Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

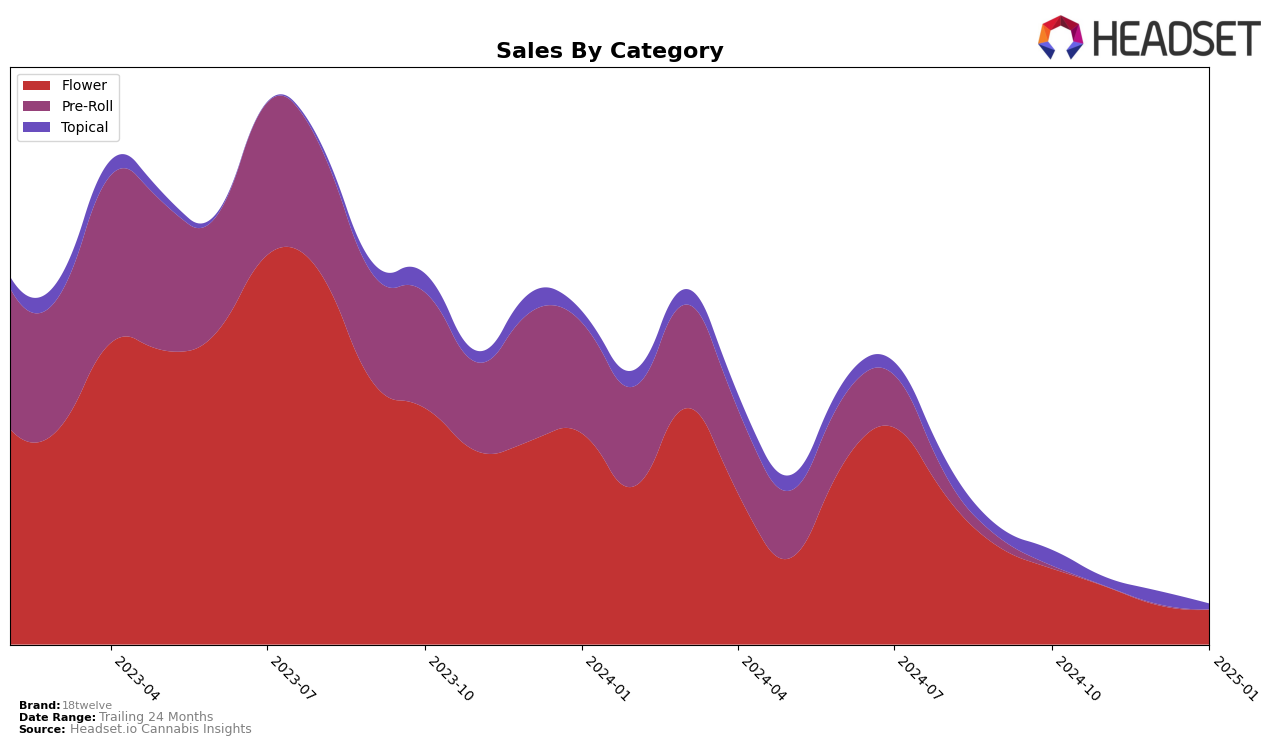

In the competitive landscape of cannabis brands, 18twelve has shown varied performance across different categories and regions. In British Columbia, the brand's presence in the Flower category has been challenging, with rankings consistently outside the top 30 over the past four months. Despite this, there has been a slight improvement in January 2025, where they moved up to rank 78 from 85 in December 2024. This upward trend, albeit gradual, indicates a potential for future growth in the region. In terms of sales, there has been a noticeable decline from October 2024 to January 2025, which might suggest a need for strategic adjustments in market approach or product offerings.

Meanwhile, in Saskatchewan, 18twelve's performance in the Flower category saw them entering the rankings at 59 in November 2024, a noteworthy achievement considering their absence from the top 30 in other months. This suggests a strong initial impact in the market, although sustaining this momentum will be crucial. The brand has also made a significant mark in the Topical category, where it achieved an impressive rank of 4, indicating a strong consumer preference for their products in this segment. This high ranking in Topicals could be a strategic area for 18twelve to focus on, potentially providing a competitive edge in the province.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, 18twelve has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked at 63rd place in October, 18twelve saw a decline to 83rd in November and 85th in December, before slightly recovering to 78th in January. This downward trend in rank coincides with a consistent decrease in sales over the same period. In contrast, Virtue Cannabis demonstrated a strong performance, climbing from 81st in October to 63rd in November, before experiencing a dip in December and January. Meanwhile, 7 Acres and Castle Rock Farms maintained relatively stable rankings, with Castle Rock Farms notably outperforming 18twelve in both rank and sales. These dynamics suggest that 18twelve faces significant competitive pressure, particularly from brands like Virtue Cannabis and Castle Rock Farms, which have shown resilience or improvement in their market positions.

Notable Products

In January 2025, the top-performing product for 18twelve was the Vital Ease CBD:THC 1:2 Transdermal Balanced Cream, maintaining its number one rank from December 2024, despite a drop in sales to 75 units. Lemon OG Candy secured the second position, climbing from fifth place in December with notable sales of 72 units. The CBD Vital Ease Cream ranked third, dropping one spot from the previous month. New entries to the rankings include Moby Dick and Lazy Susan, debuting at fourth and fifth places respectively. These shifts indicate a dynamic change in consumer preferences, particularly towards larger flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.