Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

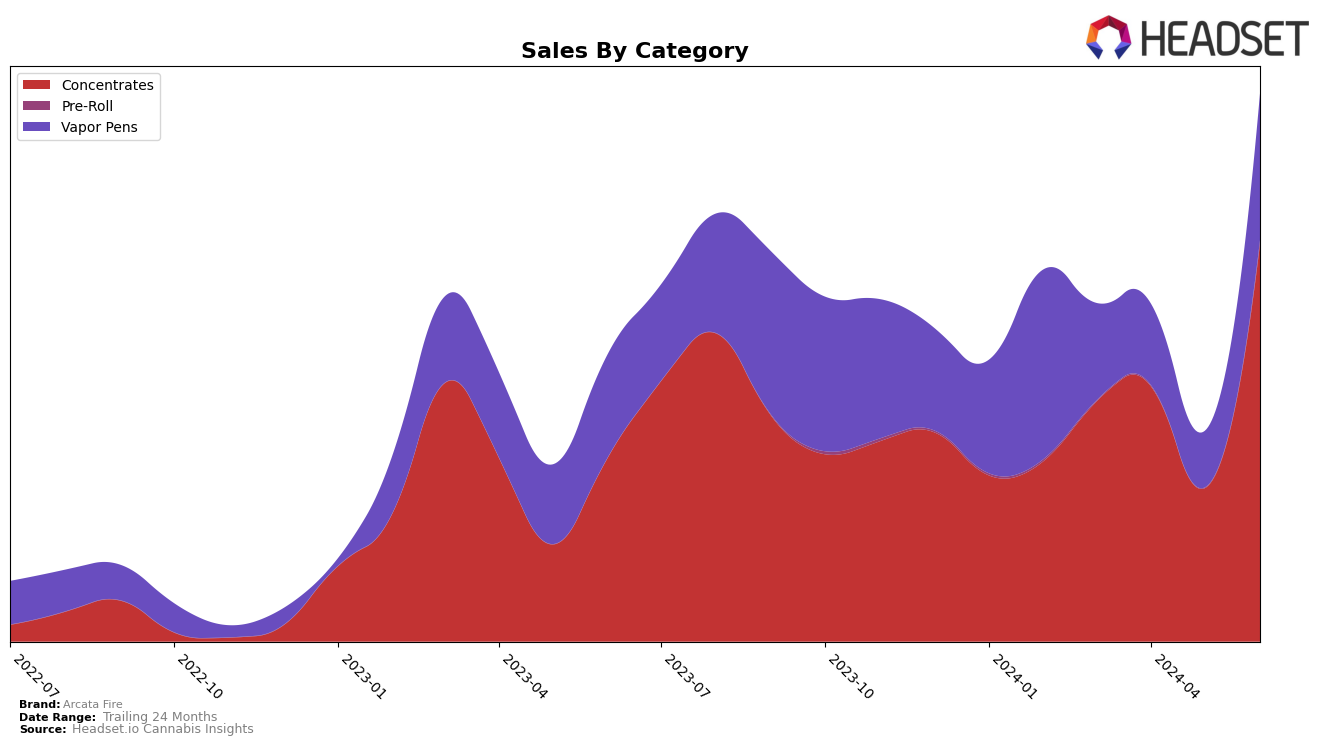

Arcata Fire has shown notable fluctuations in its performance across different states and product categories in recent months. In California, the brand exhibited a significant rebound in the Concentrates category. After a dip in May 2024, where it ranked 53rd, Arcata Fire surged to the 26th position by June 2024. This movement indicates a strong recovery and growing consumer interest. However, it is important to note that the brand was not in the top 30 for March and May, which could highlight inconsistency in its market presence or possibly seasonal variations in consumer demand.

While California remains a crucial market for Arcata Fire, the brand's performance in other states and categories is less clear. The absence of ranking data for some months suggests that Arcata Fire did not make it into the top 30 brands in those categories, which could be a cause for concern. This inconsistency might reflect challenges in maintaining a steady market position or differences in consumer preferences across regions. Nonetheless, the sharp increase in sales from May to June in California's Concentrates category underscores the brand's potential for growth and resilience in a competitive landscape.

Competitive Landscape

In the California concentrates market, Arcata Fire has shown significant fluctuations in its ranking over the past few months, which directly impacts its sales performance. Notably, Arcata Fire's rank improved dramatically from 53rd in May 2024 to 26th in June 2024, indicating a positive trend. This improvement contrasts with competitors like Creme De Canna, which saw a decline from 13th to 28th over the same period, and Almora Farms, which dropped from 18th to 24th. Meanwhile, Globs maintained a relatively stable position, moving from 32nd to 27th. The sales data reflects these rank changes, with Arcata Fire experiencing a notable increase in sales in June 2024, suggesting that its improved rank is translating into higher market traction. This dynamic landscape highlights the competitive pressure and the importance of maintaining a strong market presence for sustained growth.

Notable Products

In June 2024, the top-performing product for Arcata Fire was London Wedding Cake Live Resin (1g) in the Concentrates category, achieving the highest sales at $1714. Following closely were Grape Pie Live Rosin (1g) and Motorbreath x Papaya Bomb Live Resin (1g), ranking second and third respectively. Queens Chem Solventless Rosin (1g) took the fourth spot, while Moroccan Peaches Rosin Disposable (0.5g) in the Vapor Pens category secured the fifth position. Notably, all these products appeared in the rankings for the first time in June 2024, indicating a significant boost in their popularity. This surge suggests a strong market response to these particular products during the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.