Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

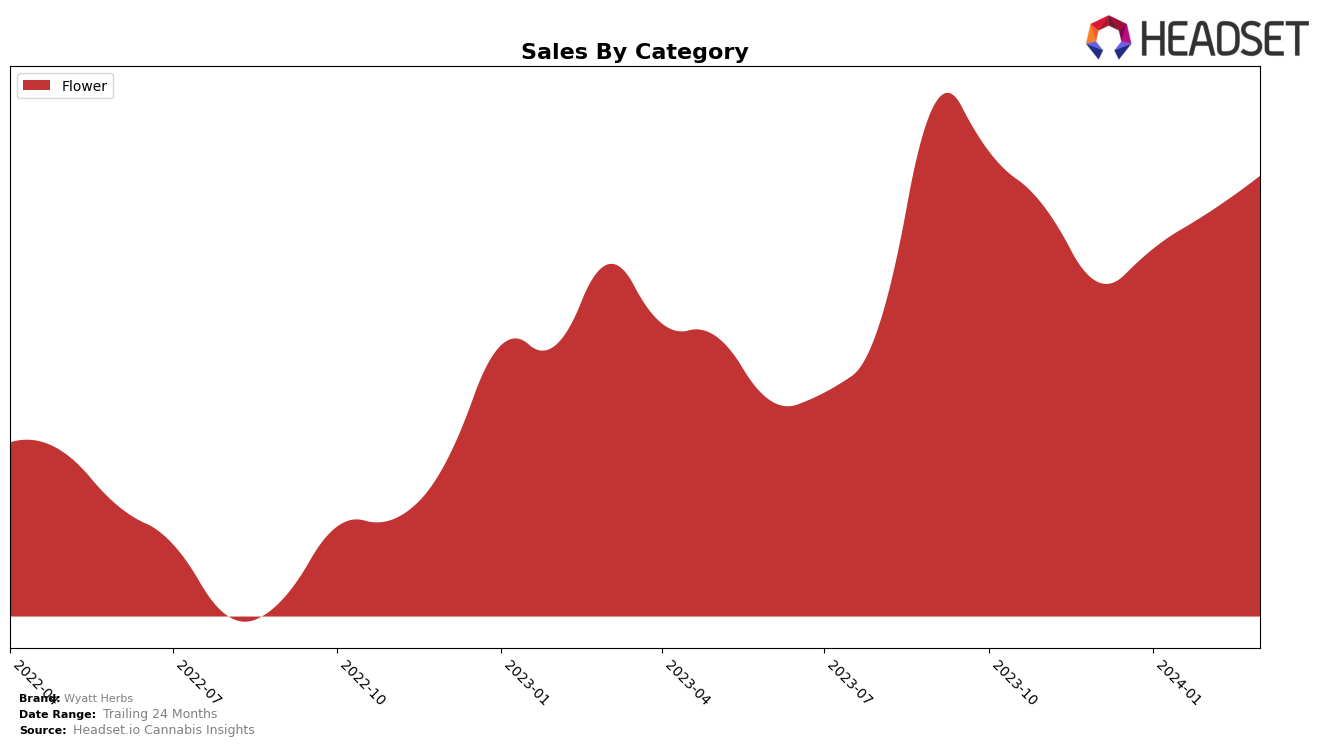

In Washington, Wyatt Herbs has shown a notable trajectory in the Flower category, steadily climbing the ranks over the recent months. Starting from a position outside the top 30 in December 2023, with a rank of 44, they made a significant leap into the 32nd spot by January 2024, followed by further ascents to 26th in February and stabilizing slightly at 28th in March 2024. This movement is indicative of growing consumer recognition and preference within the state's competitive cannabis market. The sales figures underscore this positive trend, with an initial December 2023 sales figure of $253,053, and a consistent month-over-month increase, culminating in $305,452 by March 2024. This upward sales trajectory, alongside the improvement in ranking, suggests a solidifying market presence for Wyatt Herbs in Washington's Flower category.

However, the lack of data for other states or categories implies that Wyatt Herbs' market presence is currently concentrated in the Washington Flower category. The absence from the top 30 brands in other states or categories could be interpreted in several ways; it might indicate a focused strategy on dominating a specific niche before expanding or could highlight areas for potential growth and expansion. The consistent improvement in their ranking within Washington suggests that the brand is on a positive path, but the limited data points to a need for diversification or increased market penetration in other areas to secure a broader footprint in the competitive cannabis industry. This focused yet promising performance in Washington's Flower category presents an interesting case for Wyatt Herbs, hinting at both its current strengths and future opportunities.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Wyatt Herbs has shown a notable upward trajectory in its rankings and sales over the recent months, moving from 44th in December 2023 to 28th by March 2024. This improvement in rank is significant when compared to its competitors, such as Fireline Cannabis, which saw a fluctuating rank but ended at 27th in March, just one position ahead of Wyatt Herbs. Similarly, Binx Buds and Gabriel also experienced rank fluctuations but did not demonstrate the consistent upward momentum seen with Wyatt Herbs, ending at 29th and 30th respectively in March. Falcanna, however, maintained a more stable presence in the top ranks, ending at 26th in March. This analysis suggests that Wyatt Herbs is closing the gap with its competitors, indicating a strong potential for further growth and market share capture in the Washington flower market.

Notable Products

In March 2024, Wyatt Herbs saw Lemon Cherry Gelato (3.5g) reclaim its position as the top-selling product with 892 units sold, highlighting its consistent appeal among consumers. Following closely, Wedding Cake (3.5g) rose to the second spot, demonstrating a growing preference for this variant. Orange Cookies (3.5g) made a notable comeback to the third rank, absent from the top rankings in the previous month, indicating a fluctuating but strong consumer interest. Oreoz (3.5g) entered the top rankings for the first time in March, securing the fourth position and suggesting a diversification in consumer tastes. Lastly, Candy Apple (3.5g) maintained its presence in the top five, albeit at the fifth rank, showcasing its steady demand among Wyatt Herbs' product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.