Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

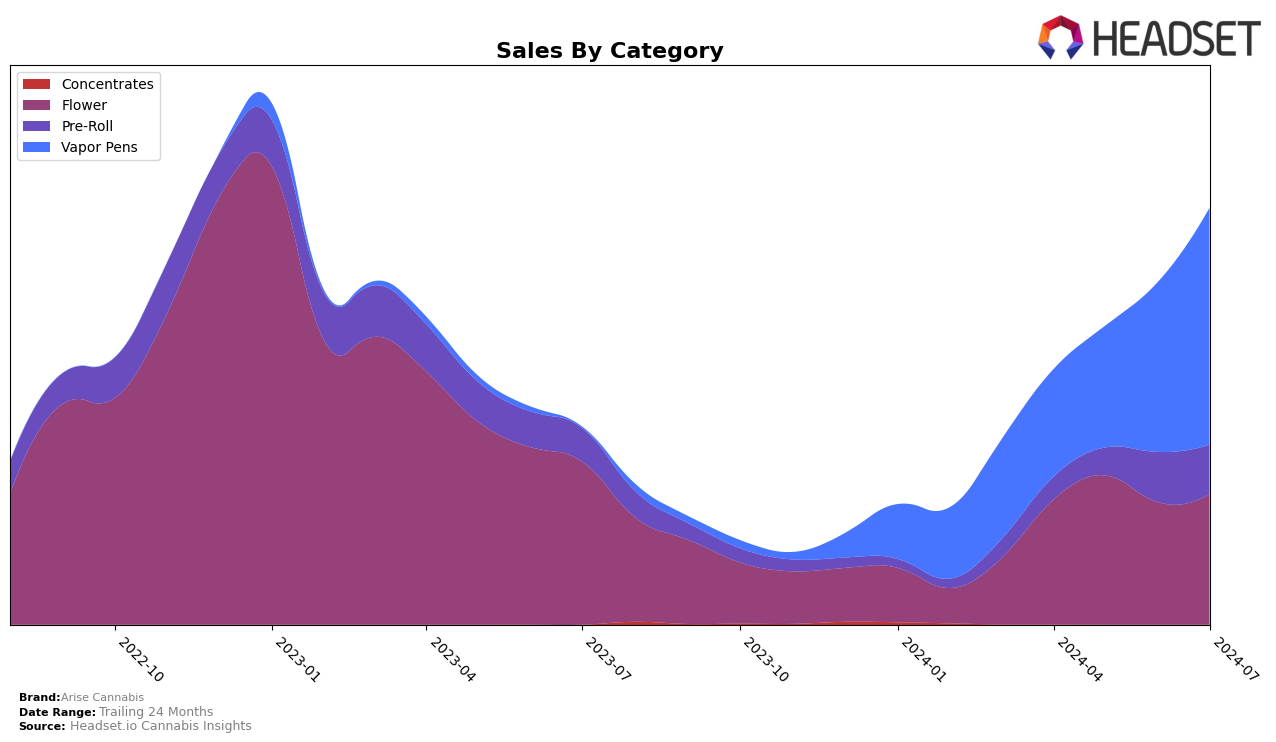

Arise Cannabis has shown varying performance across different product categories in Oregon. In the Flower category, they have struggled to break into the top 30, maintaining ranks in the 40s and 50s over the last few months. This indicates a challenging market position in this category. Conversely, their performance in the Vapor Pens category has been more promising, with a steady climb from rank 33 in April to rank 23 by July. This upward trend in Vapor Pens suggests an increasing consumer preference and market share for Arise Cannabis in this segment. However, the brand’s performance in the Pre-Roll category has been inconsistent, peaking at rank 49 in June before dropping to rank 54 in July, indicating potential volatility or competitive pressure in this category.

When examining sales figures, Arise Cannabis has seen notable movements. For instance, in the Vapor Pens category, their sales have shown a significant upward trend, culminating in a substantial increase from $121,615 in April to $268,357 in July. This growth underscores their strengthening position in the Vapor Pens market in Oregon. On the other hand, the Flower category sales have fluctuated, reflecting their struggle to secure a consistent top 30 ranking. The Pre-Roll category also presents a mixed picture, with sales peaking in June but experiencing a slight decline in July. These trends suggest that while Arise Cannabis is making headway in certain categories, particularly Vapor Pens, there are areas where they face significant challenges and competition.

Competitive Landscape

In the competitive landscape of the Oregon vapor pens market, Arise Cannabis has shown a notable upward trend in rankings over the past few months. Starting from a rank of 33 in April 2024, Arise Cannabis improved its position to 23 by July 2024, indicating a positive momentum in market presence. This upward trajectory contrasts with brands like Orchid Essentials and Echo Electuary, which experienced fluctuations and a general decline in rankings over the same period. For instance, Orchid Essentials dropped out of the top 20 in May and struggled to regain its position, while Echo Electuary fell from rank 13 in April to 24 in July. Meanwhile, Elysium Fields and Sessions Cannabis Extract maintained relatively stable positions, with Sessions Cannabis Extract consistently ranking higher than Arise Cannabis but showing a slight dip in July. These dynamics suggest that Arise Cannabis is gaining traction and could potentially challenge higher-ranked competitors if the current trend continues.

Notable Products

In July 2024, the top-performing product from Arise Cannabis was Blue Amnesia Distillate Cartridge (1g) in the Vapor Pens category, which rose to the first position with notable sales of $2185. Magic Melon Distillate Cartridge (1g) followed closely in the second rank, showing a strong performance. Lava Cake Full Spectrum Distillate Cartridge (1g) secured the third position, maintaining its presence in the top three. Heavy OG Distillate Cartridge (1g) improved its rank to fourth place, while Grapefruit Full Spectrum Distillate Cartridge (1g) dropped to fifth position from its previous higher ranks. The shifts in rankings indicate a dynamic market with significant changes in consumer preferences month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.