Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

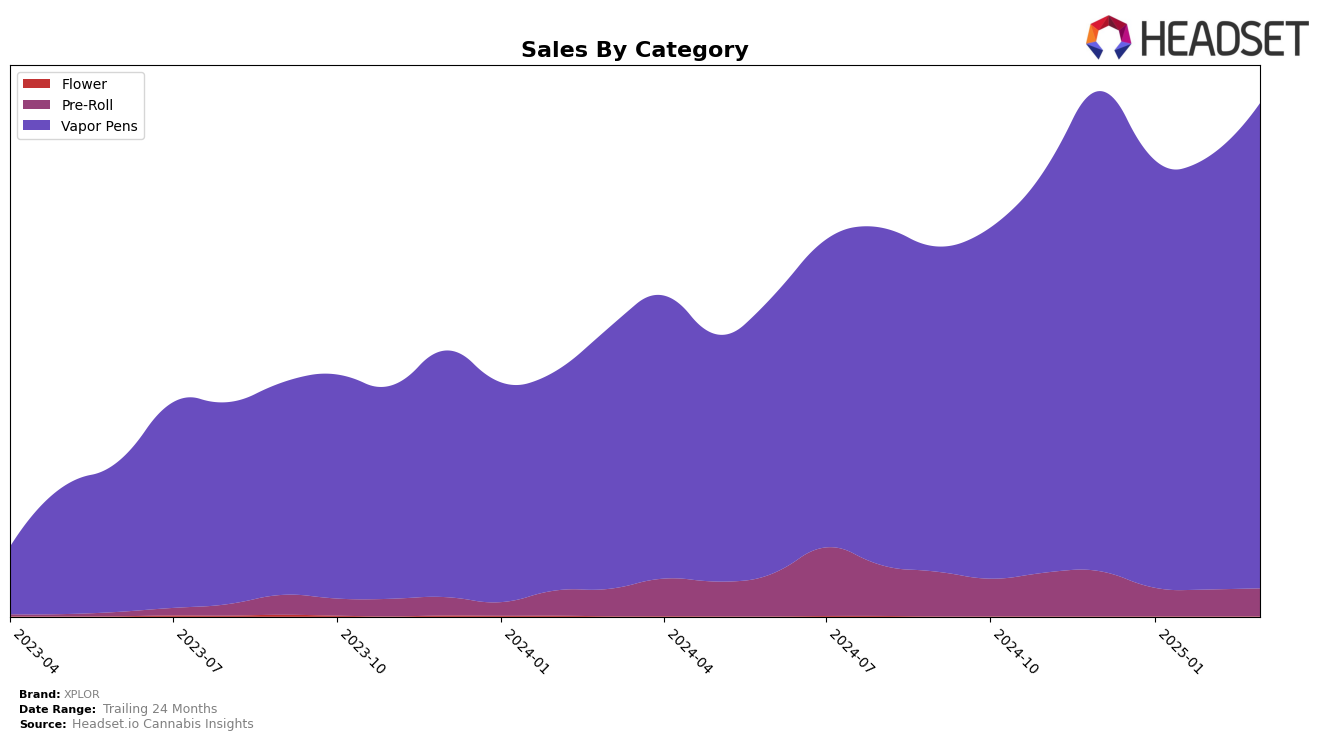

XPLOR's performance in the Vapor Pens category shows notable trends across different regions. In Alberta, XPLOR maintained a consistent rank of 9th place from December 2024 to January 2025, before climbing to the 5th position in February and March 2025. This upward movement is underscored by a significant increase in sales, indicating a strengthening presence in the market. Conversely, in British Columbia, XPLOR only entered the top 30 rankings in February 2025, securing the 25th position, and slightly improving to 24th in March. This late entry into the rankings suggests a growing but still emerging market presence in the province. Meanwhile, in Saskatchewan, XPLOR held the 16th position at the start of the year but dropped out of the top 30 in February, only to reappear at 19th in March, indicating some volatility in their market share there.

In Ontario, XPLOR's performance across categories presents a mixed picture. The brand consistently held the 3rd position in the Vapor Pens category from December 2024 through March 2025, showcasing a strong and stable market presence despite some fluctuations in sales figures. However, in the Pre-Roll category, XPLOR did not make it into the top 30 rankings, starting at 48th in December and gradually declining to 57th by March. This suggests that while XPLOR has a robust foothold in the Vapor Pens market in Ontario, it faces challenges in gaining traction in the Pre-Roll segment. These contrasting performances across categories highlight the brand's varied market dynamics and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ontario, XPLOR consistently maintained its position at rank 3 from December 2024 through March 2025. Despite a steady rank, XPLOR faces significant competition from Back Forty / Back 40 Cannabis, which has dominated the top spot throughout this period. Additionally, BoxHot holds a firm grip on the second rank, indicating a challenging environment for XPLOR to climb higher. Notably, General Admission improved its rank from 5th to 4th in March 2025, potentially signaling a threat to XPLOR's position if this trend continues. Meanwhile, Spinach experienced fluctuations, ending March 2025 at rank 5, which could provide XPLOR with a buffer against downward pressure. Overall, while XPLOR's rank remained unchanged, the dynamic shifts among other competitors highlight the need for strategic initiatives to bolster its market share and potentially advance its standing in the Ontario Vapor Pens category.

Notable Products

In March 2025, the top-performing product from XPLOR was the Red Hawaiian Co2 Cartridge (1g) in the Vapor Pens category, maintaining its leading position from February with sales reaching 16,035 units. The Beast Berry CO2 Cartridge (1g) followed closely in second place, showing consistent performance by retaining its February rank. Rainbow Razz Co2 Cartridge (1g) moved up to third place from fourth in February, despite a slight decrease in sales. Nana's Jam CO2 Cartridge (1g) improved its position to fourth place, while Jungle Fruit CO2 Cartridge (1g) dropped to fifth from second place in February. This shift indicates a dynamic change in consumer preferences within the Vapor Pens category for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.