Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

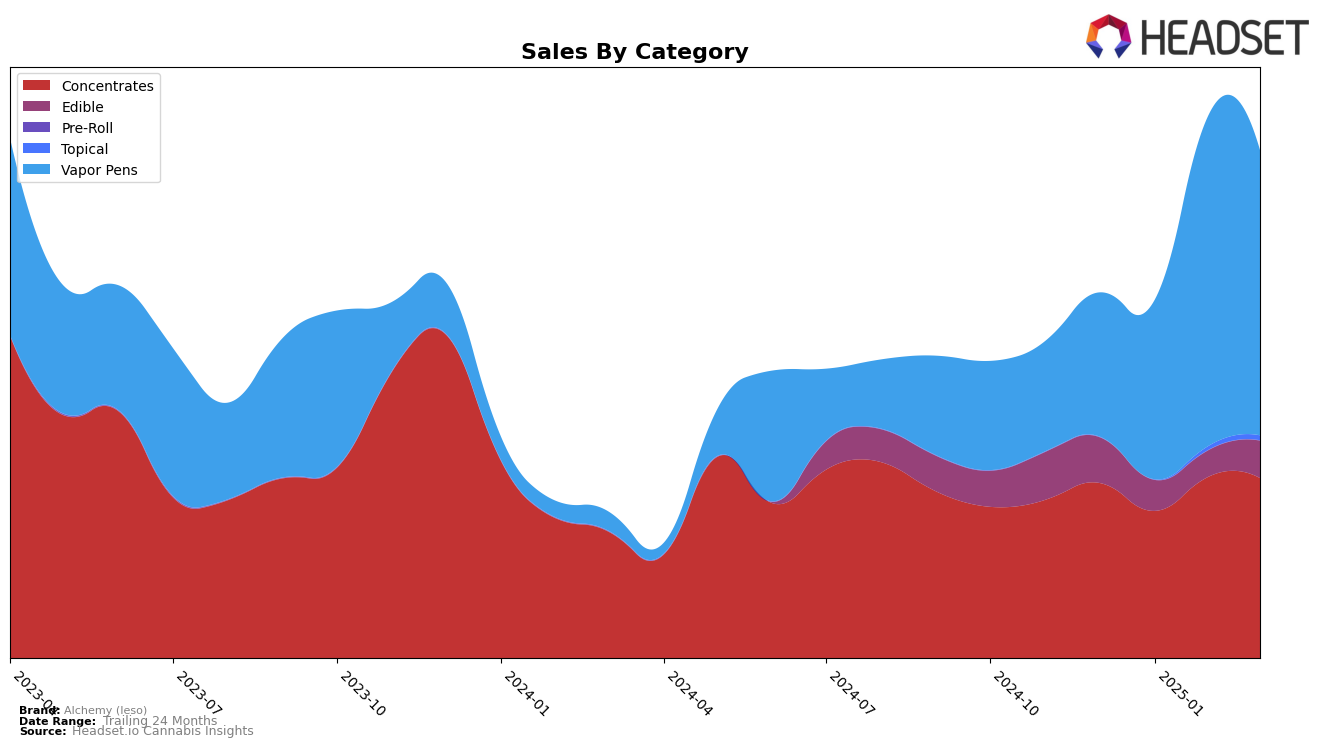

Alchemy (Ieso) has shown a consistent performance in the Illinois concentrates category, maintaining a steady rank of 7th from January to March 2025. This stability is indicative of a strong market presence and customer loyalty in the concentrates segment. However, the brand's performance in the edible category is less impressive, as it has not broken into the top 30, with ranks hovering in the low 40s. This suggests potential challenges or missed opportunities in capturing the edible market in Illinois. The vapor pens category, on the other hand, has seen a notable upward trajectory, with Alchemy (Ieso) climbing from 34th in December 2024 to a peak of 16th in February 2025, before settling at 21st in March 2025. This improvement highlights a significant gain in consumer interest and market share for their vapor pen products.

The overall sales trends for Alchemy (Ieso) in Illinois reveal interesting dynamics. While the concentrates category experienced a slight decline in sales from December 2024 to January 2025, it rebounded strongly in February and March, maintaining robust sales figures. In contrast, the edible category's sales have been more volatile, with a notable dip in January 2025 followed by a recovery in March. The vapor pens category stands out with a remarkable sales increase, particularly in February 2025, where sales almost doubled compared to December 2024. This surge in vapor pen sales suggests that Alchemy (Ieso) has successfully tapped into consumer preferences or benefited from market conditions favoring vapor products during this period.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Alchemy (Ieso) has demonstrated a notable upward trajectory from December 2024 to February 2025, moving from a rank of 34 to 16. This improvement signifies a strong market presence and growing consumer preference. However, by March 2025, Alchemy (Ieso) experienced a slight decline to rank 21, indicating potential challenges in sustaining its rapid growth. Comparatively, High Supply / Supply maintained a more stable presence, consistently ranking within the top 20, though it experienced fluctuations, ending at rank 20 in March 2025. Redbud Roots also showed resilience, closing March 2025 at rank 19, slightly ahead of Alchemy (Ieso). Meanwhile, Daze Off and Revolution Cannabis hovered around the lower 20s, suggesting a competitive but less volatile market position. Alchemy (Ieso)'s ability to climb the ranks quickly highlights its potential for capturing market share, but maintaining this momentum will be crucial in the face of consistent competitors.

Notable Products

In March 2025, Alchemy (Ieso) saw its Diablo OG Distillate Cartridge (1g) leading the sales as the top-performing product with a notable figure of 1807 units sold. Following closely, the Hippie Crasher Distillate Cartridge (1g) secured the second position, and the Don Shula Cured Budder (1g) ranked third. The Hot Cakes Distillate Cartridge (1g) and Banana Munson Distillate Cartridge (1g) took fourth and fifth places, respectively. Compared to previous months, these products have consistently maintained their top rankings, indicating stable consumer preference. Notably, the Vapor Pens category dominated the top five, reflecting a strong market trend for this product type.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.