Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

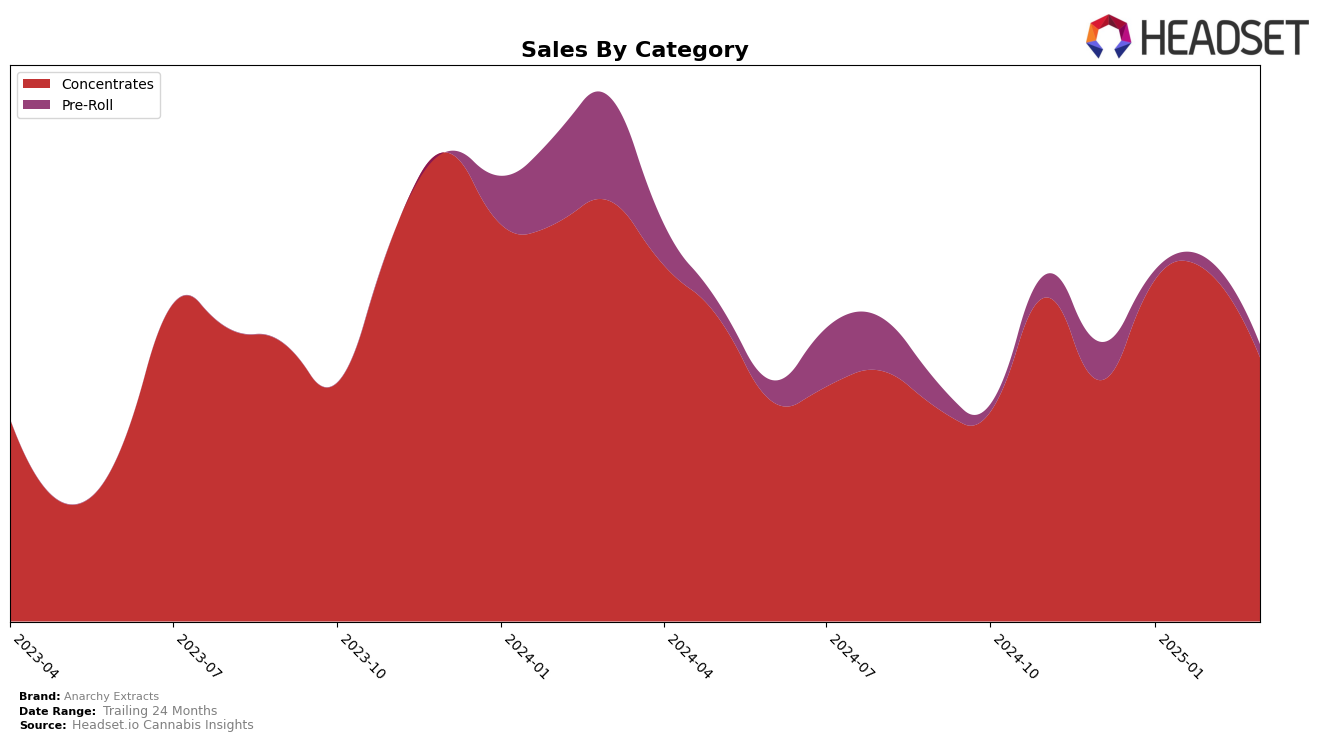

In the state of Michigan, Anarchy Extracts has demonstrated a notable presence in the Concentrates category. Over the period from December 2024 to March 2025, the brand experienced some fluctuations in its ranking. Starting at 12th place in December 2024, Anarchy Extracts improved its position to reach 9th place by February 2025, indicating a positive trend in consumer preference or market strategy. However, by March 2025, the brand's rank dropped to 15th, suggesting potential challenges or increased competition. This movement highlights the dynamic nature of the market and the importance of maintaining a competitive edge.

While Anarchy Extracts has managed to secure a spot within the top 15 in Michigan, it is important to note that the brand's absence from the top 30 rankings in other states or categories could imply limited market penetration outside of their stronghold. This could be seen as an area for potential growth or a strategic focus on maintaining strength in key markets. The fluctuations in Michigan, combined with the lack of presence in other regions, present an interesting case for analyzing the brand's market strategy and adaptability across different geographical areas and product categories.

Competitive Landscape

In the competitive landscape of Michigan's concentrates market, Anarchy Extracts has experienced notable fluctuations in its ranking over the past few months. Starting from a strong 12th position in December 2024, Anarchy Extracts climbed to 9th place by February 2025, showcasing a positive trend in consumer preference. However, by March 2025, the brand slipped to 15th place, indicating increased competition. Notably, Fresh Coast demonstrated a remarkable ascent, moving from 65th in December to 10th in February, surpassing Anarchy Extracts and highlighting a significant shift in market dynamics. Meanwhile, Rkive Cannabis maintained a consistently strong presence, hovering around the top 10, which may have contributed to the competitive pressure on Anarchy Extracts. Additionally, Cloud Cover (C3) and Bamn also showed varying ranks, with Bamn making a notable leap to 14th in February before slightly declining. These shifts suggest that while Anarchy Extracts has maintained a competitive edge, it faces challenges from rapidly advancing brands, necessitating strategic adjustments to sustain its market position.

Notable Products

In March 2025, the top-performing product for Anarchy Extracts was Bananaconda Budder (1g) in the Concentrates category, which rose to the number one rank from its previous second place in February. It achieved notable sales of 1,458 units. Paris OG Sugar (1g) held the second position, marking its debut in the rankings. Hellcat Sugar (1g) followed closely, securing the third spot. Super Boof Sugar (1g) and Papaya Bomb Budder (1g) rounded out the top five, indicating a strong preference for sugar concentrates among consumers this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.