Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

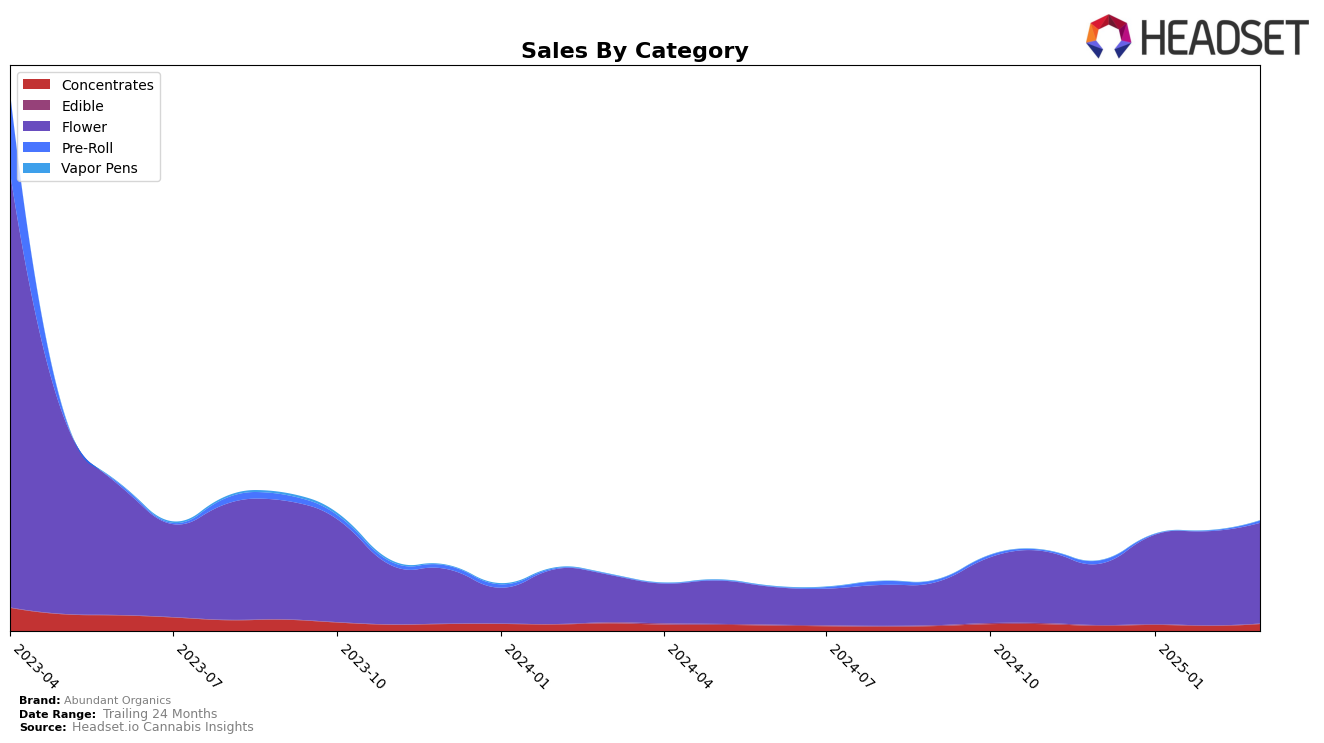

Abundant Organics has shown varied performance across different categories and states, with notable movements in Arizona. In the Concentrates category, the brand experienced a positive upward trend, moving from a rank of 30 in February 2025 to 26 in March 2025, indicating a strengthening position in the market. This improvement is accompanied by a notable increase in sales, suggesting a growing consumer preference for their concentrates. However, the brand's absence from the top 30 in the Pre-Roll category highlights an area for potential growth and improvement. This disparity in category performance suggests that while Abundant Organics is gaining traction in certain segments, there remains untapped potential in others.

In the Flower category, Abundant Organics has demonstrated consistent progress, achieving a rank of 13 by March 2025, up from 18 in December 2024. This steady climb in rankings reflects a robust demand for their flower products, which is further supported by the increasing sales figures over the months. Despite these gains, the brand's presence in only one category within the top 30 across states suggests a focused but limited market penetration. The data points to a successful strategy in the Flower category but also highlights opportunities for expansion and diversification in other product lines and regions. For a deeper dive into their market strategies and potential areas for growth, a more comprehensive analysis would be beneficial.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Abundant Organics has shown a consistent upward trend in rank from December 2024 to March 2025, moving from 18th to 13th position. This improvement is notable when compared to competitors like Fade Co., which fluctuated between 10th and 15th place, and Grassroots, which saw a significant jump from 22nd to 11th place by March 2025. Despite DTF - Downtown Flower and Riggs Family Farms maintaining higher ranks overall, Abundant Organics has been closing the gap in sales, with a steady increase over the months. This trend suggests a strengthening market presence and potential for further growth, positioning Abundant Organics as a rising contender in the Arizona flower market.

Notable Products

In March 2025, Abundant Organics' top-performing product was Scotch Bacio 3.5g in the Flower category, achieving the number one rank with sales of $1,870. Last Supper 3.5g, also in the Flower category, secured the second position, marking its entry into the top ranks. Space Sasquatch 3.5g maintained a strong presence, climbing from fifth in February to third in March. Forest Queen 3.5g and Last Supper Pre-Roll 1g rounded out the top five, with Forest Queen making its debut in the rankings. Notably, Scotch Bacio's ascent to the top spot highlights its growing popularity, rising from third place in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.