Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

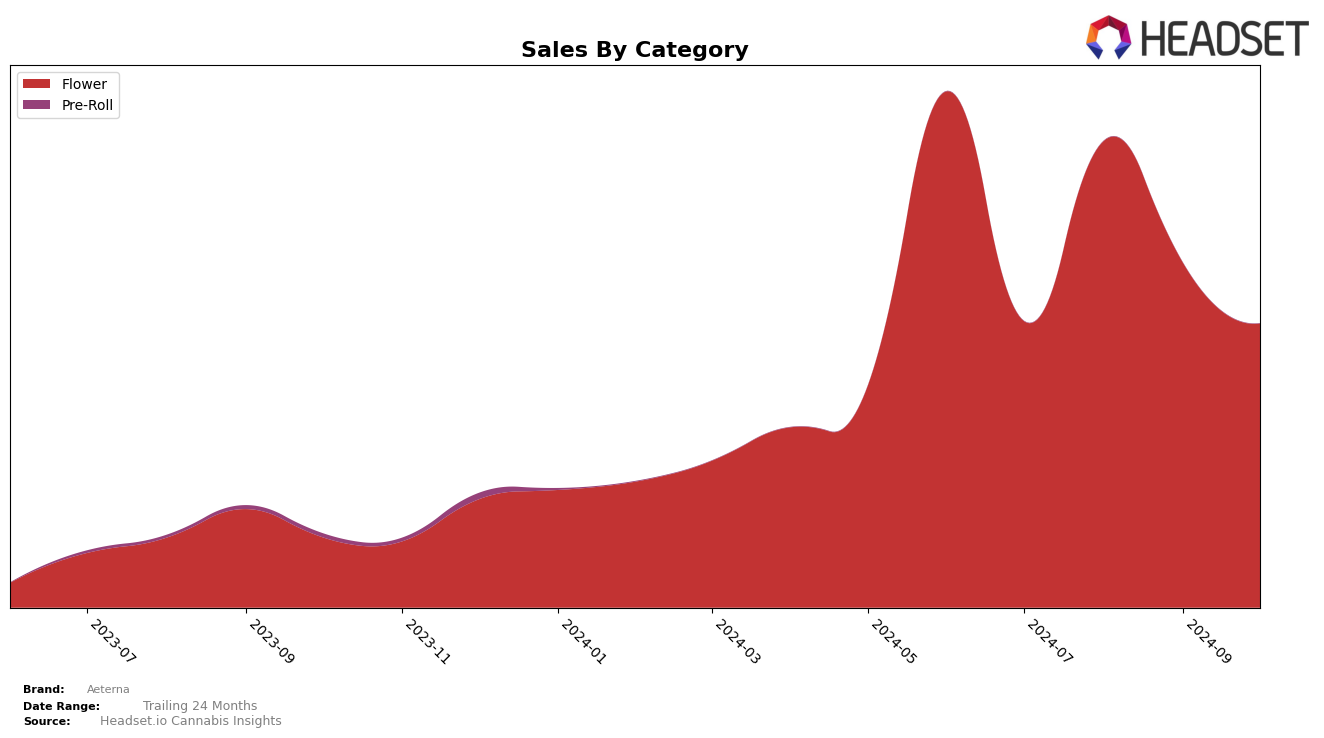

Aeterna's performance in the New York market shows a dynamic trajectory within the Flower category over the past few months. The brand climbed from the 22nd position in July 2024 to reach 19th in August, indicating a positive reception and growth. However, this upward trend faced challenges in the subsequent months as Aeterna slipped to 26th in September and further down to 29th by October. This downward movement suggests increased competition or possible shifts in consumer preferences within the state. Despite these fluctuations, the brand maintained a presence in the top 30, which is a testament to its resilience in a competitive market.

It's noteworthy that Aeterna's sales figures in New York showed a significant increase from July to August, reflecting a strong market push or successful promotional activities during that period. However, sales tapered off in the following months, aligning with the brand's declining rank. This pattern could indicate seasonal variations or the impact of new entrants in the market. The absence of Aeterna from the top 30 in any other state or category during this period highlights potential areas for strategic expansion or improvement. The insights into these trends can provide valuable guidance for stakeholders looking to understand Aeterna's market dynamics and future potential.

Competitive Landscape

In the competitive landscape of the New York flower category, Aeterna has experienced fluctuations in its market position over the past few months. Starting from a rank of 22 in July 2024, Aeterna improved to 19 in August but then slipped to 26 in September and slightly recovered to 29 in October. This shift in rank corresponds to a notable peak in sales during August, followed by a decline in the subsequent months. In contrast, Weekenders showed a significant jump from being out of the top 20 to rank 30 in October, indicating a potential threat to Aeterna's market share. Meanwhile, The Botanist maintained a relatively stable presence, peaking at rank 25 in September before dropping to 35 in October, suggesting a volatile yet competitive stance. Tarot Tokes and Etain also displayed dynamic movements, with Tarot Tokes improving to rank 27 in October and Etain consistently climbing to 28, both posing competitive pressure on Aeterna. These trends highlight the importance for Aeterna to strategize effectively to maintain and improve its market position amidst the shifting dynamics of the New York flower market.

Notable Products

In October 2024, the top-performing product for Aeterna was Papaya Cake (3.5g) in the Flower category, maintaining its first-place rank from September with sales of 855 units. Gelato 33 (3.5g) rose to the second position, up from third in September, showing consistent performance throughout the months. Apple Fritter (3.5g) experienced a drop to third place from its previous second position, with a notable decrease in sales from September. Papaya Cake (14g) held steady in fourth place, matching its rank from September. The new entry, Papaya Cake (28g), debuted in fifth place, indicating a growing interest in larger quantities of this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.