Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

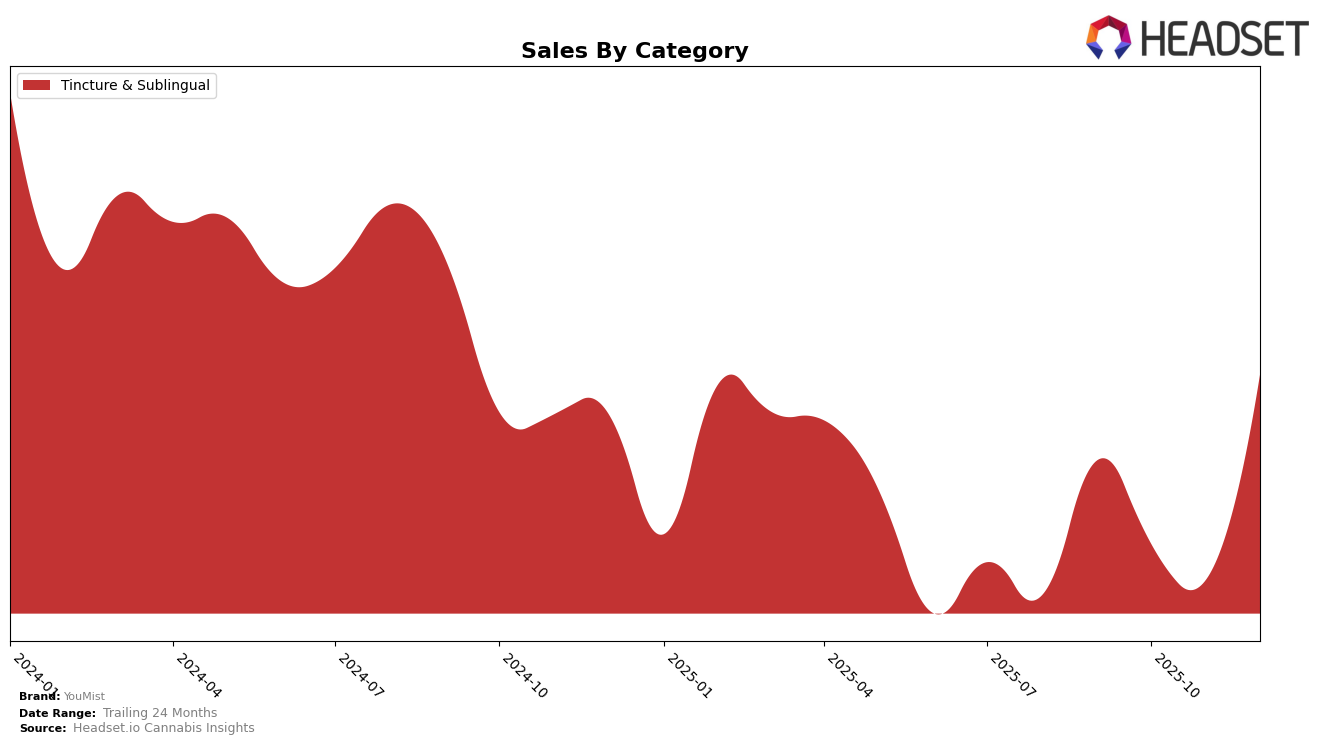

In the rapidly evolving cannabis market, YouMist has shown notable performance in the Tincture & Sublingual category in Michigan. After not ranking in the top 30 for September, October, and November 2025, YouMist made a significant leap to secure the 6th position by December. This suggests a strong end-of-year momentum, possibly driven by strategic marketing or product innovation. The absence of YouMist in the top 30 rankings for the preceding months indicates either a late entry into the market or a previous underperformance, which makes the December ranking all the more impressive.

While specific sales figures are sparse, the available data indicates a positive trend for YouMist in Michigan, with December sales reaching $11,934. This upward trajectory could be indicative of increasing consumer recognition and acceptance of their products. The lack of rankings in other states or provinces suggests that YouMist's current market presence is either limited to Michigan or not strong enough to break into the top 30 elsewhere. This regional focus might be a strategic decision, allowing the brand to concentrate resources and efforts in a promising market before expanding further.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Michigan, YouMist has shown a notable emergence by entering the top 20 brands in December 2025, securing the 6th position. This marks a significant development as YouMist was absent from the rankings in the preceding months, indicating a strategic breakthrough in market presence. In comparison, Mary's Medicinals consistently maintained a strong position, ranking 3rd or 4th throughout the last quarter of 2025, while Cannalicious Labs held steady at 5th place, except for November when they were not in the top 20. The entrance of YouMist into the rankings suggests a positive trajectory in sales performance, potentially driven by strategic marketing efforts or product innovations. This shift could pose a competitive challenge to established brands, as YouMist's upward momentum may continue to disrupt the market dynamics in the coming months.

Notable Products

In December 2025, the top-performing product for YouMist was the Energy - THC/CBG 1:1 Cinnamon Mist Spray, which rose to the first position from its previous second rank in November, with impressive sales of 323 units. The Sleepy Mist - CBD/THC 1:1 Mint Breath Spray, consistently ranked first for the past three months, shifted to the second position, maintaining strong sales figures of 302 units. Watermelon Mist Breathspray maintained its third position from September, showing steady performance with 158 units sold. The Monster X Energy Mist held its ground at the fourth rank for three consecutive months, indicating stable demand. Meanwhile, the Sleepy Mist - CBN/THC 1:1 Mint Breath Spray, despite being in the fifth rank since October, experienced a slight increase in sales to 65 units in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.