Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

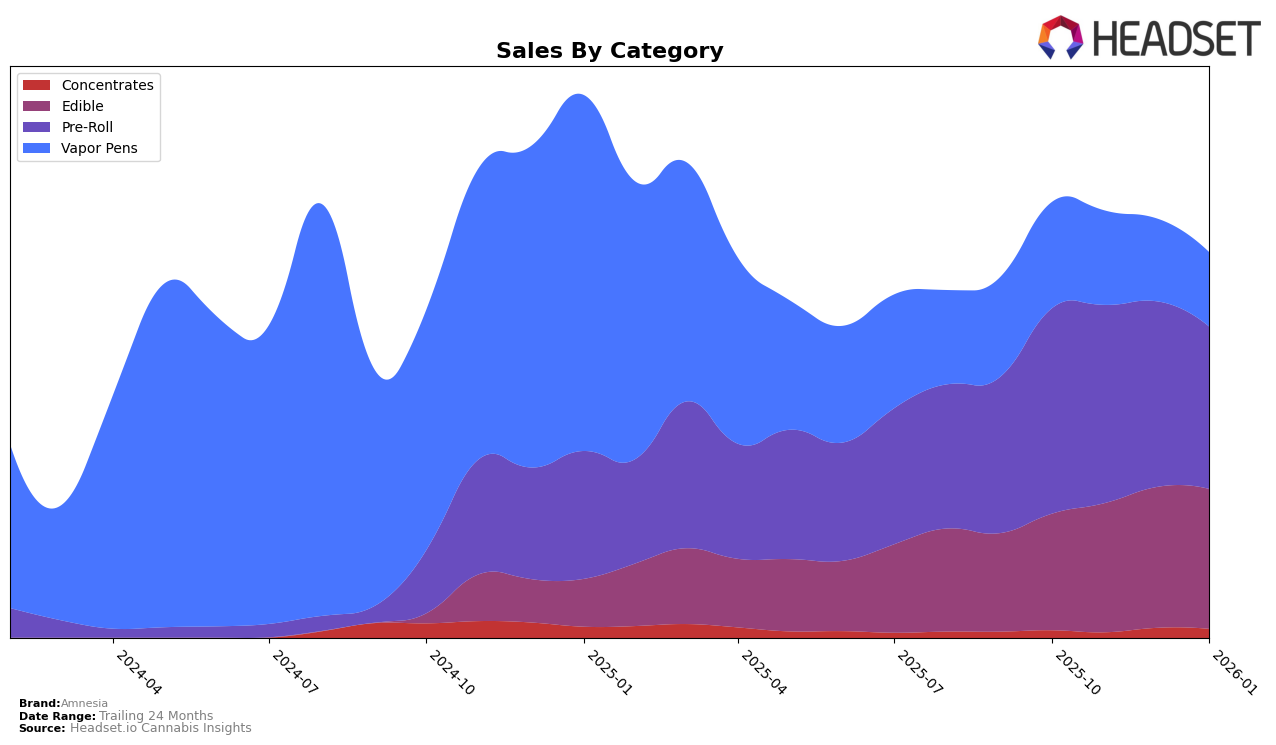

In Michigan, the performance of the Amnesia brand varies significantly across different product categories. The Edible category shows a positive trajectory, with Amnesia climbing from rank 25 in October 2025 to rank 18 by January 2026, indicating a steady increase in consumer preference. This upward movement is complemented by a consistent rise in sales figures, suggesting a strong market presence in this category. Conversely, Amnesia's position in the Vapor Pens category has seen a decline, dropping from rank 36 in October 2025 to rank 45 by January 2026, which may reflect a shift in consumer preferences or increased competition.

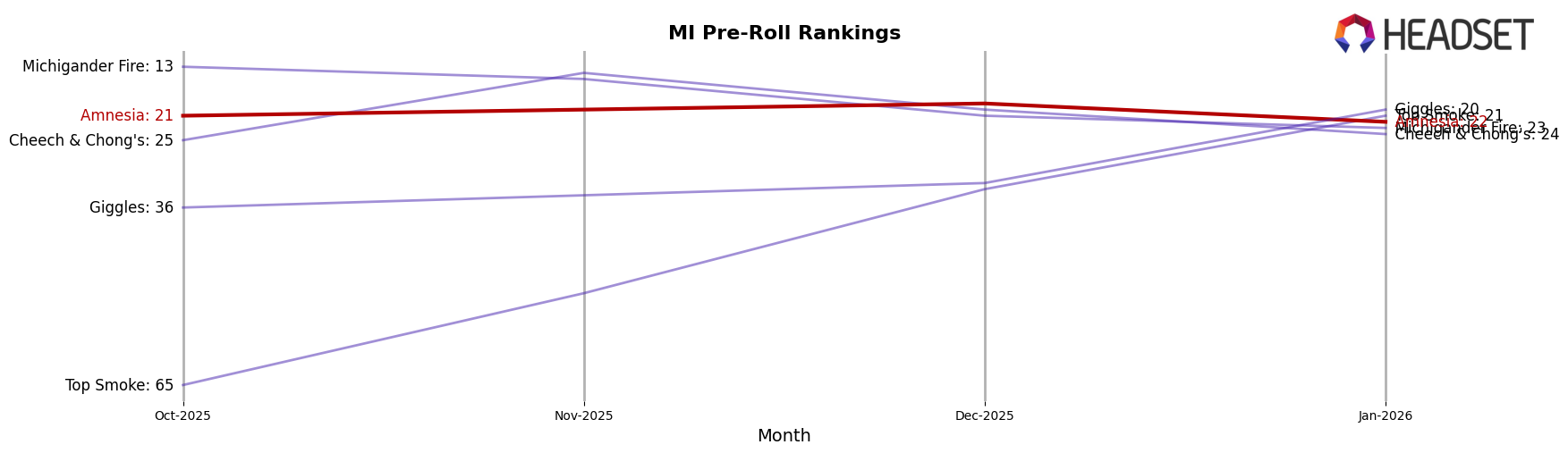

Amnesia's performance in the Pre-Roll category in Michigan reveals a mixed trend. The brand improved its rank from 21 in October to 19 in December, but then slipped back to 22 by January 2026. This fluctuation might indicate market volatility or strategic adjustments within the category. Notably, Amnesia did not rank in the top 30 for the Concentrates category, suggesting either a lack of focus or competitiveness in this segment. This absence could be a potential area for growth if addressed strategically. The varied performance across categories highlights the dynamic nature of the cannabis market and Amnesia's need to adapt to changing consumer demands.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, Amnesia has experienced some fluctuations in its rank and sales over the past few months. Starting from October 2025, Amnesia held the 21st position, improving slightly to 20th in November, and climbing to 19th in December, before dropping to 22nd in January 2026. This indicates a relatively stable yet competitive position within the top 20 brands. In contrast, Michigander Fire has seen a decline from 13th to 23rd over the same period, while Cheech & Chong's showed a similar pattern, peaking at 14th in November before slipping to 24th by January. Meanwhile, Top Smoke and Giggles have shown upward trends, with Top Smoke improving from 65th to 21st and Giggles from 36th to 20th, suggesting increasing competition. These dynamics highlight the importance for Amnesia to strategize effectively to maintain and potentially improve its market position amidst shifting consumer preferences and competitive pressures.

Notable Products

In January 2026, the top-performing product from Amnesia was the Zerds- Apple Burst Hash Rosin Gummy (200mg), which secured the number one rank with sales of 10,122. The Zerds- Pink Lemonade Hash Rosin Gummy (200mg) followed closely behind, moving up from fourth in December 2025 to second place. The Zerds - Strawberry Shortcake Hash Rosin Mega Gummy (200mg) entered the rankings for the first time, coming in third. The Zerds - Orange Soda Hash Rosin Gummy (200mg), which held the top spot in December, dropped to fourth place. Finally, the Zerds- Blue Razz Hash Rosin Gummy (200mg) rounded out the top five, indicating a decline from its previous second-place rank in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.