Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

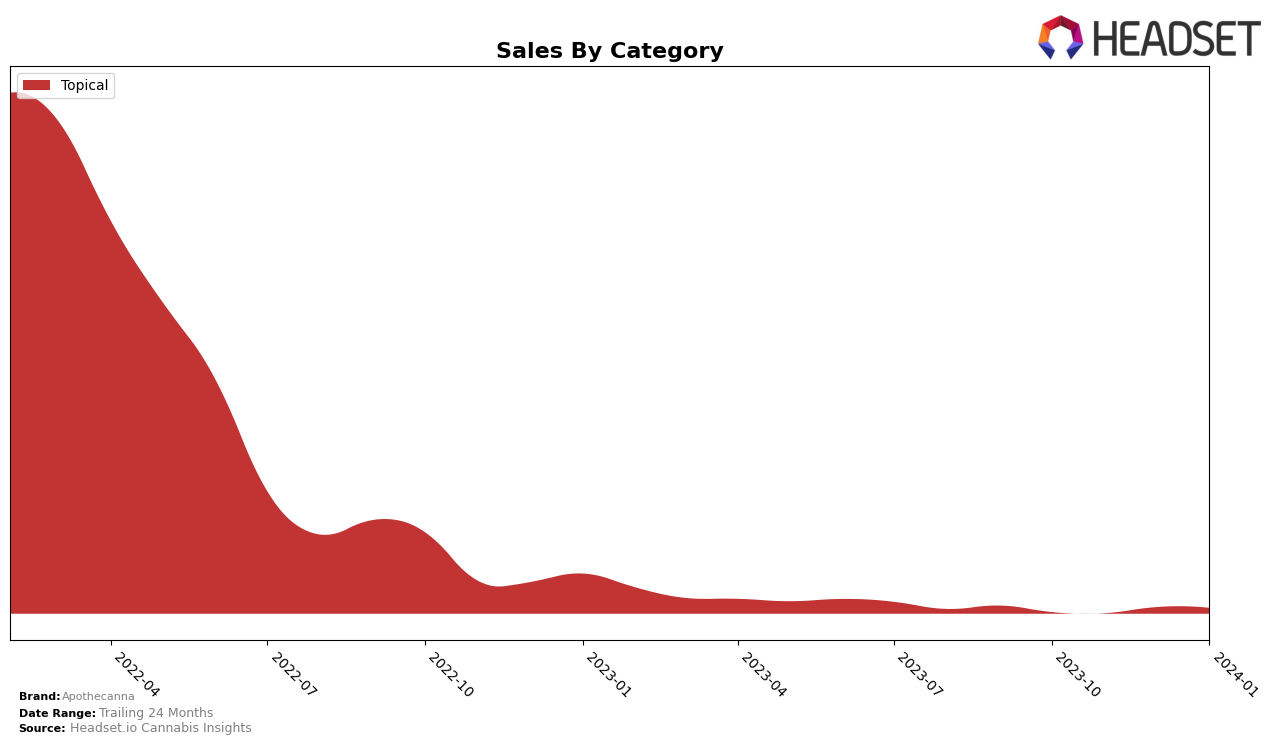

In the dynamic landscape of cannabis topicals, Apothecanna has exhibited notable performance variations across different states and provinces, with particular emphasis on its presence in Nevada, Ontario, and Oregon. In Nevada, the brand faced challenges maintaining a consistent top 20 ranking, missing out in November and January, but managed to secure the 22nd position in December 2023. This fluctuation indicates a potential area for growth or a need for strategic adjustments to solidify its market presence. Conversely, in Ontario, Apothecanna showed a remarkable upward trajectory, moving from the 32nd position in October 2023 to the 15th by January 2024, a clear indication of growing consumer acceptance and increased market penetration within this province.

Meanwhile, Oregon presented a mixed bag of results for Apothecanna, where it managed to remain within the top 20 in the topical category, albeit with some fluctuations. Starting at the 20th rank in October 2023, it experienced a slight drop in visibility in the subsequent month, not making it to the top 20, but then rebounded to the 17th position in December 2023 and slightly dipped to 18th in January 2024. These movements suggest a relatively stable consumer base with room for growth. Notably, while specific sales figures are generally held back for proprietary reasons, it's worth mentioning that in Ontario, November 2023 saw a significant sales jump to 505 units sold, highlighting a strong market response to the brand's efforts or possibly a successful marketing campaign or product launch during this period. This specific insight, coupled with the overall trend analysis, provides a nuanced understanding of Apothecanna's performance across these regions, underlining the importance of strategic market engagement and the potential for further growth.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Ontario, Apothecanna has shown a notable upward trajectory in rank over the recent months, moving from not being in the top 20 in October 2023 to securing the 15th position by January 2024. This rise in rank is indicative of a significant increase in sales, suggesting a growing consumer preference for Apothecanna's offerings. Among its competitors, Nuveev has consistently outperformed Apothecanna, maintaining a higher rank and showing a substantial sales volume that dwarfs Apothecanna's, despite experiencing a slight decline in rank from 10th to 13th. Similarly, Pura Earth has also held a higher rank than Apothecanna, remaining in the 14th position with sales figures significantly exceeding those of Apothecanna. On the other hand, Apothecary Labs and Emprise Canada have shown a fluctuating performance but generally rank above Apothecanna, with Apothecary Labs experiencing a drop to the 16th position and Emprise Canada to the 17th by January 2024. This competitive analysis highlights the dynamic nature of the market and Apothecanna's promising growth amidst stiff competition.

Notable Products

In January 2024, Apothecanna's top-performing product was the CBD:THC 1:1 Extra Strength Body Oil (100mg CBD, 100mg THC, 28ml) in the Topical category, securing the first rank with impressive sales of 24 units. Following closely, the CBD/THC 1:1 Extra Strength Relieving Body Cream (25mg CBD, 25mg THC, 2oz, 60ml) took the second rank, showcasing a notable rise from its fourth position in December 2023. The Calming Mind Body Creme (2oz, 60ml) also made a significant leap, entering the top three in January 2024 from its third rank in the previous month. Interestingly, the CBD/THC 1:1 Extra Strength Body Cream, which led the sales in December 2023, did not make it to the top rankings in January 2024, indicating a dynamic shift in consumer preferences within Apothecanna's product line. These shifts highlight the fluctuating demand in the market and Apothecanna's diverse range of topicals catering to varying customer needs.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.