Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

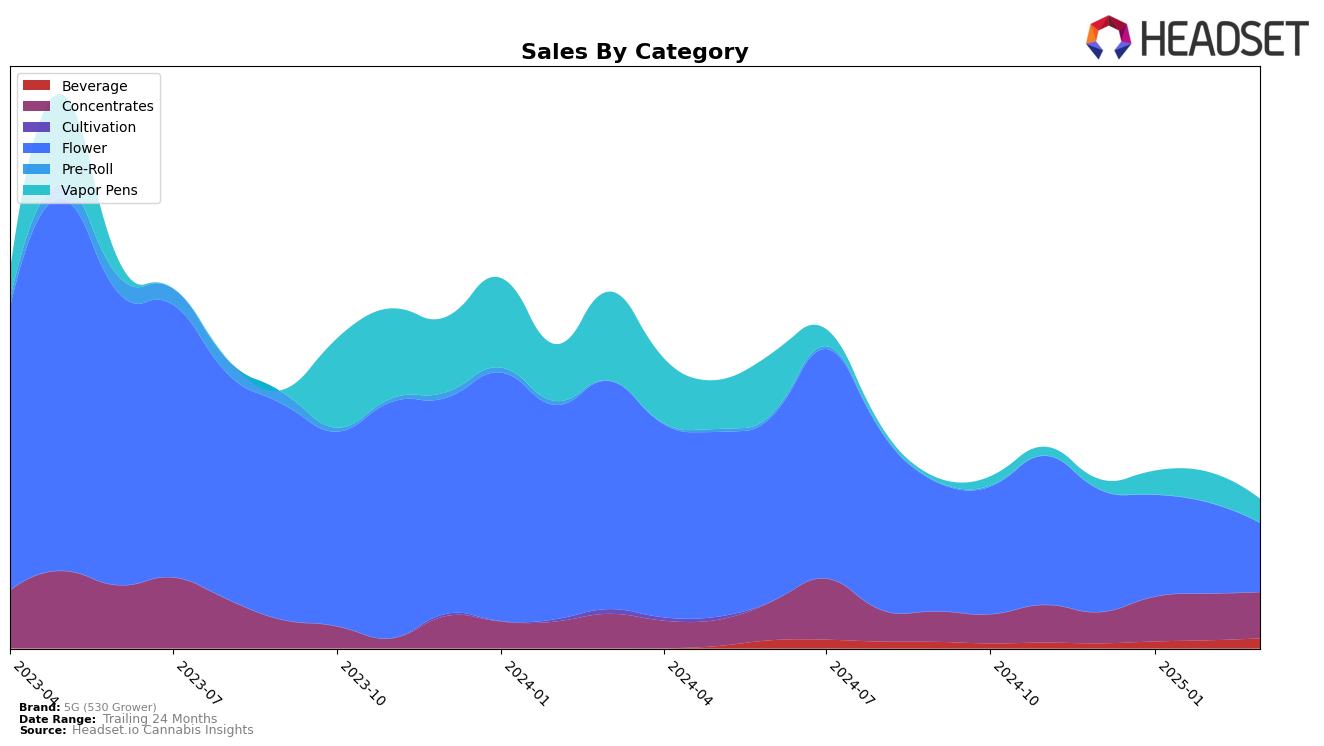

In the California market, 5G (530 Grower) has shown a notable upward trajectory in the Beverage category, improving its rank from 24th in December 2024 to 19th by March 2025. This positive movement is supported by a consistent increase in sales, culminating in March with significant growth. Conversely, in the Concentrates category, the brand has experienced some fluctuations. Starting at 48th place in December, it climbed to 30th by February but saw a slight dip to 33rd in March, suggesting a need for strategic adjustments to maintain momentum. It's worth noting that 5G (530 Grower) did not appear in the top 30 rankings for Flower or Vapor Pens during the initial months of 2025, which could be a strategic area for improvement.

The absence of 5G (530 Grower) from the top 30 in the Flower category since February, after an already declining position from 82nd to 96th in January, indicates a potential area of concern for the brand in California. This suggests that while the brand has made strides in other categories, such as Beverages, there is a competitive challenge in maintaining a strong presence in the Flower market. Similarly, the Vapor Pens category showed a brief appearance at 98th in February, indicating potential but also highlighting the competitive nature of this segment. These insights suggest that while 5G (530 Grower) is making notable progress in certain areas, there are opportunities for improvement and growth in others, particularly in maintaining a stable rank across all product categories.

Competitive Landscape

In the competitive landscape of the California concentrates market, 5G (530 Grower) has shown a notable upward trend in its ranking and sales performance. Starting from a rank of 48 in December 2024, 5G (530 Grower) improved to 33 by March 2025. This progression is significant when compared to competitors like Jetty Extracts, which fluctuated between ranks 31 and 38, and Almora Farms, which saw a decline from rank 19 to 39 over the same period. The sales figures for 5G (530 Grower) also reflect a stable performance, maintaining a consistent level from January through March 2025, while Almora Farms experienced a downward trend in sales. Meanwhile, Hashtag showed an impressive rank improvement, surpassing 5G (530 Grower) in February and March 2025. These dynamics suggest that while 5G (530 Grower) is on a positive trajectory, it faces strong competition from brands like Hashtag, necessitating strategic efforts to maintain and enhance its market position.

Notable Products

In March 2025, the top-performing product for 5G (530 Grower) was Holy Grail x Og Badder (1g) in the Concentrates category, climbing to the first rank with sales of 2186 units. Wedding Cake x Gelato Badder (1g) dropped to the second position from its previous consecutive first-place rankings in January and February. Banana Macaroons Badder (1g) maintained a strong presence, securing the third rank, although it experienced a slight decline from its second-place position in February. Red Dragon Badder (1g) consistently held the fourth position for two months in a row. GMO Badder (1g) re-entered the rankings at fifth place in March, showcasing a return to popularity after not being ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.