Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

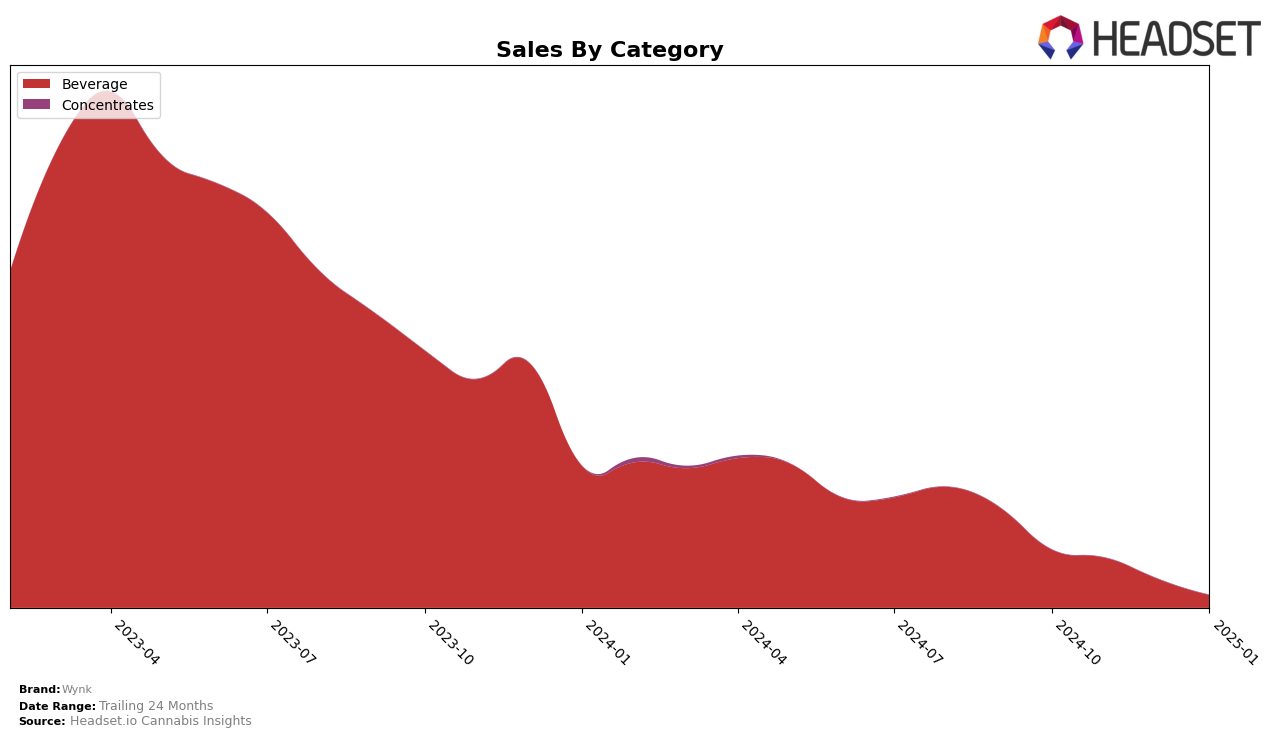

Wynk's performance in the Beverage category in Massachusetts saw a notable presence in October 2024, where it ranked 18th. However, in the subsequent months of November and December 2024, as well as January 2025, Wynk did not appear in the top 30 brands, indicating a drop out of the competitive rankings. This absence from the rankings could suggest either a decline in sales or an increase in competition within the state. The initial ranking in October, however, shows that Wynk had a significant foothold in the Massachusetts market at one point, with sales amounting to $13,311, which provides a benchmark for their market potential.

The fluctuation in Wynk's rankings across the months in Massachusetts highlights a dynamic market environment. While the October 2024 ranking demonstrated potential, the absence in the following months suggests challenges in maintaining market share or possibly a strategic shift in focus. This could be an area worth exploring further for insights into Wynk's market strategy or the competitive landscape of the beverage category in Massachusetts. Understanding these movements can provide valuable insights into how brands like Wynk navigate the cannabis market across different states and categories.

Competitive Landscape

In the Massachusetts beverage category, Wynk has experienced notable fluctuations in its market position, particularly when compared to competitors like Keef Cola and Journeyman. As of October 2024, Wynk was ranked 18th, but by January 2025, it was no longer in the top 20, indicating a decline in its market presence. In contrast, Keef Cola emerged in December 2024 at 8th place, suggesting a strong upward trend, while Journeyman appeared in November 2024 at 12th place, showing a competitive edge over Wynk. These shifts highlight a challenging landscape for Wynk, as it faces increasing competition from brands that are gaining traction and potentially capturing a larger share of the market.

Notable Products

In January 2025, the top-performing product from Wynk was the CBD/THC 1:1 Juicy Mango Infused Seltzer (5mg CBD, 5mg THC, 12oz), maintaining its first-place rank with sales of 318 units. The CBD/THC 1:1 Lime Twist Infused Seltzer (2.5mg CBD, 2.5mg THC, 12oz) held steady in second place, showing consistent performance over the past few months. The CBD/THC 1:1 Black Cherry Fizz Infused Seltzer (2.5mg CBD, 2.5mg THC, 250ml, 12oz) ranked third, following a similar pattern of stability since October 2024. The fourth and fifth positions were occupied by the CBD/THC 1:1 Lime Twist Infused Seltzer (5mg CBD, 5mg THC, 12oz) and the CBD/THC 1:1 Black Cherry Fizz Infused Seltzer (5mg CBD, 5mg THC, 355ml, 12oz), respectively, both maintaining their ranks from previous months. Overall, the product rankings for January 2025 were consistent with the trends seen in the last quarter of 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.