Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

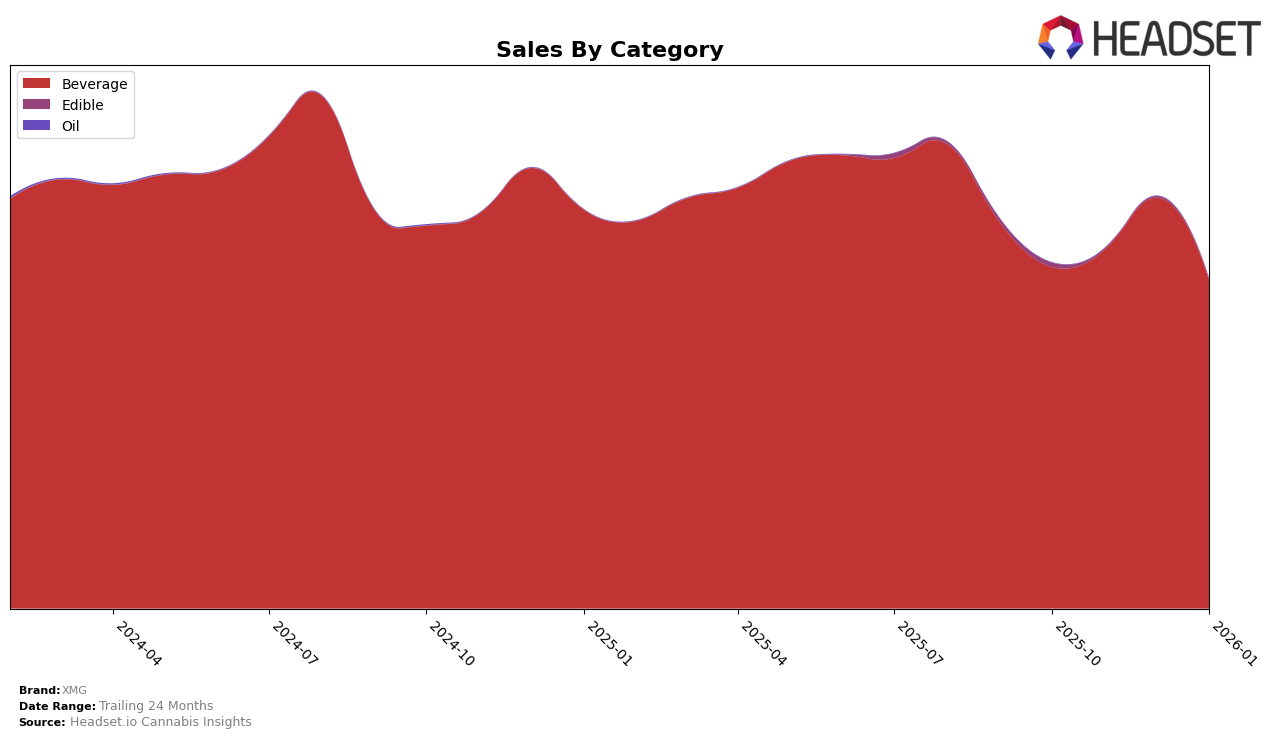

XMG has consistently dominated the beverage category across several Canadian provinces, maintaining the top spot in Alberta, Ontario, and Saskatchewan from October 2025 to January 2026. This unwavering performance highlights their strong market presence and consumer preference in these regions. In British Columbia, XMG holds a steady second position in the beverage category, indicating a robust but slightly more competitive market environment. Despite fluctuations in monthly sales figures, such as a notable dip in Alberta from October to November 2025, XMG's ability to reclaim and sustain its top rankings suggests resilience and effective market strategies.

Interestingly, XMG's absence from the top 30 rankings in any other provinces or states outside of the mentioned Canadian markets signals potential areas for growth or challenges in entering new territories. This absence could be seen as a gap in their market expansion strategy, or it might reflect a strategic focus on consolidating their leadership position in existing strongholds. While detailed sales figures remain proprietary, the directional trends indicate a dynamic market where XMG continues to leverage its brand strength, though opportunities for further growth and expansion remain untapped in other regions.

Competitive Landscape

In the Alberta beverage category, XMG has consistently maintained its top position from October 2025 to January 2026, showcasing its dominance in the market. Despite a slight dip in sales from November 2025 to January 2026, XMG's lead remains unchallenged, with sales figures significantly higher than its closest competitors. Sweet Justice and Mollo have been vying for the second and third positions, with Sweet Justice reclaiming the second spot in December 2025 and January 2026 after a brief drop to third in November. Mollo, while maintaining a steady presence, has not surpassed Sweet Justice in rank since November 2025. This competitive landscape highlights XMG's robust market presence, though the fluctuating ranks of its competitors suggest a dynamic environment where strategic shifts could impact future standings.

Notable Products

In January 2026, XMG's top-performing product was Cream Soda (10mg THC, 355ml), maintaining its first-place rank for the fourth consecutive month with sales of 23,807 units. Cherry Cola (10mg THC, 355ml) also held steady in second place, although its sales figures saw a slight decrease compared to December 2025. Zero - Orange Soda (10mg THC, 355ml) rose to third place, overtaking Plus - CBG/THC 1:1 Tropical Cream Float Sparkling Soda, which dropped to fourth. Plus - THC/CBG 1:1 Paradise Treat Sparkling Beverage remained consistently in fifth place throughout the observed months. The rankings indicate a stable preference for the top two beverages, while Zero - Orange Soda is gaining popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.