Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

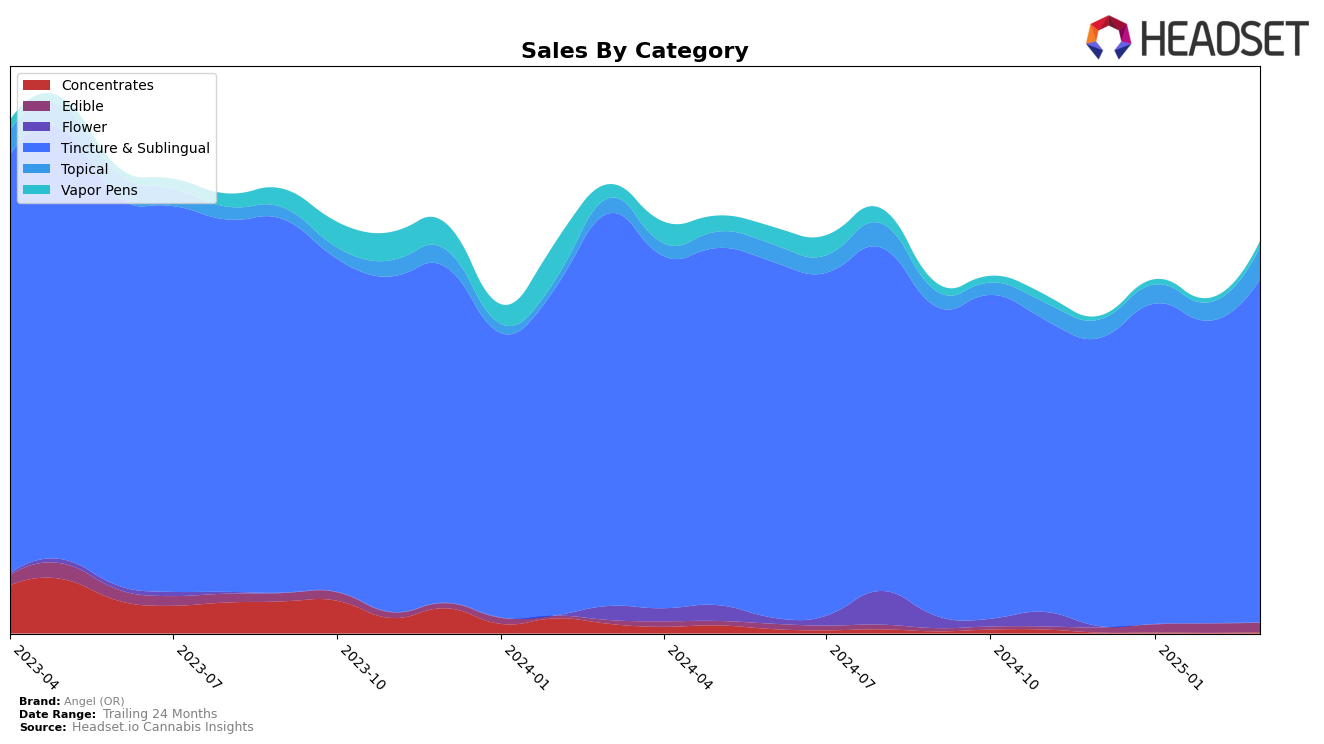

Angel (OR) has demonstrated consistent performance in the Oregon market, particularly in the Tincture & Sublingual category. The brand maintained its top position in this category from December 2024 through March 2025, indicating a strong and stable consumer base. This sustained leadership is underscored by a notable increase in sales, with March 2025 figures reaching a peak of $246,152. Such dominance suggests that Angel (OR) has effectively captured the market's attention and loyalty in this category, setting a high benchmark for competitors.

In the Topical category, Angel (OR) has also shown upward momentum, improving its rank from sixth in December 2024 and January 2025 to fourth by February and March 2025. This progression, coupled with a significant sales increase in March 2025, suggests growing consumer interest and potentially effective marketing strategies or product innovations. However, the brand's absence from the top 30 in other states or categories could indicate areas where there is room for growth and expansion. Such insights could be pivotal for stakeholders looking to understand Angel (OR)'s strategic positioning and potential for future market penetration.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Oregon, Angel (OR) has consistently maintained its top position from December 2024 through March 2025. Despite facing competition from brands like Farmer's Friend Extracts, which held a steady second place, Angel (OR) not only retained its number one rank but also showed a positive trend in sales, increasing from December to March. This upward trajectory in sales suggests a growing consumer preference or effective marketing strategies, setting Angel (OR) apart from competitors such as Hapy Kitchen, which remained in third place with relatively stable sales figures. The consistent top ranking and sales growth of Angel (OR) underscore its strong market presence and potential for continued dominance in this category.

Notable Products

In March 2025, Angel (OR) maintained its top position with the THC Unflavored Tincture (1000mg) leading the sales, marking a significant increase to 1762 units sold. The CBD/THC/CBN/CBG 1:1:1:1 Rainbow Children Tincture (1000mg CBD,1000mg THC, 1000mg CBN, 1000mg CBG, 1oz) held steady in second place, recovering from a dip in February. The CBD/CBG/THC/CBN 1:1:1:1 Blueberry Lemonade Blossom Gummies (25mg CBD, 25mg CBG, 25mg THC, 25mg CBN) rose back to third place, showing resilience in the Edible category. The CBD Flavorless Hemp Tincture (3000mg CBD, 30ml) maintained its fourth position, demonstrating consistent performance. Lastly, the CBD Flavorless Hemp Tincture (1500mg CBD, 30ml) slipped to fifth, showing a decline from its earlier second-place rankings in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.