Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

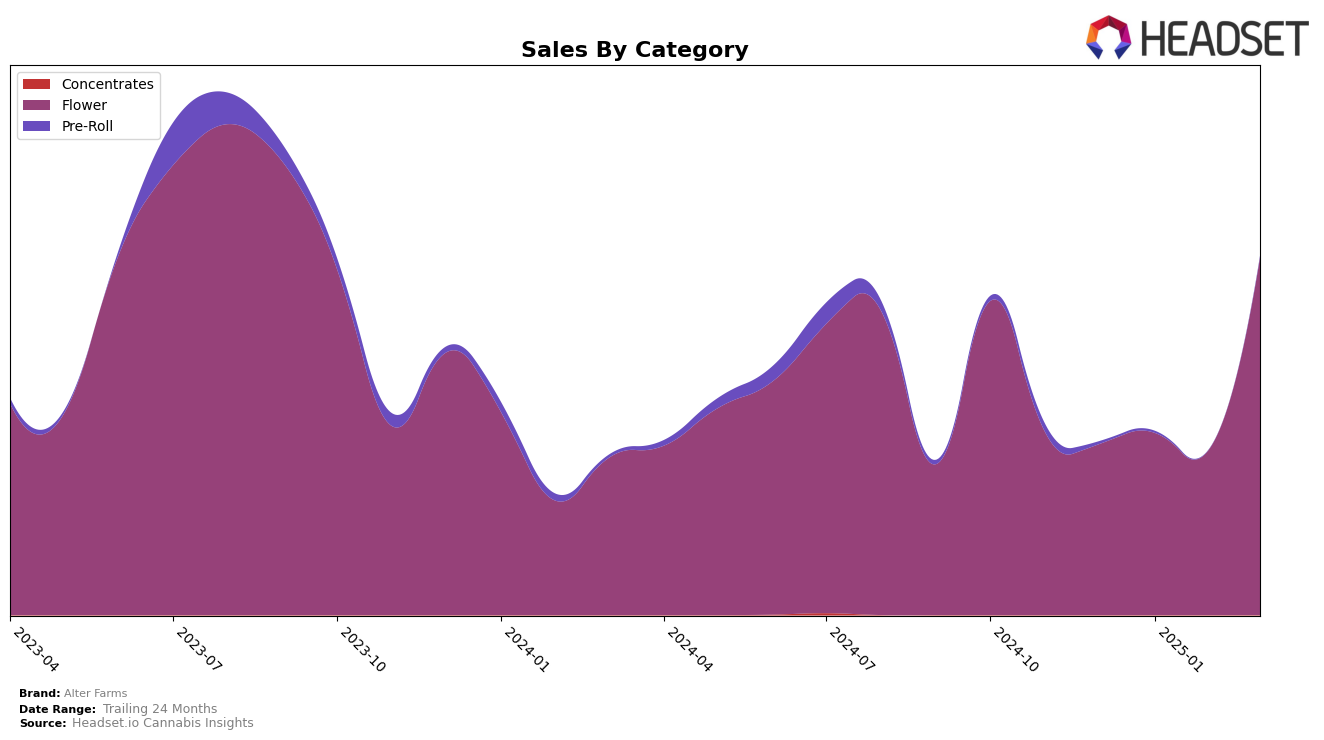

Alter Farms has shown a notable performance in the Oregon market, particularly within the Flower category. Over the months from December 2024 to March 2025, the brand has experienced significant fluctuations in its rankings. Starting from a rank of 66 in December, Alter Farms improved its position to 53 in January, but then slipped to 61 in February. However, March marked a substantial leap as the brand surged to the 29th position. This dramatic improvement in March suggests a strong upward trend, potentially indicating successful strategic adjustments or increased consumer demand during that period.

Despite the positive momentum in March, it's important to note that Alter Farms did not appear in the top 30 brands in the Flower category in Oregon for the months of December through February, which could be interpreted as a challenge in maintaining consistent top-tier performance. The sales figures reflect this variability, with a notable increase in March, where sales nearly doubled compared to the previous months. This suggests that while the brand may face competition, there are opportunities for growth and expansion if the current trajectory continues. The data highlights both the potential and the challenges for Alter Farms as it seeks to solidify its presence in the competitive Oregon cannabis market.

Competitive Landscape

In the competitive landscape of the Oregon Flower category, Alter Farms has demonstrated a significant upward trajectory in its market position. From December 2024 to March 2025, Alter Farms improved its rank from 66th to an impressive 29th, reflecting a strategic breakthrough in sales performance. This rise is particularly notable when compared to competitors like Frontier Farms, which experienced fluctuations, peaking at 18th in January 2025 before dropping to 30th by March. Similarly, Cosmic Treehouse maintained a relatively stable position, ending March at 27th, just slightly ahead of Alter Farms. Meanwhile, Excolo saw a significant improvement from 55th in February to 28th in March, closely trailing Alter Farms. The consistent rise of Alter Farms, particularly its leap in March, suggests a successful strategy in capturing market share and enhancing brand visibility, positioning it favorably against competitors in the Oregon Flower market.

Notable Products

In March 2025, Alter Farms' top-performing product was Purple Hindu Kush (Bulk) in the Flower category, maintaining its first-place rank from previous months with a notable sales figure of 10,332. Pineapple Thai (1g) held steady at the second position, continuing its consistent performance across January and February. New to the rankings, Pineapple Thai (Bulk) emerged in third place, indicating a growing preference for bulk purchases. Lemon Pastries (Bulk) entered the list at fourth, showing a positive trajectory in sales. Orange Apricot Mac (Bulk) remained in fifth place, suggesting stable demand since its introduction in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.