Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

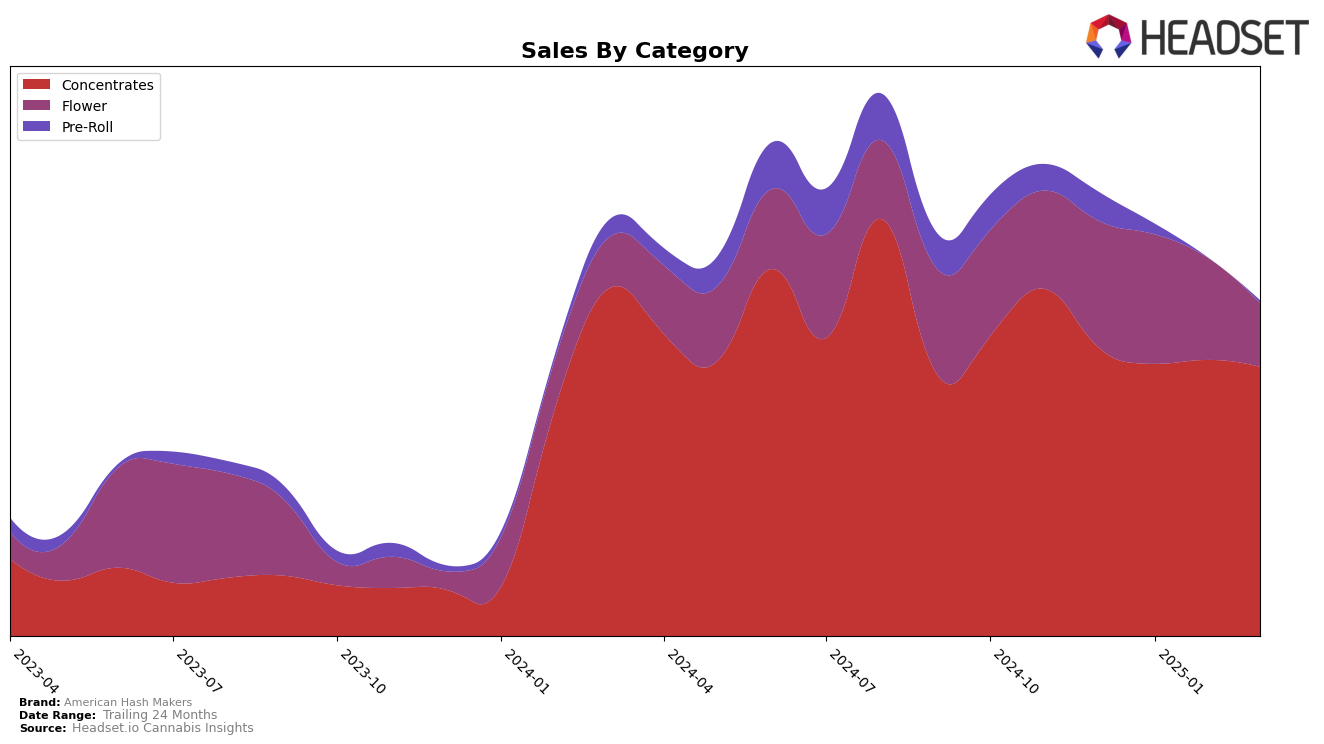

American Hash Makers has shown a noteworthy performance in the New York market within the Concentrates category. Over the months from December 2024 to March 2025, the brand has consistently ranked within the top 15, peaking at 11th place in February 2025. This indicates a strong presence and consumer preference in the state, although there was a slight dip back to the 13th position in March. Despite this minor fluctuation, the brand maintains a solid foothold in the market, with sales figures reflecting a stable demand for their products. Notably, the sales in February 2025 were the highest in this period, suggesting a possible seasonal or promotional influence that could be explored further.

In contrast, American Hash Makers has not been able to secure a top 30 position in the Washington market for the Concentrates category during the same timeframe. Their rankings fluctuated between 74th and 88th place, indicating challenges in gaining traction and visibility in this competitive market. The sales figures in Washington reflect this struggle, with a noticeable decline in February and March 2025. This trend suggests that American Hash Makers might need to reassess their strategies in Washington to enhance their market presence and boost sales. The contrasting performance between New York and Washington highlights the varying dynamics and consumer preferences in different states, offering insights into potential areas for strategic improvements.

Competitive Landscape

In the competitive landscape of the New York concentrates market, American Hash Makers has shown a relatively stable performance, maintaining a rank within the top 15 brands from December 2024 to March 2025. Despite a slight dip in rank from 11th to 13th in March 2025, the brand has managed to keep its sales figures consistent, with a notable peak in February 2025. Competitors like Silly Nice have consistently ranked higher, maintaining a steady position at 10th place, which indicates a strong market presence. Meanwhile, House of Sacci has shown volatility, fluctuating between 11th and 13th place, yet experiencing a significant sales increase in March 2025. Happy Cabbage Farms re-entered the top 20 in March 2025 at 15th place, suggesting a resurgence in their market strategy. The data implies that while American Hash Makers maintains a solid position, there is room for growth and strategic adjustments to climb higher in the ranks, especially when compared to the consistent performance of brands like Silly Nice.

Notable Products

In March 2025, Mystery Cookies Classic Hash (1g) maintained its position as the top-performing product for American Hash Makers, despite a slight decline in sales to 432 units. Afghan Kush Kief (1g) showed significant improvement, climbing from fourth place in February to second place in March, with sales reaching 237 units. Purple Oreoz Classic Hash (1g) entered the rankings at third place, indicating a strong performance for its debut. Tangerine Dream Hash (1g) experienced a drop from third to fourth place, reflecting a decrease in sales. White Widow Classic Hash (1g) re-entered the rankings at fifth place, showing a modest performance compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.