Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

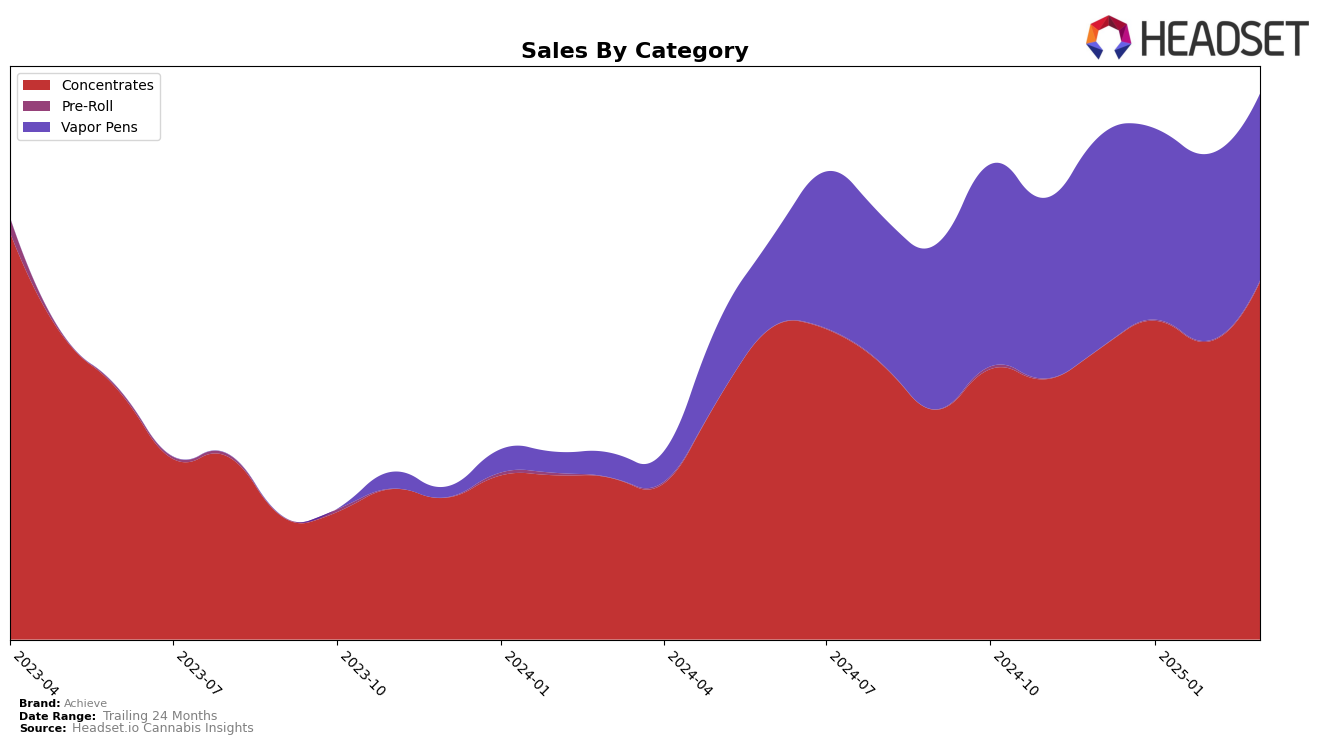

In the state of Arizona, Achieve has shown a notable performance in the Concentrates category. Throughout December 2024 to March 2025, Achieve maintained a consistent rank of 12th place, before climbing to 10th place in March 2025. This upward movement suggests a strengthening position in the market, supported by a growth in sales from $112,641 in December 2024 to $138,701 in March 2025. However, in the Vapor Pens category, Achieve did not manage to break into the top 30, with rankings hovering in the low 40s, indicating a need for strategic adjustments to improve their competitive edge in this segment.

While Achieve's performance in Concentrates is promising, their absence from the top 30 in the Vapor Pens category across the months could be seen as a missed opportunity in Arizona. The consistency in their ranking for Concentrates, coupled with the sales growth, highlights a potential area of focus for Achieve to capitalize on. On the other hand, the lack of presence in the top 30 for Vapor Pens might suggest either a competitive market or a gap in product offerings that needs addressing to boost their market position and visibility.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Achieve has demonstrated a notable upward trend in its market position. From December 2024 to March 2025, Achieve improved its rank from 12th to 10th, indicating a positive trajectory in a highly competitive market. This improvement is significant, especially when compared to competitors like iLava, which moved from 11th to 8th, and High Grade, which experienced a decline from 9th to 11th. Achieve's sales growth over this period also reflects its strengthening market presence, with a notable increase in March 2025. Meanwhile, Jukebox maintained a relatively stable position, fluctuating slightly between 8th and 9th place, and Sweet Science made a significant leap from 24th to 12th, showcasing the dynamic nature of this market. Achieve's consistent improvement in both rank and sales suggests a successful strategy in capturing market share and enhancing brand visibility in Arizona's concentrates segment.

Notable Products

In March 2025, the top-performing product for Achieve was Alien Pharaoh Hash (1g) from the Concentrates category, which climbed to the number one rank with sales of 610 units, up from its second position in February. Blue Dream RSO Syringe (1g) also showed strong performance, securing the second spot, improving from its third rank in February. Superboof Hash (1g) entered the rankings for the first time, achieving the third position in March. Holy Grail RSO Syringe (1g) maintained a steady performance, ranking fourth, slightly improving from its fifth position in February. Sour Alien RSO Syringe (1g) debuted in the rankings at fifth place, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.