Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

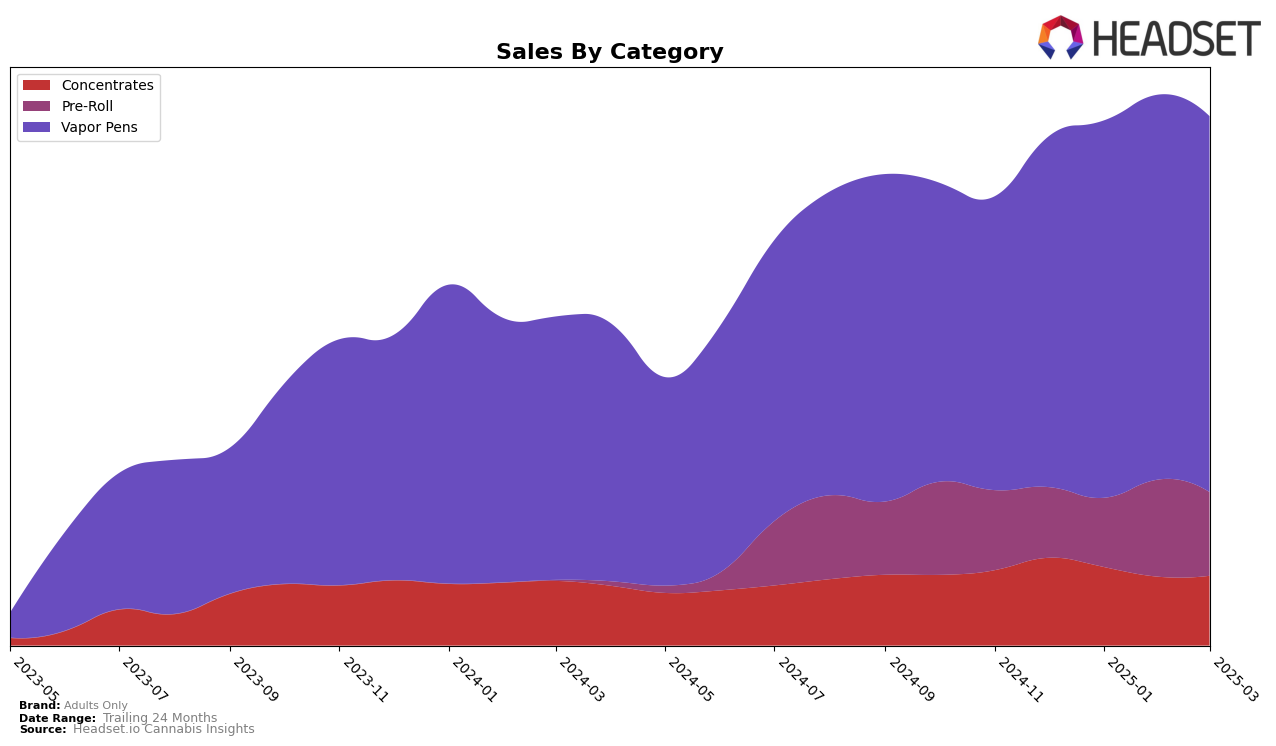

Adults Only has demonstrated varied performance across different categories and regions, with notable movements in rankings and sales trends. In Alberta, the brand has maintained a consistent presence in the top 10 for Concentrates, holding steady at 9th place from December 2024 to March 2025, indicating a stable market position. However, their performance in the Pre-Roll category has been more volatile, with a significant jump to 37th place in February 2025 from being outside the top 30 in December 2024, before slipping back to 54th in March. Meanwhile, in the Vapor Pens category, Adults Only showed a positive trend by improving its rank from 21st in December 2024 to 16th in February 2025, although there was a slight dip to 17th in March.

In British Columbia, Adults Only has maintained a stronghold in the Vapor Pens category, consistently ranking within the top 10, though there was a slight decline from 7th in December 2024 to 9th in March 2025. The Concentrates category saw a stable performance, with the brand hovering around the 14th and 15th positions. However, the Pre-Roll category reflects a more challenging landscape, as the brand did not break into the top 30, peaking at 68th in February 2025. In Ontario, the brand's Vapor Pens have shown resilience, maintaining a rank of 10th from January to March 2025, while the Concentrates category experienced a slight decline, dropping to 13th in March from a consistent 10th place in the preceding months.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Adults Only has shown a consistent performance, maintaining its rank at 10th place from January to March 2025, after climbing from 12th in December 2024. This steady position highlights an upward trend in sales, contrasting with brands like Endgame, which saw a decline in rank from 10th to 12th over the same period. Meanwhile, Weed Me has remained a top contender, consistently ranking between 6th and 8th, indicating a stronger market presence. LITTI has maintained a stable 9th position, just ahead of Adults Only, suggesting a close competition. Kolab, on the other hand, has fluctuated slightly but remains behind Adults Only, indicating potential opportunities for Adults Only to further solidify its position in the market. These dynamics suggest that while Adults Only is holding its ground, there is room for strategic growth to climb higher in the rankings.

Notable Products

In March 2025, the top-performing product from Adults Only was the Missionary Mango NSFW Liquid Diamond Cartridge in the Vapor Pens category, maintaining its number one rank from February with sales of 14,030 units. The Cheeky Cherry NSFW Liquid Diamond Cartridge also held its position as the second top product, continuing its consistent performance from January and February. Bumpin' Blue Raspberry NSFW Liquid Diamond Cartridge remained steady in third place, showing no change in its ranking over the past four months. Promicuous Peach NFSW Liquid Diamond Cartridge held the fourth position consistently throughout the observed months. Meanwhile, Cheeky Cherry NSFW Liquid Diamond Dispenser in the Concentrates category re-entered the rankings in March at fifth place, showing a stable sales performance similar to December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.