Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

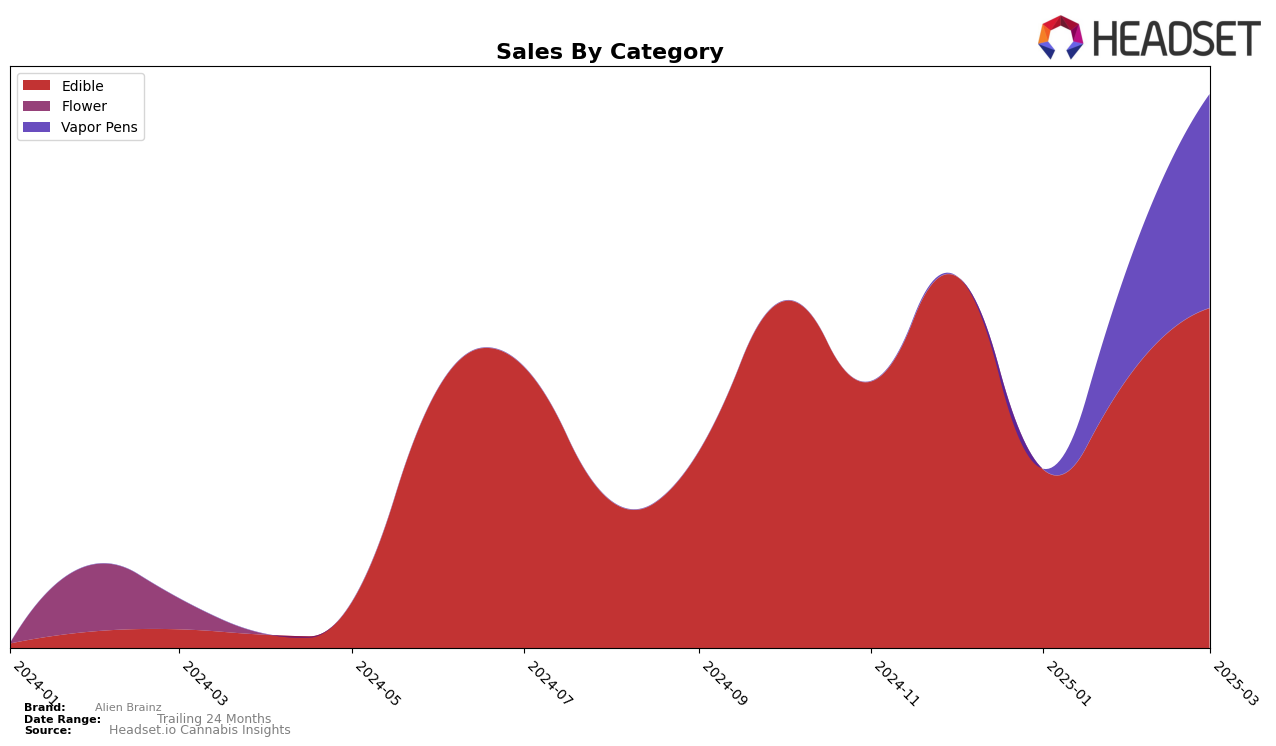

Alien Brainz has shown notable fluctuations in its performance across different categories and states. In the Michigan market, the brand has maintained a presence in the Edible category, with rankings fluctuating between 27th in December 2024 and 29th by March 2025. This indicates a consistent presence in the competitive landscape, though the dip in January 2025 to 41st place suggests a period of underperformance. Despite this, the brand managed to recover, climbing back into the top 30 by February 2025. Such movements highlight the brand’s resilience and ability to rebound in the Michigan Edible market.

In contrast, Alien Brainz's entry into the Vapor Pens category in Michigan is relatively recent, with the brand not appearing in the top 30 until February 2025, where it entered at 70th place. By March 2025, it improved its standing to 53rd, indicating a positive trajectory. This upward movement suggests that while the brand is still establishing itself in this category, there is potential for further growth if the trend continues. The absence of a top 30 ranking in the earlier months could reflect the initial challenges faced in penetrating this segment, but the recent gains are promising for future performance.

Competitive Landscape

In the competitive landscape of the Edible category in Michigan, Alien Brainz has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 27th in December, Alien Brainz saw a significant drop to 41st in January, which coincided with a sharp decline in sales. However, the brand rebounded to 31st in February and improved further to 29th in March, reflecting a recovery in sales figures. This volatility contrasts with competitors like Kiva Chocolate, which maintained a relatively stable ranking, fluctuating between 24th and 30th, and Petra, which consistently held a position around 26th to 29th. Meanwhile, North Cannabis Co. showed a positive trend, climbing from 35th to 28th by March, suggesting a potential threat to Alien Brainz's market share. The varying performance of these brands indicates a dynamic market environment where Alien Brainz's ability to stabilize and improve its rank could significantly impact its competitive standing and sales trajectory in the coming months.

Notable Products

In March 2025, the top-performing product for Alien Brainz was ET Tangerine Gummies 4-Pack (200mg) in the Edible category, maintaining its leading position from February with sales of 14,232 units. Following closely was Treky Cherry Gummies 4-Pack (200mg), which climbed from fourth place in February to second place in March, showcasing a significant increase in performance. Celestial Strawberry Galactic Gummies 10-Pack (200mg) dropped from first place in February to third in March, indicating a slight decline in sales momentum. Beamz of Blue Razz Gummies 4-Pack (200mg) held steady at fourth place, while Grape Gummies 4-Pack (200mg) remained consistent in fifth place since February. Overall, the rankings reflect a dynamic shift in consumer preferences, with notable gains for Treky Cherry Gummies.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.