Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

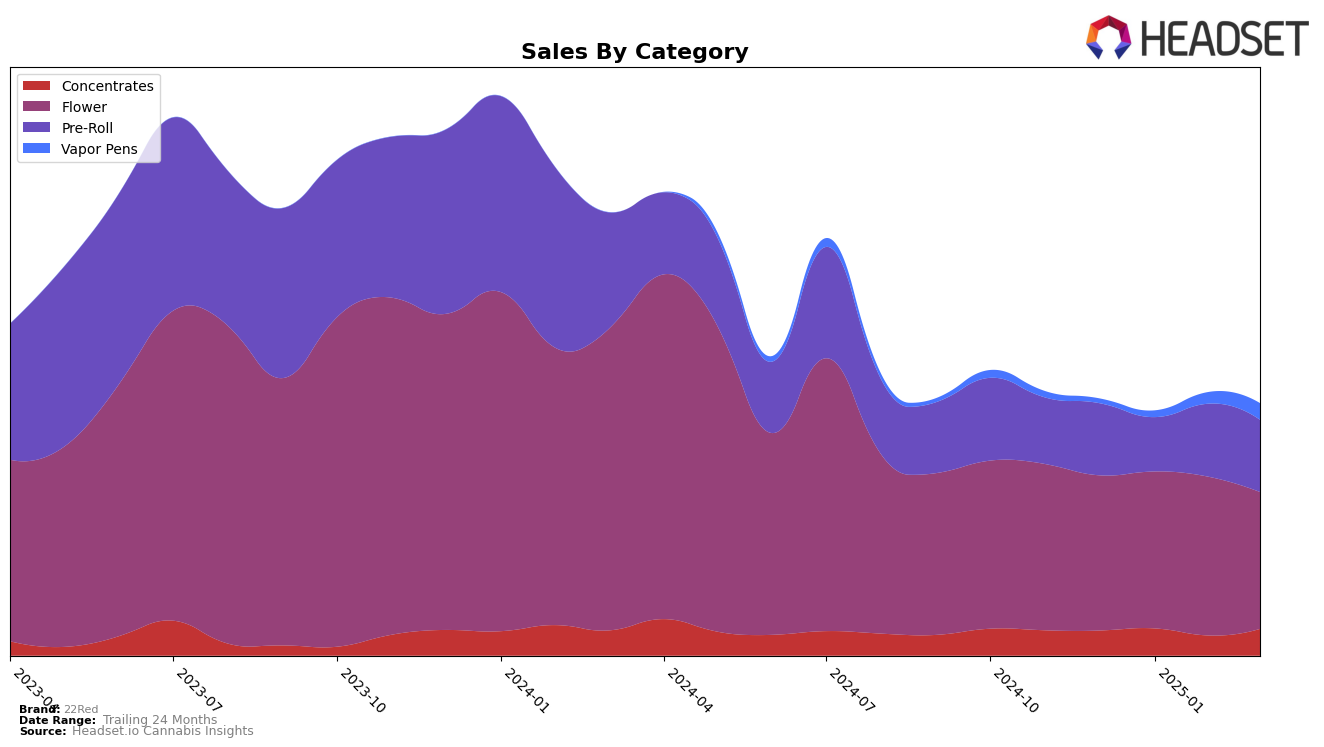

In the state of Arizona, 22Red has shown a notable presence across several categories. In the Concentrates category, the brand maintained a fairly stable ranking around the low 20s, with a slight dip in February 2025 before bouncing back in March 2025. Their Flower category performance witnessed a minor decline from 19th in December 2024 to 24th in March 2025, indicating some competitive challenges. However, the Pre-Roll category remained relatively strong, holding a consistent position in the early teens, suggesting a steady consumer preference. Despite not making it into the top 30 for Vapor Pens in December 2024, 22Red showed significant improvement by March 2025, climbing to the 55th position, which could be indicative of a growing market share in this segment.

In contrast, the performance of 22Red in Nevada appears to be more limited, with the brand not featuring in the top 30 for most categories. The Flower category saw 22Red entering the rankings at 75th in March 2025, which, while not a high position, marks its entry into the competitive landscape of Nevada. This could be seen as a strategic entry point for the brand, potentially setting the stage for future growth. The absence of 22Red in other categories in Nevada suggests either a lack of market penetration or a strategic focus on specific segments. As the brand continues to evolve, monitoring its movements across these states could provide valuable insights into its market strategies and consumer engagement.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, 22Red has experienced fluctuations in its market position, highlighting both challenges and opportunities. From December 2024 to March 2025, 22Red's rank shifted from 19th to 24th, indicating a slight decline in its competitive standing. This period saw a decrease in sales, contrasting with the upward trajectory of competitors like Daze Off, which improved its rank from 32nd to 23rd, and FENO, which climbed from 26th to 22nd. Notably, TRIP experienced a drop from 15th to 25th, suggesting potential volatility in the market. Meanwhile, Tru Infusion showcased a significant rise in February 2025, reaching 23rd place, before settling at 26th in March. These dynamics underscore the competitive pressures 22Red faces, as well as the importance of strategic positioning to regain and enhance its market share in Arizona's Flower category.

Notable Products

In March 2025, the top-performing product for 22Red was Brainfizz Pre-Roll (1g) in the Pre-Roll category, climbing from a rank of 5 in February to 1, with sales reaching 2921 units. Power Purp Pre-Roll (1g) maintained a strong position at rank 2, although its sales decreased from 4470 in February to 1786 in March. BCC x Jealousy (3.5g) emerged in the Flower category at rank 3, marking its first appearance in the rankings. Red Popz (3.5g) followed closely, debuting at rank 4 in the Flower category. Sherbanger Pre-Roll (1g) saw a significant drop, falling from rank 1 in February to rank 5 in March, with a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.