Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

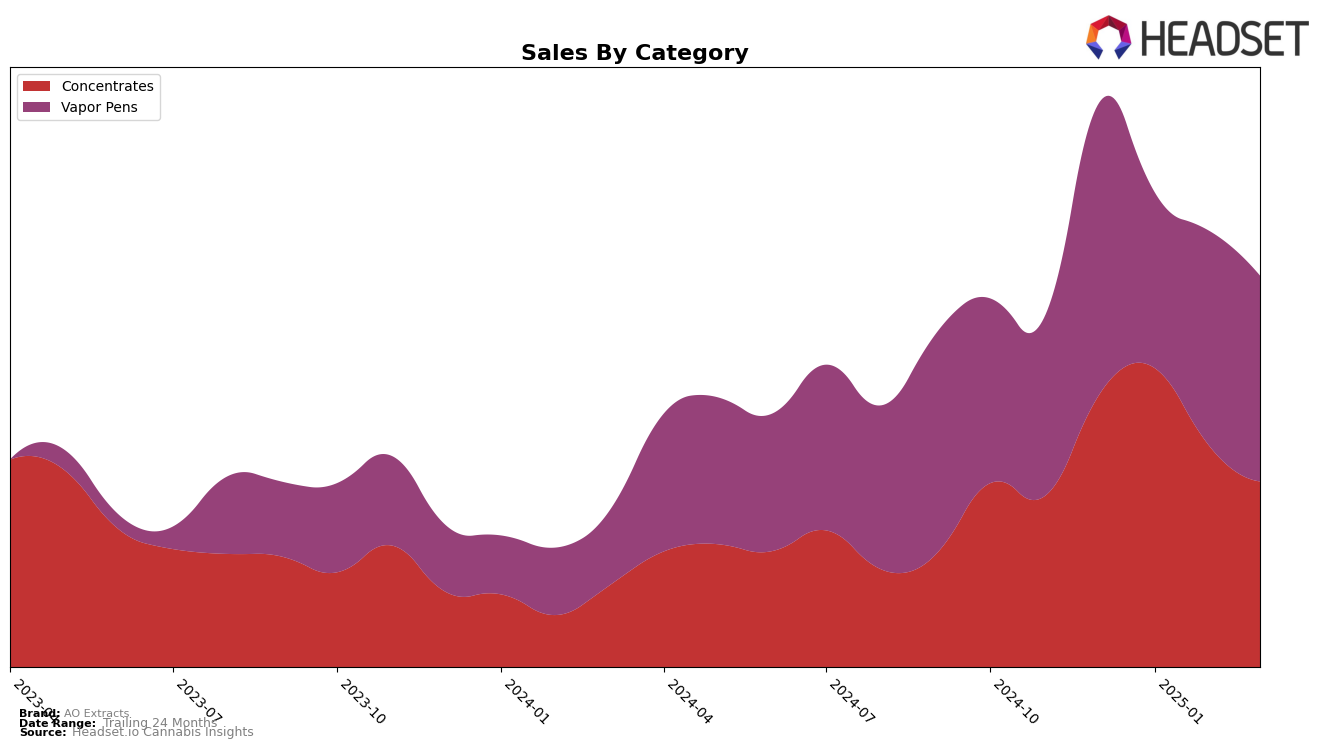

AO Extracts has shown varied performance across different categories and states, demonstrating both strengths and areas for improvement. In the Colorado market, the brand has maintained a consistent presence in the Concentrates category, although there was a slight decline in their ranking from 12th in January 2025 to 16th by March 2025. This movement is indicative of competitive pressures within the state, as well as possible shifts in consumer preferences. Despite the drop in ranking, AO Extracts has managed to maintain a foothold in the top 30, showcasing resilience in a highly competitive market. However, the sales trend from December 2024 to March 2025 indicates a downward trajectory, suggesting a need for strategic adjustments to regain momentum.

In contrast, AO Extracts' performance in the Vapor Pens category in Colorado has been less stable, with the brand not making it into the top 30 rankings consistently. The brand ranked 36th in December 2024 but fell out of the top 30 in January 2025, before re-entering at 37th in February and slipping to 40th in March. This inconsistency highlights a challenge for AO Extracts in sustaining its market position in this category, potentially due to increased competition or shifts in consumer demand. The fluctuating rankings suggest that while there were moments of recovery, the brand needs to address underlying issues to achieve a more stable and upward trajectory in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, AO Extracts has experienced fluctuating rankings from December 2024 to March 2025, reflecting a dynamic market environment. Starting at rank 36 in December 2024, AO Extracts saw a dip to 41 in January 2025, followed by a recovery to 37 in February, before slipping again to 40 in March. This volatility is indicative of the competitive pressures from brands like Juicy, which consistently maintained a close rank, and Wavelength Extracts, which also experienced similar fluctuations. Notably, Newt Brothers Artisanal showed a strong upward trend, improving from rank 53 in December to 38 by March, potentially capturing market share and impacting AO Extracts' sales performance. Despite these challenges, AO Extracts' sales demonstrated resilience, with a notable rebound in February, suggesting effective strategies to counteract competitive pressures. As the market continues to evolve, understanding these dynamics is crucial for AO Extracts to strategize and maintain its position in the Colorado vapor pen category.

Notable Products

In March 2025, AO Extracts' top-performing product was the Zlushie Distillate Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 777 units. The Strawberry Jam Distillate Cartridge (1g) followed closely in second place, while the Gummy Bear Distillate Cartridge (1g) dropped to third, despite having been the top seller in February. The Orange Cream Pop Distillate Cartridge (1g) maintained a steady presence, ranking fourth in March. Notably, the Lemonade Kush Distillate Cartridge (1g) showed a positive shift, climbing from an unranked position in February to fourth place in March. These rankings indicate dynamic shifts in product popularity within the Vapor Pens category over the past few months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.