Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

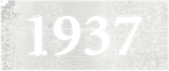

In Maryland, the cannabis brand 1937 has demonstrated varied performance across different product categories. Concentrates saw a fluctuating but generally positive trend, moving from a rank of 26 in December 2024 to 22 by March 2025. This indicates a strong recovery after a dip in February. The Flower category also shows promise, consistently staying within the top 30, reaching a rank of 24 by March 2025. Although Pre-Rolls have struggled to maintain a strong position, with a notable drop from 33 in February to 43 in March, the Vapor Pens category exhibited a noteworthy improvement, climbing to a rank of 22 in February before settling at 28 in March. This mixed performance across categories suggests strategic opportunities for 1937 to capitalize on growing segments while addressing challenges in others.

In New York, 1937's presence in the Flower category has been progressively strengthening. Initially not ranking in the top 30, the brand made a significant leap to 81 in February 2025, followed by an improvement to 64 in March. This upward trajectory in New York's Flower market indicates a growing acceptance and potential for expansion in this region. The absence of 1937 in the top 30 for other categories in New York suggests either a nascent entry into these segments or a strategic focus on Flower, which might be paying off. This selective performance highlights the importance of market-specific strategies and the potential for 1937 to explore further growth opportunities in the New York market.

Competitive Landscape

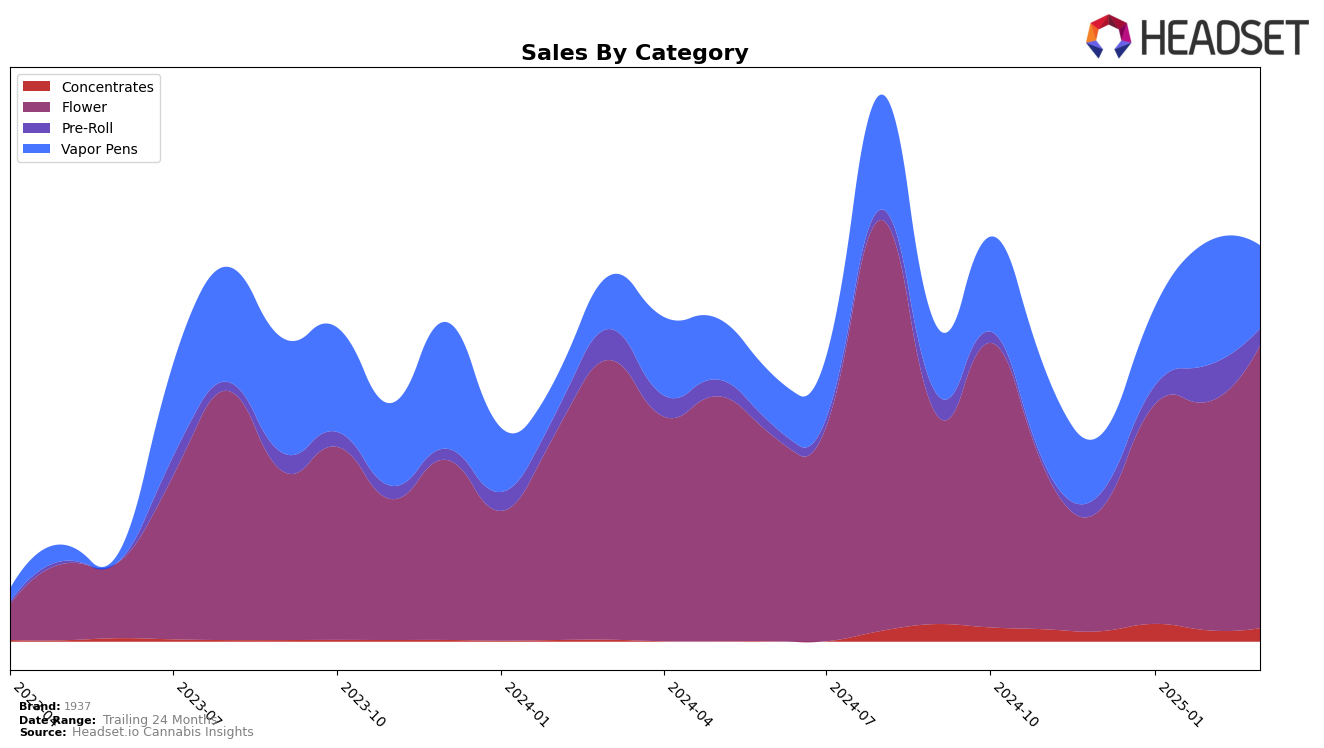

In the Maryland flower category, 1937 has shown a notable upward trajectory in its ranking over the first quarter of 2025, moving from 34th in December 2024 to 24th by March 2025. This positive movement is indicative of a strong sales performance, with sales figures increasing from December to March. In contrast, competitors like Cookies and JustFLOWR have experienced a decline in their rankings, with Cookies dropping from 17th to 23rd and JustFLOWR from 16th to 22nd over the same period. This suggests a potential shift in consumer preference towards 1937, possibly driven by product quality or marketing strategies. Meanwhile, Matter. and Find. have shown fluctuating ranks, with Matter. slightly declining and Find. re-entering the top 25 in March after being absent in February. These dynamics highlight 1937's growing competitiveness in the Maryland market, potentially positioning it for further gains if current trends continue.

Notable Products

In March 2025, the top-performing product from 1937 was Fried Ice Cream (3.5g) in the Flower category, securing the number one rank with sales of 1092 units. GMO Pie (3.5g) showed a strong performance by moving up to the second rank from fourth in February, with sales reaching 1022 units. Hellcat #15 (3.5g) slipped to third place after being second in February, indicating a slight decline in sales momentum. Watermelon Zkittlez Shake (7g) entered the top five, ranking fourth, while Gorilla Glue (3.5g) followed in fifth place. The rankings highlight a competitive shift among the top products, with notable movements in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.