Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

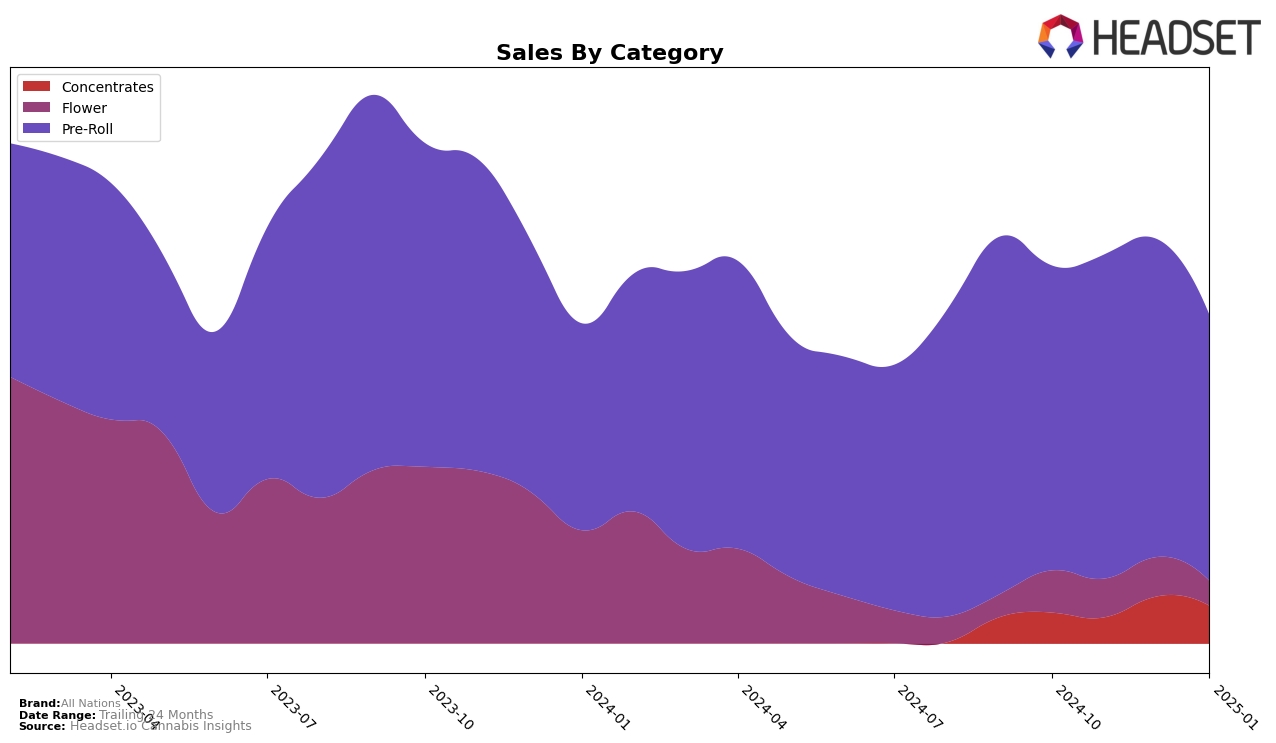

In British Columbia, All Nations has shown varied performance across different product categories. The brand's presence in the Concentrates category has been somewhat inconsistent, slipping out of the top 30 in November and December 2024 but making a slight recovery to 35th place by January 2025. This fluctuation is mirrored in their sales figures, which peaked in December before dropping again in January. In contrast, the Pre-Roll category has been a relative stronghold for All Nations, maintaining a position within the top 30 throughout the observed months, albeit with a slight decline in January 2025. The Flower category, however, has been challenging for the brand, as it has consistently failed to break into the top 80, indicating a potential area for strategic improvement.

In Saskatchewan, All Nations has demonstrated a noteworthy entry into the Concentrates category, achieving a commendable 12th place by January 2025, despite not being ranked in the months prior. This suggests a significant upward trajectory and an opportunity for growth in this market segment. However, the Pre-Roll category tells a different story, with All Nations appearing in the rankings only sporadically, indicating challenges in maintaining a consistent market presence. The absence of rankings in certain months highlights potential volatility and competition in this space. These dynamics present both challenges and opportunities for All Nations as they navigate the competitive landscape across Canadian provinces.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, All Nations has shown a relatively stable performance, maintaining a presence in the top 30 brands from October 2024 to January 2025. Despite a slight dip in January 2025, where it ranked 30th, All Nations has generally kept pace with its competitors. Notably, Simply Bare and BC Green have consistently hovered around similar rankings, indicating a tightly contested market segment. Meanwhile, Jonny Chronic has shown a remarkable upward trajectory, improving its rank from 61st in October 2024 to 31st by January 2025, which could signify a growing threat to All Nations. Additionally, Woody Nelson experienced a significant jump in December 2024, surpassing All Nations, although it fell back slightly in January 2025. These dynamics suggest that while All Nations is holding its ground, it must strategize to counter the rising momentum of competitors like Jonny Chronic and Woody Nelson to maintain and potentially improve its market position.

Notable Products

In January 2025, Sto:Lo Haze Pre-Roll 3-Pack (1.5g) reclaimed its top spot as the leading product for All Nations, showing consistent performance since October 2024, with sales reaching 2714 units. Lemon Tartz Pre-Roll 3-Pack (1.5g) maintained its strong position at number two, although it experienced a decrease in sales from December. Frosted Gelato Pre-Roll 3-Pack (1.5g) dropped from the top spot in December to rank third in January. Mac Daddy Pre-Roll 3-Pack (1.5g) held steady at fourth place across the months, indicating stable demand. Cherry Gas Pre-Roll 3-Pack (1.5g) reappeared in the rankings at fifth, despite a slight dip in sales compared to December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.