May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

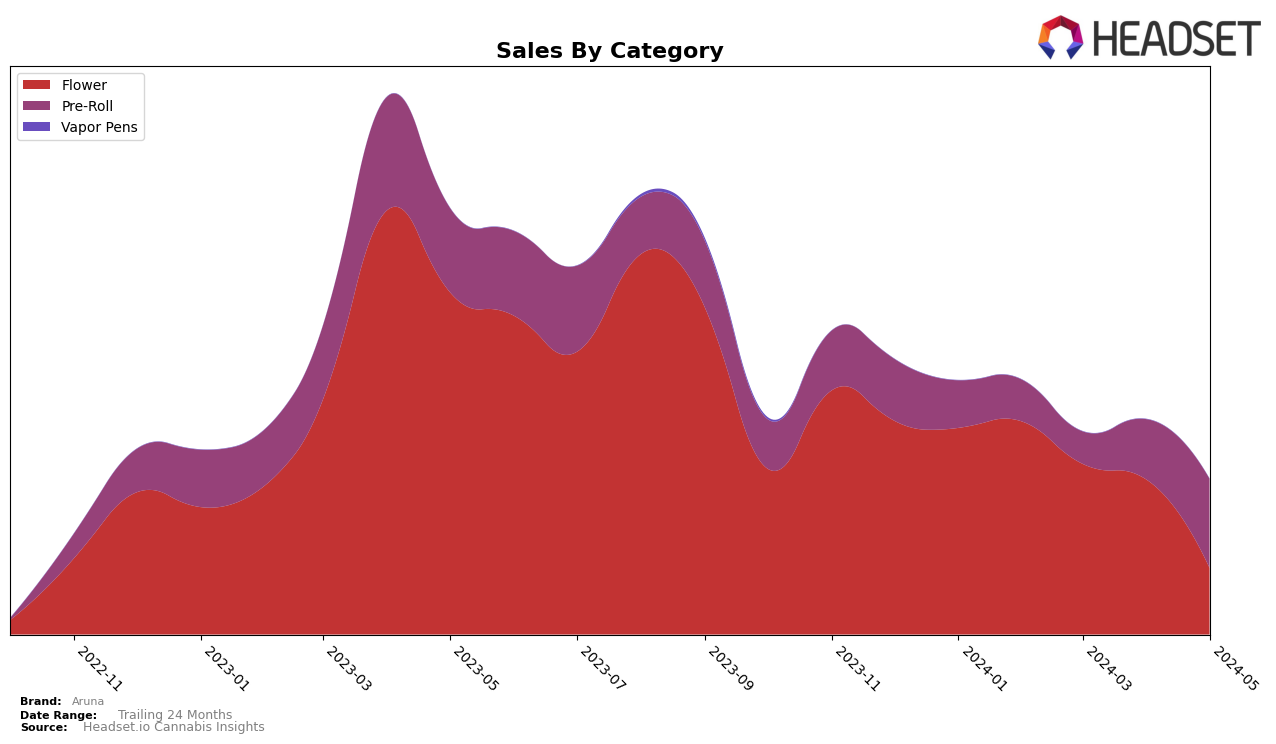

Aruna's performance in the Massachusetts market has shown significant fluctuations across different categories. In the Flower category, Aruna experienced a notable decline, starting at rank 17 in February 2024 and dropping out of the top 30 by May 2024. This downward trend in rankings is mirrored by a decrease in sales, indicating potential challenges in maintaining market share or consumer preference in this category. Conversely, the Pre-Roll category presents a more positive outlook for Aruna. While the brand started outside the top 30 in February and March, it showed a strong recovery by April, reaching rank 30, and further climbing to rank 21 in May. This improvement suggests a growing consumer interest or successful marketing strategies in the Pre-Roll segment.

The contrasting performance across categories in Massachusetts highlights the dynamic nature of Aruna's market presence. The decline in the Flower category to a rank outside the top 30 by May 2024 is a point of concern, potentially indicating increased competition or shifts in consumer preferences. On the other hand, the impressive rise in the Pre-Roll category, culminating in a rank of 21 in May, showcases a significant turnaround and potential growth area for the brand. These movements underscore the importance of category-specific strategies and the need for Aruna to possibly re-evaluate its approach in the Flower market while capitalizing on its gains in the Pre-Roll sector.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, Aruna has demonstrated notable volatility in its rankings and sales over the past few months. Starting from a low rank of 46 in February 2024, Aruna made a significant leap to rank 21 by May 2024, indicating a strong upward trend in market presence. This improvement is mirrored in its sales, which surged from $123,647 in February to $265,730 in May. Comparatively, Resinate also showed an upward trend, moving from rank 31 to 20, but with a less dramatic increase in sales. Meanwhile, Ace Weidman's experienced fluctuations, peaking at rank 11 in February but dropping to 23 by May. Four20 had a notable rise from rank 28 to 19, with a significant sales increase to $300,954 in May. Springtime maintained a relatively stable performance, peaking at rank 16 in April before settling at 22 in May. These dynamics suggest that while Aruna is gaining traction, it faces stiff competition from brands like Four20 and Springtime, which are also showing strong sales growth and rank improvements.

Notable Products

In May-2024, the top-performing product for Aruna was V6 Haze Pre-Roll 2-Pack (1g) in the Pre-Roll category, securing the number 1 rank with sales of 1442 units. Gary Payton Pre-Roll 2-Pack (1g) followed closely in the second position with notable sales figures. Oreoz Pre-Roll 2-Pack (1g), which was ranked second in April, dropped to the third position. Caramel Haze Pre-Roll 2-Pack (1g) improved its rank from fifth in March to fourth in May. Super Silver Piff Pre-Roll 2-Pack (1g) entered the top five rankings in May for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.