Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

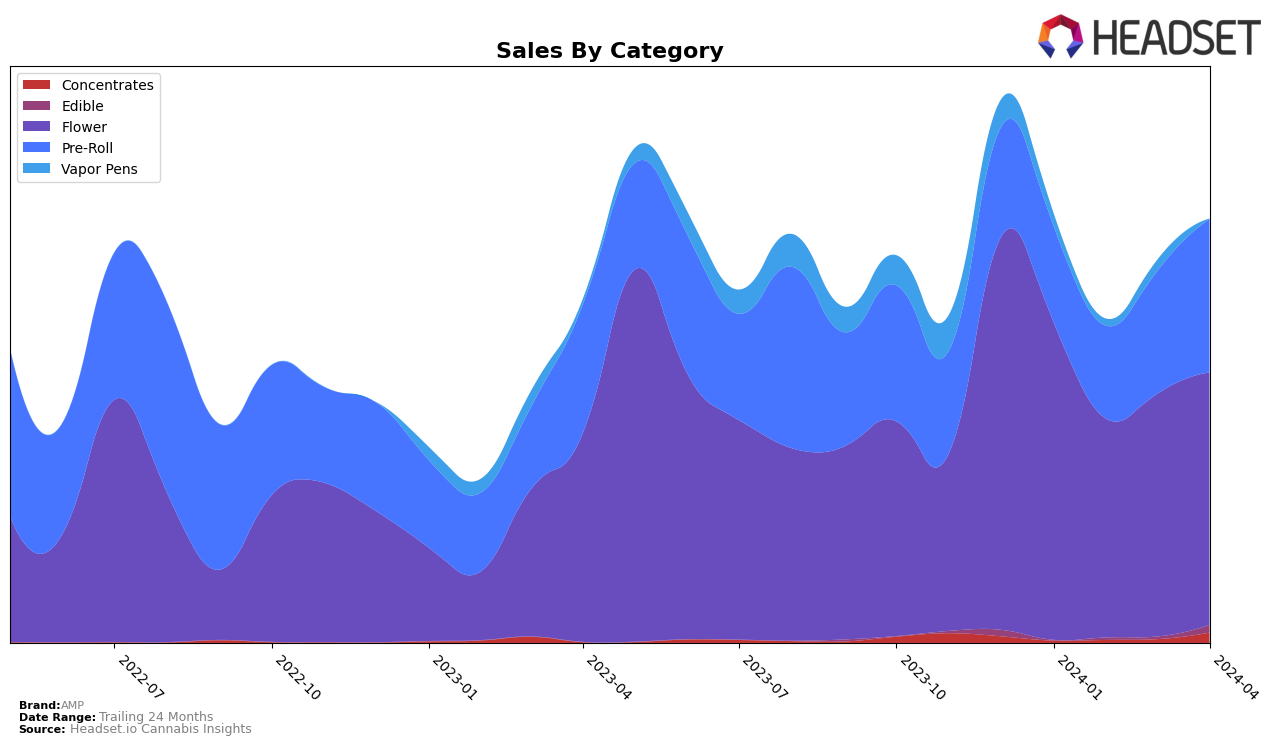

In Massachusetts, AMP has shown a mixed bag of performances across its product categories, with notable trends in both positive and negative directions. In the Flower category, AMP maintained a consistent presence within the top 50, albeit with a slight downward trend from January to April 2024, moving from rank 27 to 40. This indicates a stable demand for their Flower products, though the slight decline might suggest increasing competition or changes in consumer preferences. Conversely, AMP's Pre-Roll category demonstrated significant improvement, climbing from rank 39 in January to 30 by April, highlighting a growing consumer interest or possibly successful marketing efforts in this segment. However, the brand faced challenges in the Vapor Pens category, where it was ranked 80th in January, disappeared from the top 30 in February, and then reappeared at rank 81 in April, suggesting volatility and perhaps a need to reassess its strategy in this market.

Notably, AMP's Concentrates category in Massachusetts did not make it into the top 30 rankings in any of the months reported, which could be viewed as a missed opportunity given the growing market for concentrates. This absence in the rankings might indicate either a lack of focus on this category or a need to improve product offerings or marketing strategies to capture consumer interest. On a brighter note, the sales data for January 2024 in the Flower category, which amounted to $357,654, underscores the brand's strong foothold in this segment, despite the slight ranking slippage over the subsequent months. This single sales figure hints at AMP's potential to leverage its strengths and address areas of weakness, particularly in categories where it has yet to make a significant impact or where it has experienced fluctuating rankings.

Competitive Landscape

In the competitive landscape of the Flower category in Massachusetts, AMP has faced challenges in maintaining its rank, sliding from not being in the top 20 in January 2024 to the 40th position by April 2024. This trend suggests a struggle in a highly competitive market, despite a slight increase in sales over the same period. Notably, Local Roots has shown a remarkable improvement, moving up to the 39th position by April 2024, surpassing AMP with a significant sales jump. Similarly, Smyth Cannabis Co. has maintained a stronger presence, consistently ranking higher than AMP and demonstrating more stable sales figures. Bailey's Buds and Sparq Cannabis Company also remain notable competitors, with Sparq slightly outperforming AMP in April 2024 in both rank and sales. This competitive analysis highlights the need for AMP to innovate and adapt strategies to reclaim and improve its market position amidst these dynamic shifts.

Notable Products

In April 2024, AMP's top-performing product was Lilac Diesel (3.5g) in the Flower category, securing the first rank with sales figures peaking at 2105 units. Following closely, Skywalker OG Pre-Roll (1g) from the Pre-Roll category made a significant entry to the rankings, landing at second place with notable sales. The third spot was taken by Blue Dream Pre-Roll (1g), also in the Pre-Roll category, showing a consistent performance improvement from its previous fifth position in January 2024. Lilac Diesel Pre-Roll (1g), despite leading in the first quarter of the year, saw a dip to the fourth position in April, indicating a shift in consumer preference within AMP’s product line. Blue Dream (3.5g) in the Flower category rounded out the top five, marking its steady climb from not being ranked in January to fifth in April, showcasing an increasing trend in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.