Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

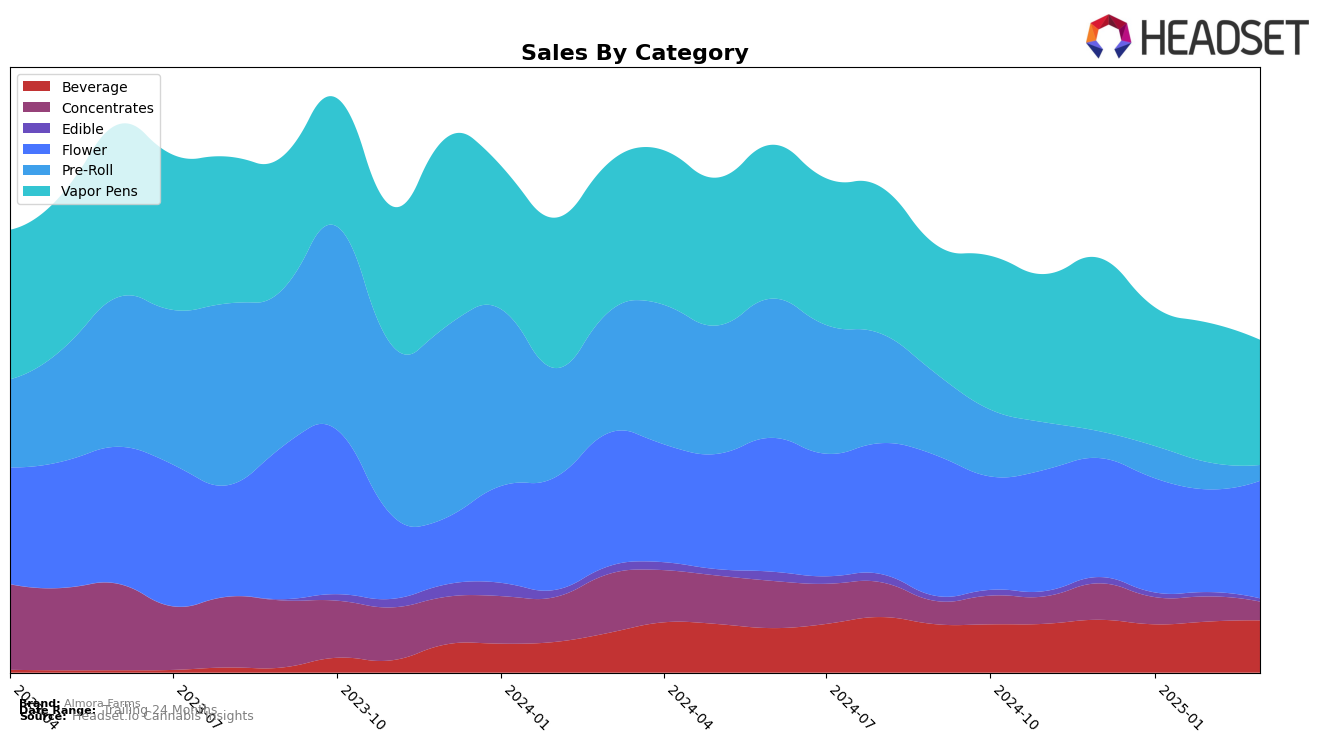

Almora Farms has demonstrated consistent performance in the California market, particularly in the Beverage category, where it held steady at the 7th rank from December 2024 through March 2025. This stability suggests a strong foothold in this category, despite a slight dip in sales during January 2025. In contrast, the brand's presence in the Concentrates category experienced a downward trajectory, falling out of the top 30 by March 2025, which may indicate challenges in maintaining competitiveness or shifts in consumer preferences. The Flower category showed some volatility, with Almora Farms moving from 47th in December 2024 to 46th by March 2025, suggesting a recovery after a dip in February 2025.

In the Vapor Pens category, Almora Farms experienced fluctuations, starting at 24th in December 2024, dropping slightly to 31st by March 2025. This movement reflects a competitive landscape where maintaining a top position is challenging. The Pre-Roll category saw a significant decline, with the brand falling from 75th in December 2024 to 91st by March 2025, indicating a need for strategic adjustments. Overall, while Almora Farms maintains a strong presence in certain categories, the data suggests areas for potential improvement and strategic focus, particularly in the Pre-Roll and Concentrates markets.

Competitive Landscape

In the competitive landscape of vapor pens in California, Almora Farms has experienced notable fluctuations in its ranking over the past few months. Starting in December 2024, Almora Farms was positioned at rank 24, but saw a decline to rank 31 by March 2025. This downward trend in ranking is significant as it indicates a potential challenge in maintaining market share amidst strong competition. Brands like Eighth Brother, Inc. have shown a remarkable improvement, moving from rank 35 in December 2024 to rank 30 by March 2025, suggesting a competitive edge in capturing consumer interest. Meanwhile, PAX and Oakfruitland also demonstrate competitive pressure, with PAX climbing to rank 29 and Oakfruitland maintaining a steady presence around the 33rd position. Despite these challenges, Almora Farms' sales figures remain relatively robust, indicating that while its rank may have slipped, it still holds a significant position in the market. This dynamic environment underscores the importance for Almora Farms to innovate and adapt strategies to regain its competitive standing in the California vapor pen market.

Notable Products

In March 2025, Almora Farms' top-performing product was the Strawberry Live Resin Lemonade (100mg THC, 12oz) in the Beverage category, maintaining its consistent first-place ranking with sales of $12,266. The OG Live Resin Lemonade (100mg THC, 12oz) also held steady in second place, showing an increase in sales compared to February. The Iced Tea Live Resin Lemonade (100mg THC, 12oz) remained in third place, with a slight uptick in sales figures. New to the top rankings are Motor Breath (3.5g) and Hybrid Pre Ground (28g), both in the Flower category, taking fourth and fifth places respectively. This marks a notable entry for these products, as they were not ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.