Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

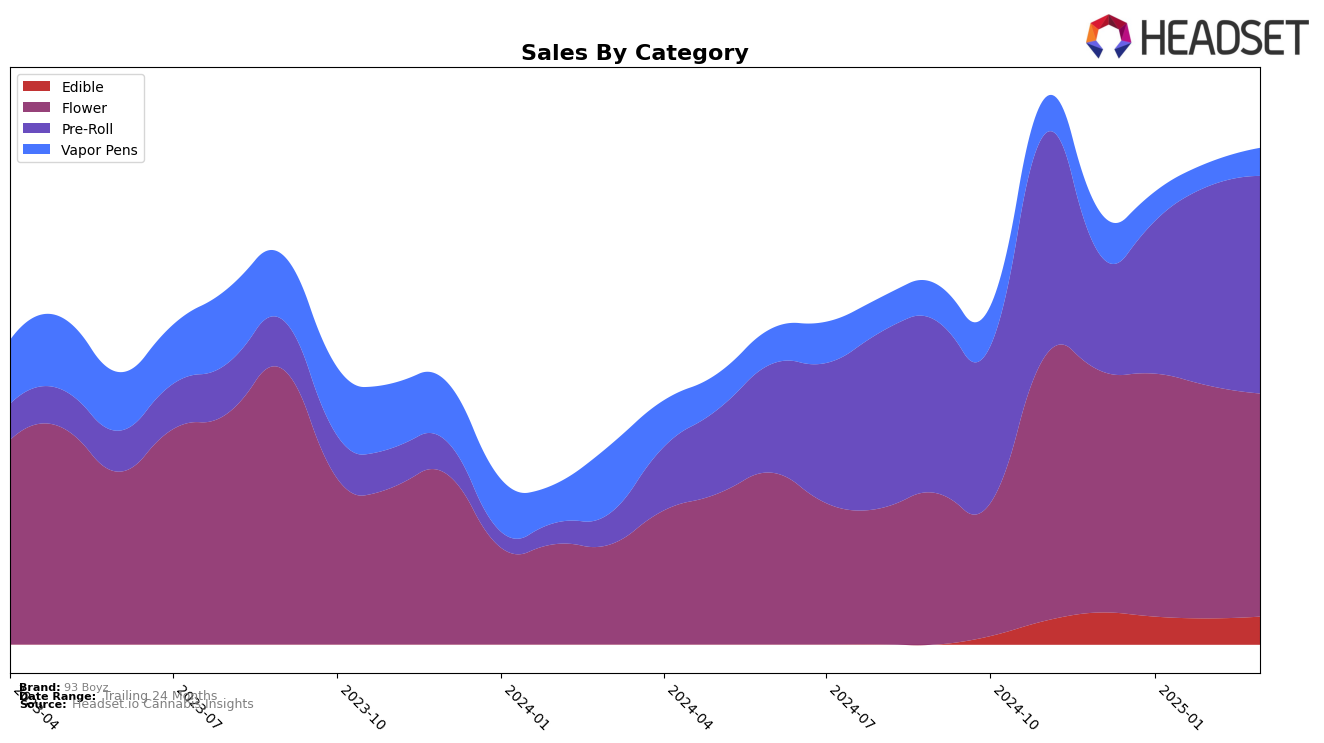

In the state of Illinois, 93 Boyz has shown varied performance across different product categories. Notably, the brand has made significant strides in the Pre-Roll category, moving up from 13th place in December 2024 to a commendable 4th place by March 2025. This upward trend indicates a strong consumer preference and a growing market share in this segment. Conversely, in the Edible category, 93 Boyz has consistently ranked outside the top 30, maintaining a rank of 36th from December 2024 through March 2025, which suggests limited traction in this area. The Flower category has seen a slight decline, with the brand slipping from 21st to 22nd place by March 2025, a trend that may warrant strategic attention.

In the Vapor Pens category, 93 Boyz has experienced some fluctuations, starting at 42nd place in December 2024 and dropping to 48th in February 2025, before slightly recovering to 46th in March. This suggests a competitive and challenging market environment where the brand is struggling to maintain a stable position. Despite these challenges, the overall sales figures for March 2025 indicate a potential for recovery and growth, particularly in categories where the brand has shown resilience. The data highlights the importance of strategic focus on categories with upward momentum, such as Pre-Rolls, while also addressing areas where performance could be improved.

Competitive Landscape

In the competitive landscape of the Illinois flower category, 93 Boyz has maintained a relatively stable presence, consistently ranking around the 21st and 22nd positions from December 2024 to March 2025. Despite this stability, 93 Boyz faces stiff competition from brands like Paul Bunyan, which has seen a decline in rank from 14th to 20th but still maintains higher sales figures. Meanwhile, (the) Essence has shown a more dynamic performance, improving its rank from 22nd to 18th in January before settling at 21st in March, closely trailing 93 Boyz. Additionally, Island and Kaviar have fluctuated in and out of the top 20, indicating a volatile market environment. These shifts suggest that while 93 Boyz maintains a steady rank, there is significant competition from brands that are either improving their market position or maintaining higher sales, highlighting the need for strategic marketing efforts to bolster its competitive edge.

Notable Products

In March 2025, the top-performing product for 93 Boyz was Rellos Jealousy Thin Mintz Kief Infused Blunt, which climbed to the 1st rank with notable sales of 4,408 units. Rellos Peanut Butter Mintz Kief Infused Blunt maintained its position at 2nd rank, demonstrating consistent demand. Rellos NYC Diesel Kief Infused Blunt entered the rankings at 3rd place, showcasing a strong debut. Rellos Jet Fuel Kief Infused Pre-Roll, however, dropped from 1st place in January and February to 4th in March. Finally, Rellos Trophy Wife Kief Infused Pre-Roll secured the 5th spot, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.