Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

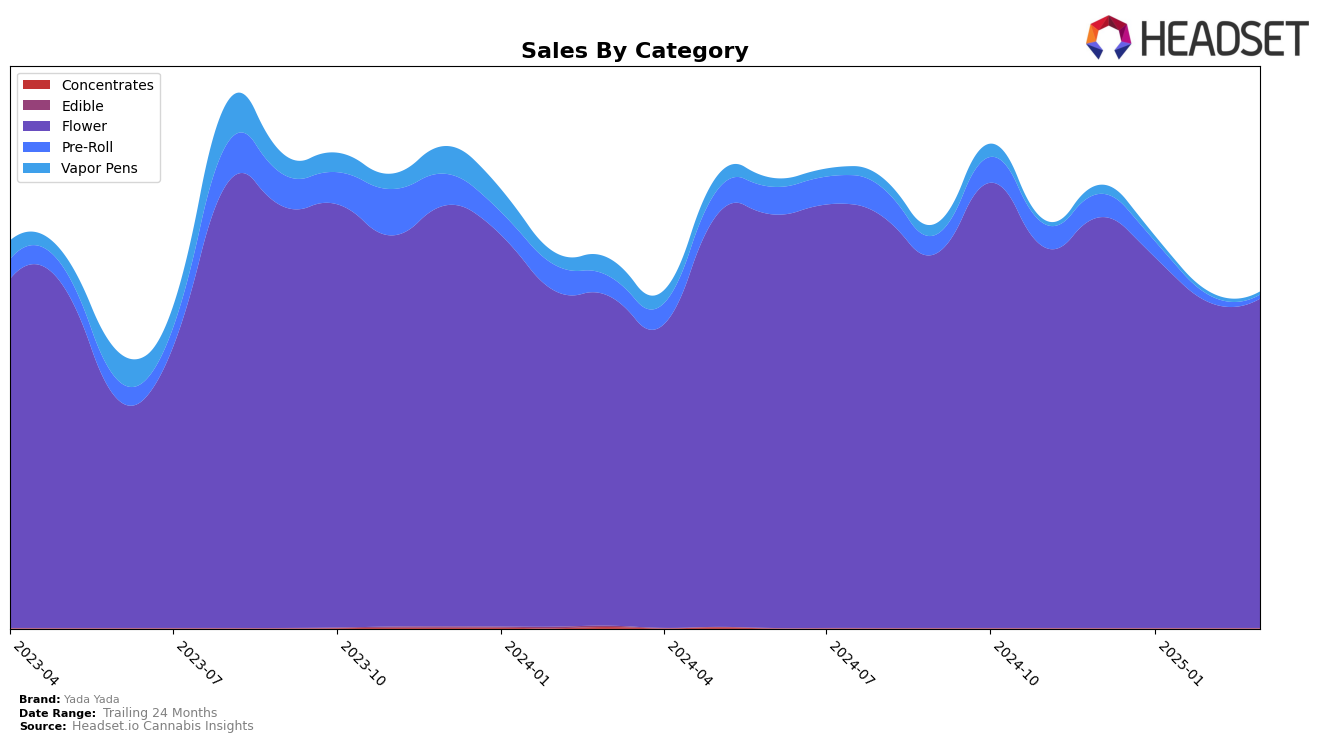

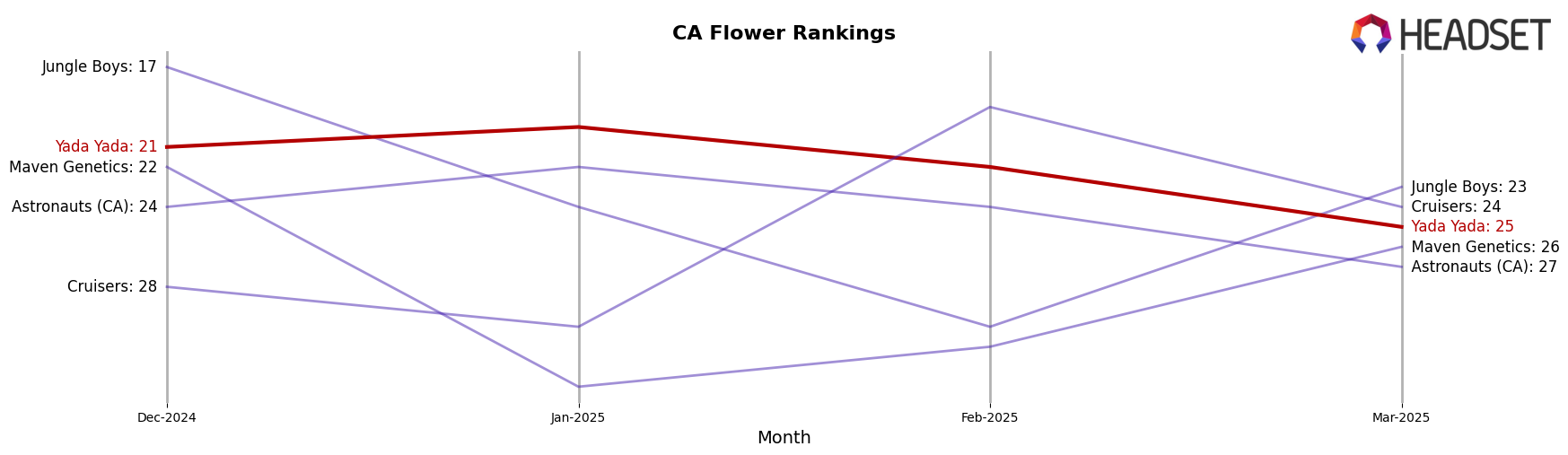

Yada Yada's performance in the California market has shown some fluctuations, particularly in the Flower category. The brand ranked 21st in December 2024, slightly improving to 20th in January 2025, before slipping to 22nd in February and 25th in March. This movement suggests a competitive landscape in the Flower category, where maintaining a consistent position can be challenging. The sales trend mirrors this ranking movement, with a noticeable decrease from December to February, although there was a slight recovery in March. This indicates that while Yada Yada remains a recognized player, sustaining growth amidst competition requires strategic adjustments.

Notably, Yada Yada did not appear in the top 30 brands in any other category or state, which could be a point of concern or an opportunity for expansion. Their absence from other rankings might suggest a focused strategy on the Flower category within California, or it could indicate potential areas for growth and diversification. The brand's ability to navigate the competitive Flower market in California is evident, but exploring additional categories or markets could provide new avenues for revenue and brand recognition. As the cannabis market continues to evolve, Yada Yada's strategic decisions in the coming months will be crucial in determining their trajectory.

Competitive Landscape

In the competitive landscape of California's flower category, Yada Yada has experienced some fluctuations in its market position, impacting its sales dynamics. Starting from December 2024, Yada Yada was ranked 21st, showing a slight improvement to 20th in January 2025, before slipping to 22nd in February and further to 25th by March. This downward trend in rank contrasts with the performance of competitors such as Cruisers, which saw a notable rise from 28th in December to 19th in February, although it fell slightly to 24th in March. Meanwhile, Jungle Boys and Maven Genetics have shown inconsistent rankings, with Jungle Boys dropping out of the top 20 in January and February, and Maven Genetics not making the top 20 in January. Despite these shifts, Yada Yada's sales figures have remained relatively stable, though slightly declining, indicating a resilience in consumer loyalty amidst competitive pressures. This analysis suggests that while Yada Yada maintains a strong presence, strategic adjustments may be necessary to regain and sustain higher rankings in the evolving California flower market.

Notable Products

In March 2025, Gush Mints Pre-Ground (3.5g) emerged as the top-performing product for Yada Yada, climbing to the number one rank with sales of 3,587 units. GMO Shake (14g) followed closely behind, making a significant first appearance in the rankings at the second spot. Bob Hope Pre-Ground (3.5g) secured the third position, also debuting in the rankings. Gush Mints Shake (14g), previously holding the top rank for consecutive months, dropped to fourth place, indicating a shift in consumer preference. GG#4 Shake (14g) maintained a stable presence, rounding out the top five with slight fluctuations in rank over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.