Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

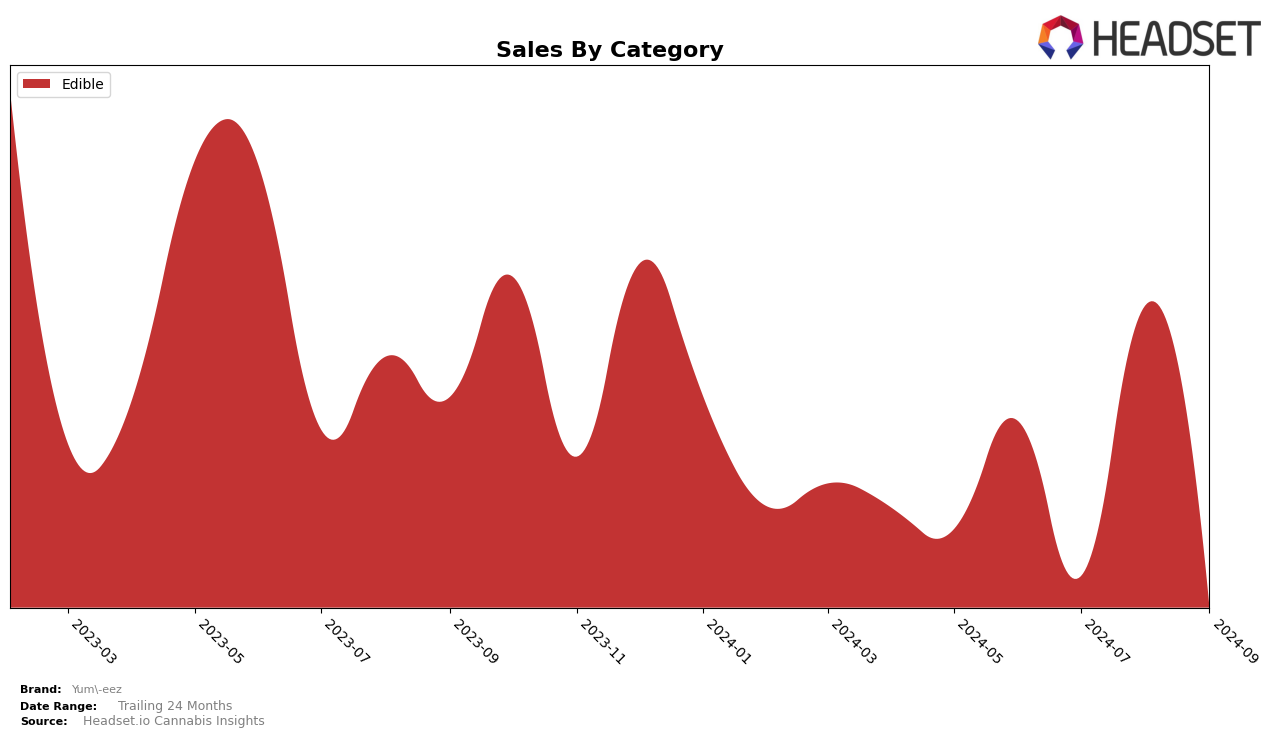

In the state of Missouri, Yum-eez has shown varying performance across the months in the Edible category. Starting in June 2024, Yum-eez was ranked 28th, but by July, it had fallen out of the top 30, indicating a challenging period. However, a rebound was seen in August, with the brand climbing to 25th place, suggesting a positive shift in consumer interest or successful marketing efforts. By September, the brand slipped back to 28th, highlighting a potential volatility in the market or competitive pressures in the Edible category. Notably, the sales in August were the highest in the observed period, indicating a significant spike in consumer engagement or product availability.

The fluctuation in rankings for Yum-eez in Missouri's Edible category underscores the competitive nature of the cannabis market in this region. The brand's inability to maintain a consistent top 30 position in July and its subsequent drop in September could point to challenges in maintaining a steady market presence or adapting to consumer preferences. This inconsistency might be a strategic point for the brand to address, perhaps through enhanced product offerings or targeted marketing campaigns. The dynamics observed in Missouri could serve as a microcosm for Yum-eez's performance in other states, although specific data from other regions would be needed to draw comprehensive conclusions.

```Competitive Landscape

In the Missouri edible cannabis market, Yum-eez has experienced notable fluctuations in its ranking and sales over the past few months. Starting from June 2024, Yum-eez held the 28th rank, which dropped to 31st in July, then improved significantly to 25th in August, before settling at 28th in September. This dynamic shift indicates a volatile market presence, possibly due to varying consumer preferences or competitive pressures. Notably, Atta and Smackers have shown upward trends, with Atta moving from 31st to 27th and Smackers climbing from 32nd to 26th by September. Despite these competitive pressures, Yum-eez's sales peaked in August, suggesting a potential for growth if they can stabilize their market position. Meanwhile, brands like Ratio and CLOVR have maintained relatively stable but lower rankings, indicating that while they are consistent, they do not pose a significant threat to Yum-eez's market share at this time.

Notable Products

In September 2024, the top-performing product from Yum-eez was the Hybrid Sour Pink Lemonade Gummies 10-Pack (100mg), which maintained its top rank from July, despite a slight sales decrease to 1110 units. The Hybrid Blackberry Gummies 10-Pack (100mg) secured the second position, consistent with its rank from August, though sales figures dropped to 981 units. Sativa Mango Gummies 10-Pack (100mg) moved up to third place, a slight improvement from its fourth place in August, although its sales were lower at 764 units. The Sativa Sour Green Apple Gummies 10-Pack (100mg) slipped to fourth place from its previous fifth, continuing a downward sales trend to 639 units. Indica Sour Watermelon Gummies 10-Pack (100mg) fell to fifth place from third in August, with a notable decrease in sales to 500 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.