Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

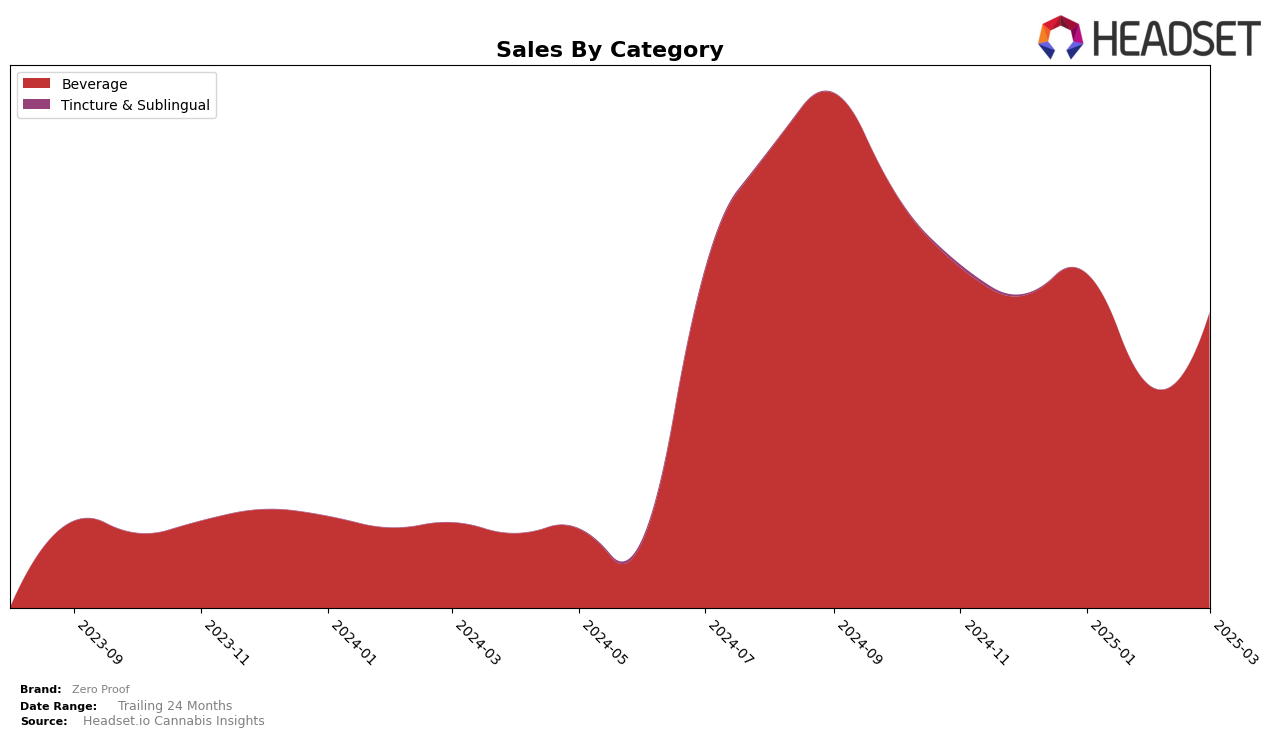

Zero Proof has demonstrated varied performance across different states in the beverage category. In Illinois, the brand has shown a steady upward trajectory, improving its ranking from 12th in December 2024 to 9th by March 2025. This consistent climb in rankings indicates a positive reception and growing market presence in the state, even though sales dipped in February before recovering slightly in March. Conversely, in Missouri, Zero Proof's performance is notable for its entry into the top 10 in January 2025, maintaining the 8th position through February. However, the absence of a ranking in December 2024 suggests that the brand was previously not among the top 30, indicating a significant leap in market penetration within a short period.

In New Jersey, Zero Proof has maintained a dominant position, consistently holding the number one rank from December 2024 through March 2025. This stability at the top reflects strong consumer loyalty and brand strength in the state. Despite a noticeable dip in sales in February 2025, the brand's ability to retain its leading position highlights its resilience and the effectiveness of its market strategies. The contrasting performances across these states underscore the importance of regional strategies and consumer preferences in the beverage category for Zero Proof.

Competitive Landscape

In the New Jersey cannabis beverage market, Zero Proof has consistently maintained its position as the leading brand from December 2024 through March 2025. Despite a slight dip in sales from January to February 2025, Zero Proof's dominance remains unchallenged, as it retains the top rank throughout this period. In contrast, Major, its closest competitor, consistently holds the second position. While Major experienced a significant increase in sales from January to March 2025, it still falls short of surpassing Zero Proof's sales figures. This consistent ranking suggests that Zero Proof's brand strength and customer loyalty are robust, allowing it to maintain its leadership position in the New Jersey beverage category despite competitive pressures.

Notable Products

In March 2025, the top-performing product for Zero Proof was Squeeze - Dash of Lime Beverage Enhancer, which maintained its leading position from February with sales reaching 2127 units. Following closely was Squeeze - Dash of Cherry Drink Enhancer, which climbed to the second spot from third place the previous month. Squeeze - Dash of Sweet Beverage Enhancer showed significant improvement, rising from fourth to third place. Conversely, Squeeze - Dash Of Orange Drink Enhancer experienced a drop, moving from second in February to fourth in March. A new entrant, Mango Lime Stir Drink Mix 6-Pack, debuted in fifth place, indicating potential growth in the beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.