Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

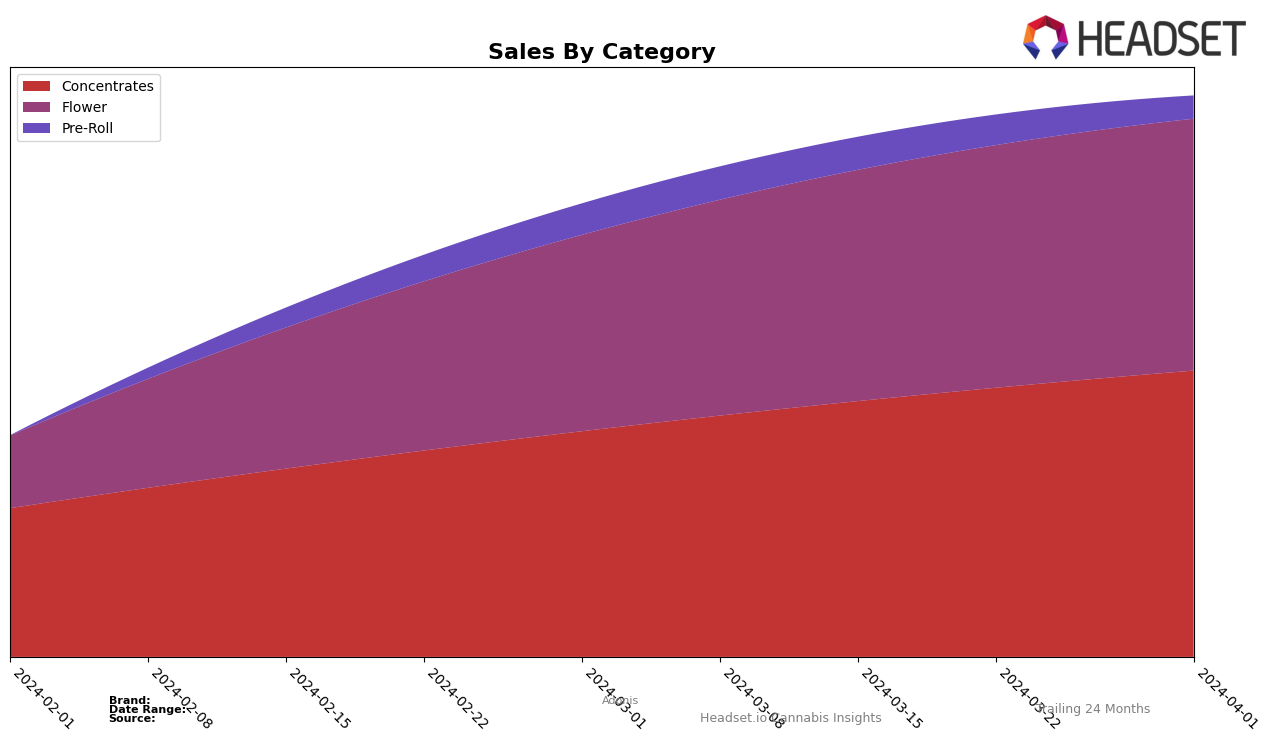

In the highly competitive cannabis market of New York, Adonis has shown a noteworthy performance in the Concentrates category, making its entry into the top 30 brands by March 2024 and improving its rank to 17th by April 2024. This upward trajectory, underscored by a sales increase from $12,883 in March to $15,750 in April, indicates a growing consumer preference for Adonis' concentrates. However, their performance in the Flower category tells a different story. Despite a slight improvement from an 81st rank in March to 76th in April, their inability to break into the top 30 highlights significant challenges in gaining market share amidst fierce competition. The contrast between the two categories underscores the brand's varied performance across different segments of the cannabis market in New York.

Adonis' journey in the New York market reflects the brand's strategic positioning and consumer reception across different product categories. The notable rank improvement in Concentrates suggests a successful penetration and growing foothold within this category. Conversely, the Flower category presents a tougher battleground for Adonis, with its ranking remaining outside the top 30. This discrepancy in performance between categories may point to differing consumer preferences, market saturation, or possibly Adonis' strategic focus and resource allocation. For stakeholders and observers, these movements offer insights into Adonis' market dynamics, potential growth areas, and challenges in New York's diverse cannabis landscape.

Competitive Landscape

In the competitive landscape of the concentrates category in New York, Adonis has shown a fluctuating yet promising performance. Starting outside the top 20 in January and February 2024, Adonis made a notable entrance in March, securing the 14th rank, and slightly dipped to the 17th position in April. This trajectory suggests a growing presence in the market, albeit with challenges in maintaining a steady climb. Competitors such as Lobo have demonstrated stronger consistency, ranking within the top 15 in January, March, and April, with sales peaking in April, indicating a robust competitive edge. Conversely, Hepcat Cannabis and Glenna's have shown more sporadic appearances in the rankings, with Hepcat peaking at 13th in February but falling to 19th in April, and Glenna's only appearing in April at 18th. This volatility highlights an opportunity for Adonis to capitalize on the gaps left by these fluctuating performances. However, the emergence of Olio in April at the 15th rank, despite not being ranked in the earlier months, signifies a dynamic and competitive market that Adonis must navigate carefully to improve its rank and sales in the concentrates category in New York.

Notable Products

In April 2024, Adonis saw Monkey Pie Infused Flower (3.5g) maintaining its top spot in the sales ranking, with notable sales figures, peaking at 134.0 units sold. Following closely, Blizzards Diamond Infused Flower (3.5g) made a significant entry to the rankings, securing the second position despite not being listed in the previous months. Mimosa #33 Hash (1g) and Dutch Treat Hippie Hash (1g) held steady in their rankings at third and fourth place respectively, demonstrating consistent preference among consumers. Biscotti Infused Pre-Roll (2.5g), previously ranked second in March, experienced a slight dip to the fifth position in April, indicating a shift in consumer choices. This month's data illustrates a dynamic market with Adonis's diverse product offerings capturing varied consumer interests.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.