Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

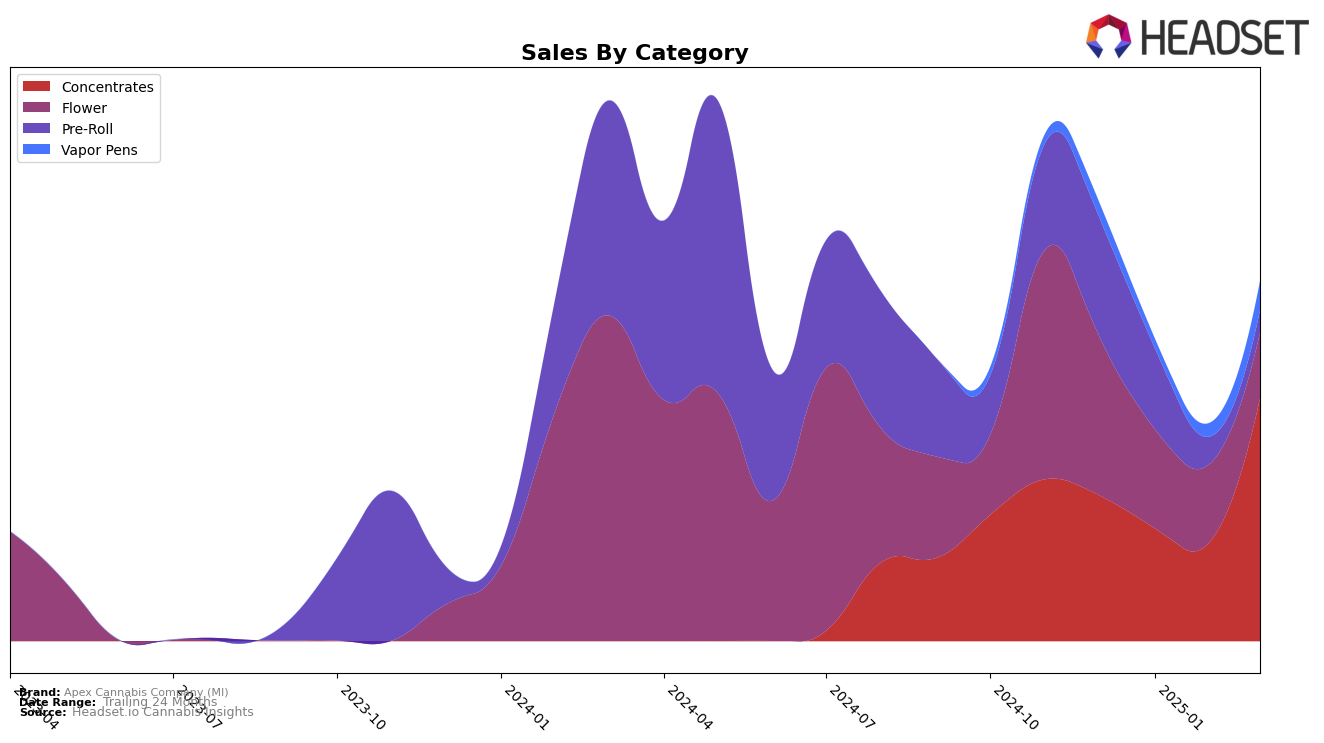

Apex Cannabis Company (MI) has shown notable performance fluctuations in the Michigan market, particularly in the Concentrates category. After starting December 2024 ranked 45th, the brand experienced a slight dip in January and February 2025, maintaining a consistent 57th place. However, a remarkable recovery was observed in March 2025, when Apex Cannabis Company (MI) jumped to the 28th position, indicating a strong upward trend. This substantial improvement suggests a successful strategy or product launch that resonated well with consumers, leading to a significant increase in sales from February to March 2025.

In contrast, the Pre-Roll category presents a different narrative for Apex Cannabis Company (MI). The brand started at the 85th rank in December 2024 and slipped to 99th in January 2025, failing to make it into the top 30 in subsequent months. This absence from the top 30 highlights a potential area for improvement or increased competition in the Pre-Roll segment within Michigan. The lack of ranking in February and March 2025 could indicate challenges in maintaining market share or consumer interest, which might require strategic adjustments to regain competitive positioning in this category.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Apex Cannabis Company (MI) has shown a significant improvement in its ranking from December 2024 to March 2025. Initially ranked 45th in December 2024, Apex Cannabis Company (MI) experienced a dip to 57th in both January and February 2025, before making a notable recovery to 28th by March 2025. This upward trajectory is indicative of a strategic shift or successful marketing efforts that have positively impacted its sales performance. In contrast, #Hash experienced a dramatic decline from 2nd place in December 2024 to 30th by March 2025, suggesting potential challenges in maintaining its market position. Meanwhile, Rise (MI) and Uplyfted Cannabis Co. have shown fluctuating ranks, with Rise (MI) dropping out of the top 20 entirely by March 2025, and Uplyfted Cannabis Co. maintaining a relatively stable position. These dynamics highlight the competitive pressures and opportunities for Apex Cannabis Company (MI) to further capitalize on its recent gains and continue its upward momentum in the Michigan concentrates market.

Notable Products

In March 2025, the top-performing product for Apex Cannabis Company (MI) was Cherry Bombz Pre-Roll (1g) in the Pre-Roll category, climbing from the second position in February to claim the top spot. Iced Kush Pre-Roll (1g) maintained a strong presence, securing the second rank, but experienced a decrease in sales from previous months. Rainbow Belts 3.0 #4 Hash Rosin (1g) emerged in third place within the Concentrates category, marking its first appearance in the rankings. Iced Kush (3.5g) debuted at fourth place in the Flower category, while Front Porch Sittin' #10 Live Rosin (1g) rounded out the top five in the Concentrates category. Notably, Cherry Bombz Pre-Roll (1g) achieved a sales figure of 2072 units in March, showcasing its consistent popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.