Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

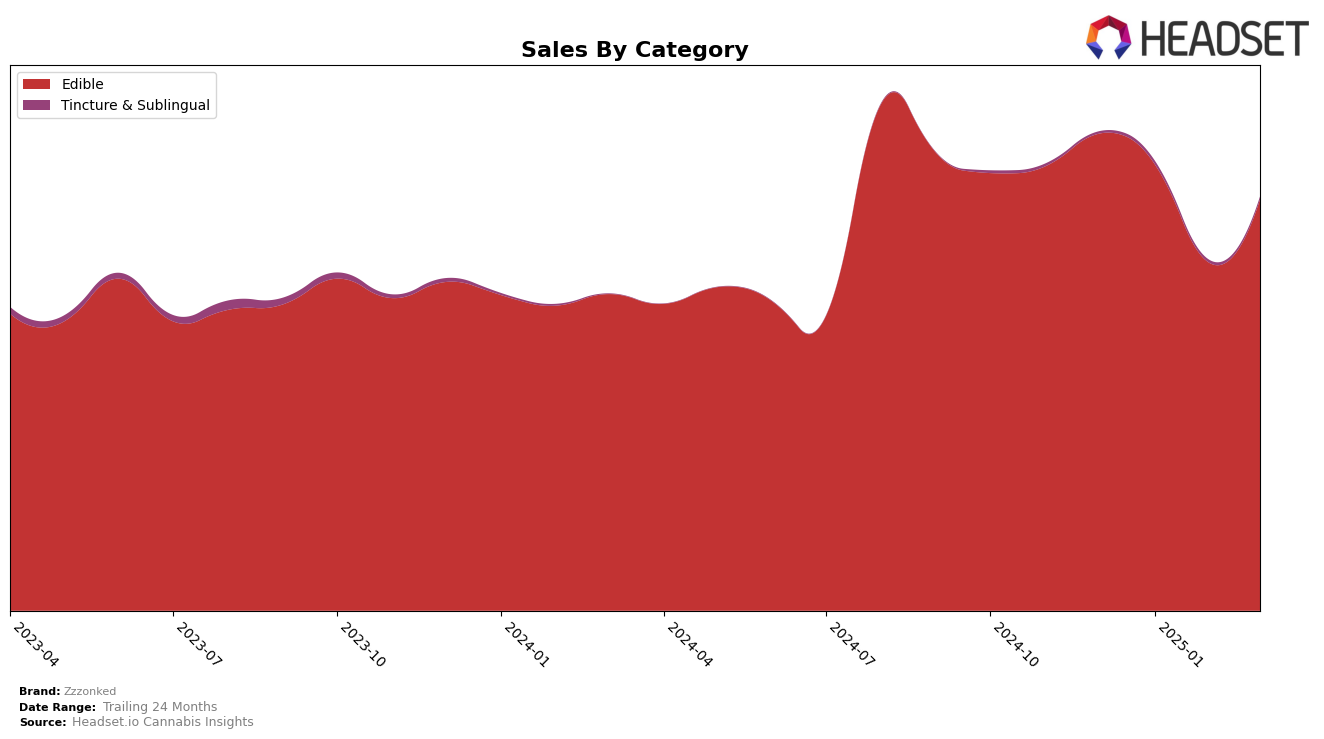

In the Massachusetts market, Zzzonked has shown a slight decline in the Edible category rankings over the first quarter of 2025. Starting from a steady 8th position in December 2024 and January 2025, the brand slipped to 9th place in February and further to 10th in March 2025. This downward trend is reflected in their sales figures, which saw a noticeable dip from December to February before rebounding slightly in March. The brand's ability to maintain a top 10 position, despite the fluctuations, indicates a resilient presence in the Massachusetts market, but the shift in rankings suggests potential challenges or increased competition within the Edible category.

Meanwhile, in New Jersey, Zzzonked's performance in the Edible category has been somewhat more stable, with rankings hovering around the mid-teens. The brand improved its position from 17th in December 2024 to 15th in January 2025, only to drop back to 18th in February before recovering to 17th in March. This fluctuation in rankings is mirrored in their sales, which peaked in January before experiencing a dip in February and a slight recovery in March. The ability to stay within the top 20 suggests a consistent, albeit competitive, market presence. However, the absence of top 10 rankings could imply that Zzzonked is facing stiffer competition or needs to enhance its market strategies to climb higher in the ranks.

Competitive Landscape

In the competitive landscape of the Massachusetts edible cannabis market, Zzzonked has experienced some fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 8th in December 2024, Zzzonked saw a decline to 10th by March 2025. This shift coincides with a notable decrease in sales during January and February, although a recovery is observed in March. In comparison, Choice maintained a steady presence in the top ranks, slipping slightly from 6th to 7th, while Good News improved its position from 10th to 9th, driven by a significant sales boost in March. Meanwhile, Happy Valley and In House showed upward momentum, with In House climbing from 15th to 11th, reflecting a consistent increase in sales. These dynamics suggest that while Zzzonked faces stiff competition, particularly from brands like Choice and Good News, there is potential for regaining its standing by capitalizing on its March sales recovery.

Notable Products

In March 2025, the top-performing product from Zzzonked was the CBD/THC/CBN 1:1:1 Sleepy Mixed Berry Gummies 20-Pack, maintaining its first-place rank for four consecutive months with sales reaching 8,746 units. Following closely was the CBD/THC/CBN 1:1:1 Strawberry Slumber Gummies 20-Pack, consistently holding the second rank since December 2024. The CBD/THC/CBN 1:1:1 Tutti Frutti Sleepy Gummies 20-Pack secured the third position, showing a steady performance over the months. The CBD/THC/CBN 1:1:1 Sleepy Pineapple Dreams Gummies 20-Pack remained in fourth place, while the CBD/THC/CBN Sleepy Tincture consistently ranked fifth. Notably, all products retained their rankings from previous months, indicating strong brand consistency and customer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.