Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

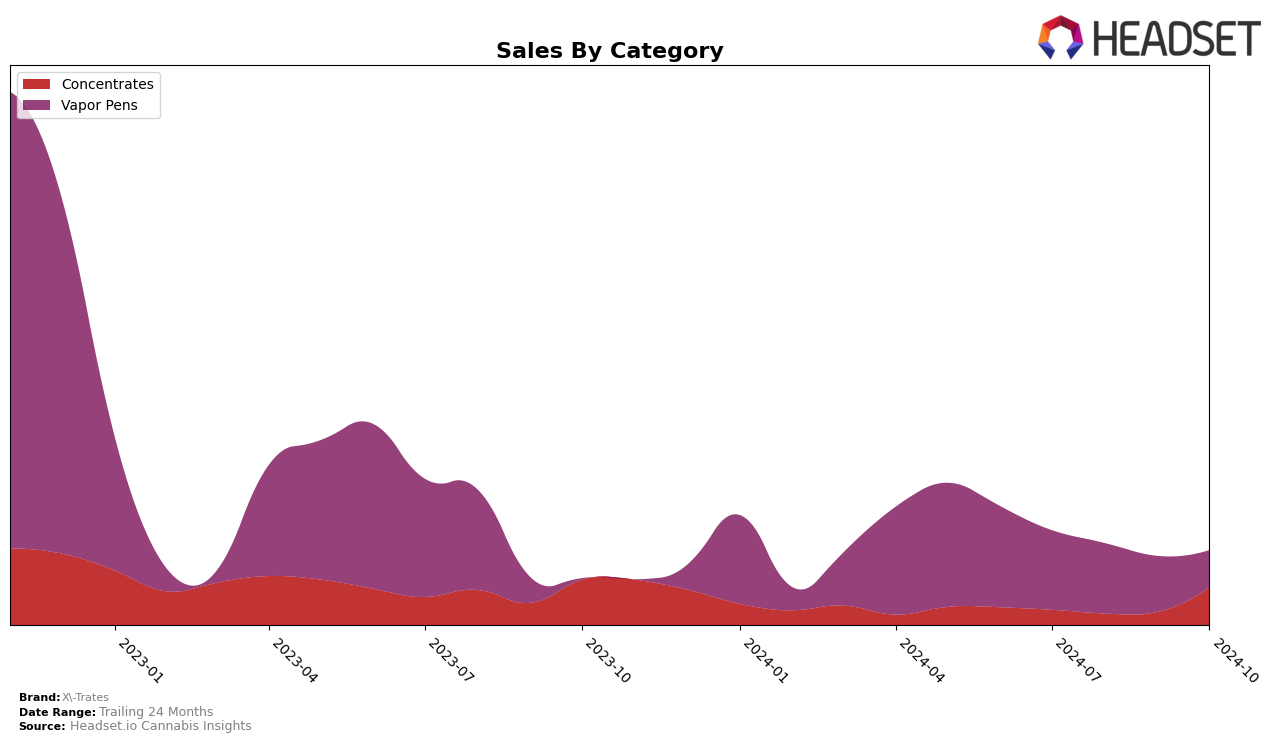

In the state of Massachusetts, X-Trates has shown a significant upward trajectory in the Concentrates category. Starting from a rank of 51 in July 2024, the brand has impressively climbed to the 23rd position by October 2024. This notable advancement suggests a strategic push or increased consumer preference within this segment. However, the Vapor Pens category tells a different story, where X-Trates has seen a decline in rankings from 49 in July to 67 by October. This downward trend in Vapor Pens might indicate challenges in market competition or shifting consumer interests within the state.

The contrasting performance across categories in Massachusetts highlights the dynamic nature of X-Trates' market presence. While they have successfully broken into the top 30 brands in the Concentrates category, their absence from the top 30 in Vapor Pens is a point of concern. This dichotomy could be attributed to various factors such as product innovation, marketing strategies, or consumer trends, which seem to favor their Concentrates over Vapor Pens. This situation presents both an opportunity and a challenge for X-Trates as they navigate the competitive landscape of the cannabis market in Massachusetts.

Competitive Landscape

In the Massachusetts concentrates market, X-Trates has demonstrated a significant upward trajectory in its ranking, jumping from outside the top 50 in July 2024 to a commendable 23rd position by October 2024. This notable improvement in rank is accompanied by a substantial increase in sales, indicating a strong market presence and growing consumer preference. In contrast, Natural Selections and Avexia have maintained relatively stable rankings, with Natural Selections consistently hovering around the 28th position and Avexia experiencing fluctuations between 19th and 30th. Meanwhile, Volcanna has shown volatility, peaking at 13th in September before settling at 22nd in October. The emergence of Amber in the rankings in October, debuting at 21st, further intensifies competition. These dynamics highlight X-Trates' impressive performance and potential to further capitalize on its momentum in the Massachusetts concentrates category.

Notable Products

In October 2024, the top-performing product for X-Trates was the RSO Dart Dropper (0.5g) in the Concentrates category, which climbed to the number one rank with impressive sales of 725 units. The Orange Creamsicle Distillate Cartridge (1g) in the Vapor Pens category, although dropping from its previous top position, maintained a strong second place with consistent sales. The Wedding Cake Live Resin Sugar (1g) made its debut in the rankings, securing the third spot in the Concentrates category. Meanwhile, the Chemdawg Distillate Cartridge (1g) held steady at fourth place, showing resilience in the Vapor Pens category. The Blue Dream Distillate Cartridge (1g) slipped to fifth place, indicating a decline in momentum compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.