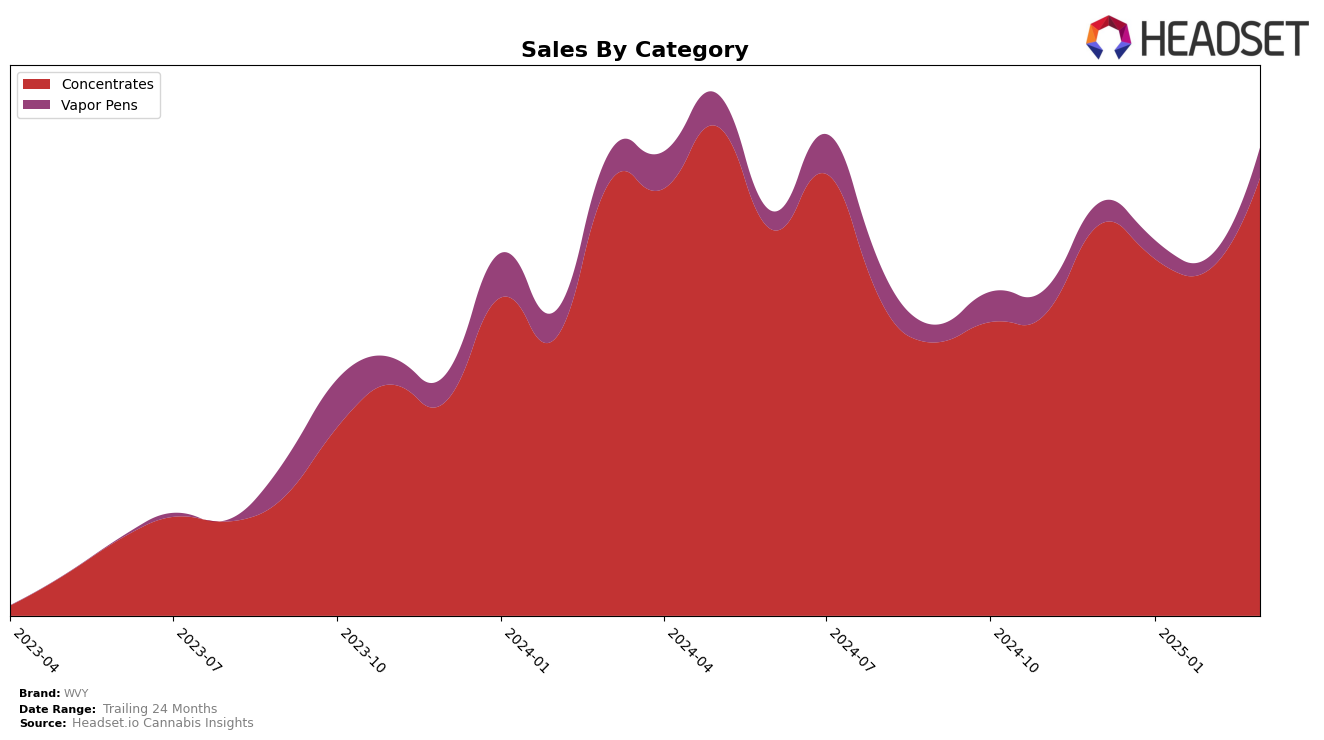

WVY has shown a notable performance in the Concentrates category across California. Starting from December 2024, WVY maintained a consistent position at rank 8 through January 2025, before experiencing a slight dip to rank 9 in February. However, by March, WVY made a substantial recovery, climbing to rank 6. This upward movement in March indicates a positive reception of their product offerings or possibly successful marketing strategies that resonated with consumers. The sales figures for March, which saw an increase compared to previous months, further corroborate this upward trend in their ranking.

Despite the fluctuations in monthly rankings, WVY's ability to remain within the top 10 in California's Concentrates category is commendable. The brand's absence from the top 30 in other states or provinces suggests that their market presence is currently concentrated in California. This could be seen as both a limitation and an opportunity for WVY to expand its footprint. The lack of presence in other states might indicate untapped potential, and strategic expansion could enhance their overall market performance. For now, their focus seems to be on consolidating their strengths in California, where they have shown resilience and growth.

Competitive Landscape

In the competitive landscape of the California concentrates market, WVY has shown a notable upward trajectory in recent months. Starting from the 8th rank in December 2024, WVY maintained this position in January 2025, but experienced a slight dip to 9th in February. However, by March 2025, WVY made a significant leap to the 6th position, surpassing brands like Himalaya and West Coast Cure, which saw declines in their rankings. This improvement in rank for WVY is indicative of a positive trend in sales performance, as it managed to increase its sales figures when many competitors were experiencing declines. Notably, 710 Labs consistently held a strong position within the top 4, indicating a robust market presence. WVY's ability to climb the ranks amidst such competition suggests a growing consumer preference and effective market strategies, positioning it as a brand to watch in the California concentrates category.

Notable Products

In March 2025, the top-performing product for WVY was Lemon Cherry Gelato Budder (1g) in the Concentrates category, achieving the number one rank with sales of 5937 units. Following closely were Pineapple X Gelato Budder (1g) and Pineapple Gas Budder (1g), ranking second and third, respectively, both also in the Concentrates category. Blue Runtz Budder (1g) and Truffle Butter Budder (1g) rounded out the top five, securing the fourth and fifth positions. Notably, all these products were not ranked in previous months, indicating a strong emergence in March 2025. This suggests a significant shift in consumer preference towards these specific concentrates during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.