Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

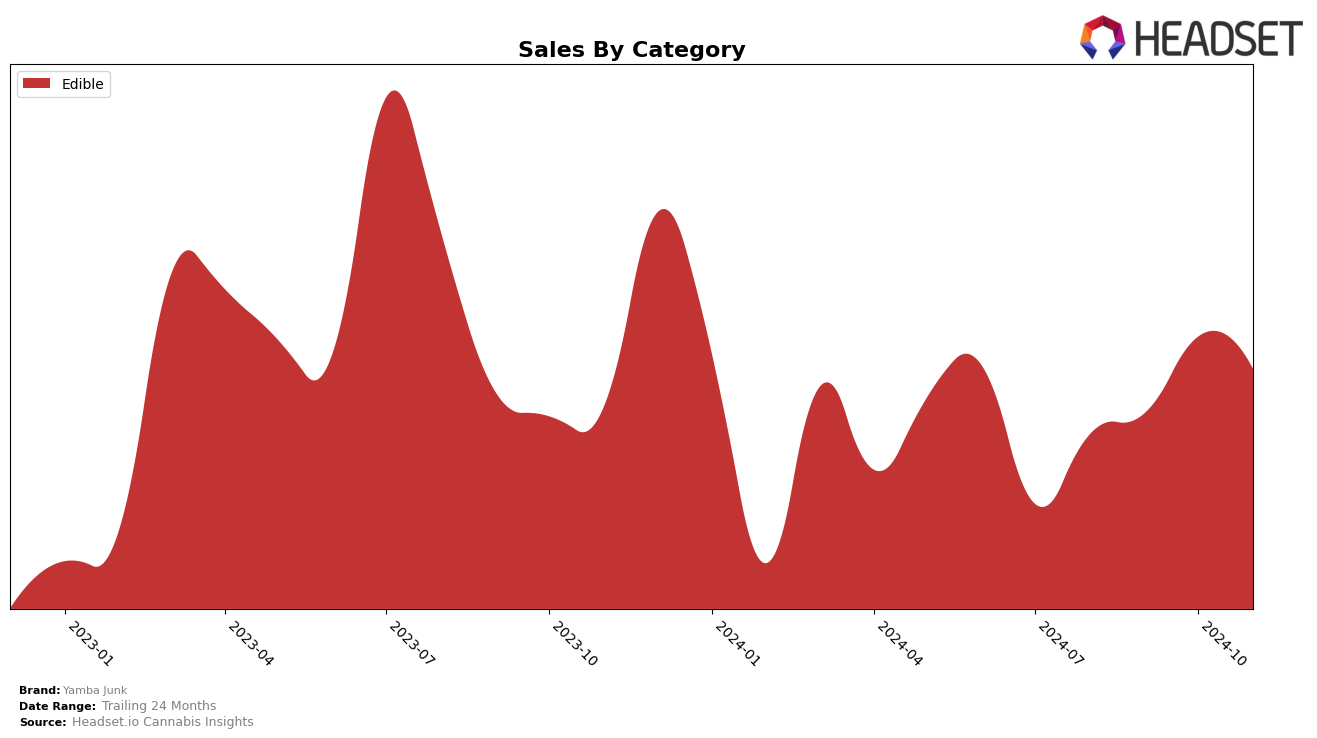

Yamba Junk's performance in the Edible category in Oregon has shown some notable fluctuations over recent months. Starting from August 2024, the brand was positioned just outside the top 30, at rank 31. However, they managed to enter the top 30 by September, achieving a rank of 30. The upward trend continued into October with a climb to rank 27, indicating a strengthening presence in the market. Yet, by November, Yamba Junk experienced a slight drop back to rank 30. This movement suggests a competitive landscape within the Edible category in Oregon, where maintaining a top position requires consistent performance and possibly innovation.

Despite these fluctuations in rankings, Yamba Junk's sales figures in Oregon have shown a positive trend, particularly notable in October 2024, where there was a significant increase compared to the previous months. This suggests that while the brand might face challenges in maintaining its rank, its sales strategies or product offerings are resonating well with consumers. The fact that Yamba Junk is consistently appearing in the top 30, albeit at the lower end, highlights both an achievement in staying relevant and a potential area for growth to secure a stronger foothold. The brand's ability to re-enter the top 30 after dropping out in August is commendable, but it also underscores the need for strategic planning to avoid future rank fluctuations.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Yamba Junk has shown a fluctuating performance in recent months. From August to November 2024, Yamba Junk's rank shifted from 31st to 30th, peaking at 27th in October before dropping back to 30th in November. This indicates a moderate improvement in market positioning, although it remains outside the top 20. In comparison, Pacific Wave experienced a more stable presence, maintaining a rank within the top 30, and consistently outperforming Yamba Junk in sales figures. Meanwhile, She Don't Know and Concrete Jungle have seen varied rankings, with She Don't Know dropping to 33rd in November and Concrete Jungle not ranking in September, indicating potential volatility. Yamba Junk's sales have shown a positive trend, with a notable increase in October, suggesting potential for growth if they can maintain momentum against these competitors.

Notable Products

In November 2024, Yamba Junk's top-performing product was Strawberry Blueberry Floss Cotton Candy (100mg), maintaining its consistent first-place ranking since August, with notable sales of 521 units. Green Apple Watermelon Floss Cotton Candy (100mg) improved its ranking from third in October to second in November, reflecting a strong sales increase. Peach Mango Floss Cotton Candy (100mg) experienced a slight drop, moving from second to third place, despite stable sales figures. Lemon x Lime Floss Cotton Candy (100mg) made its debut in the rankings at fourth place, suggesting a positive reception. Lemon Lime Sugadoobs (100mg) remained in fifth place, similar to its position in September, indicating steady demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.