Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

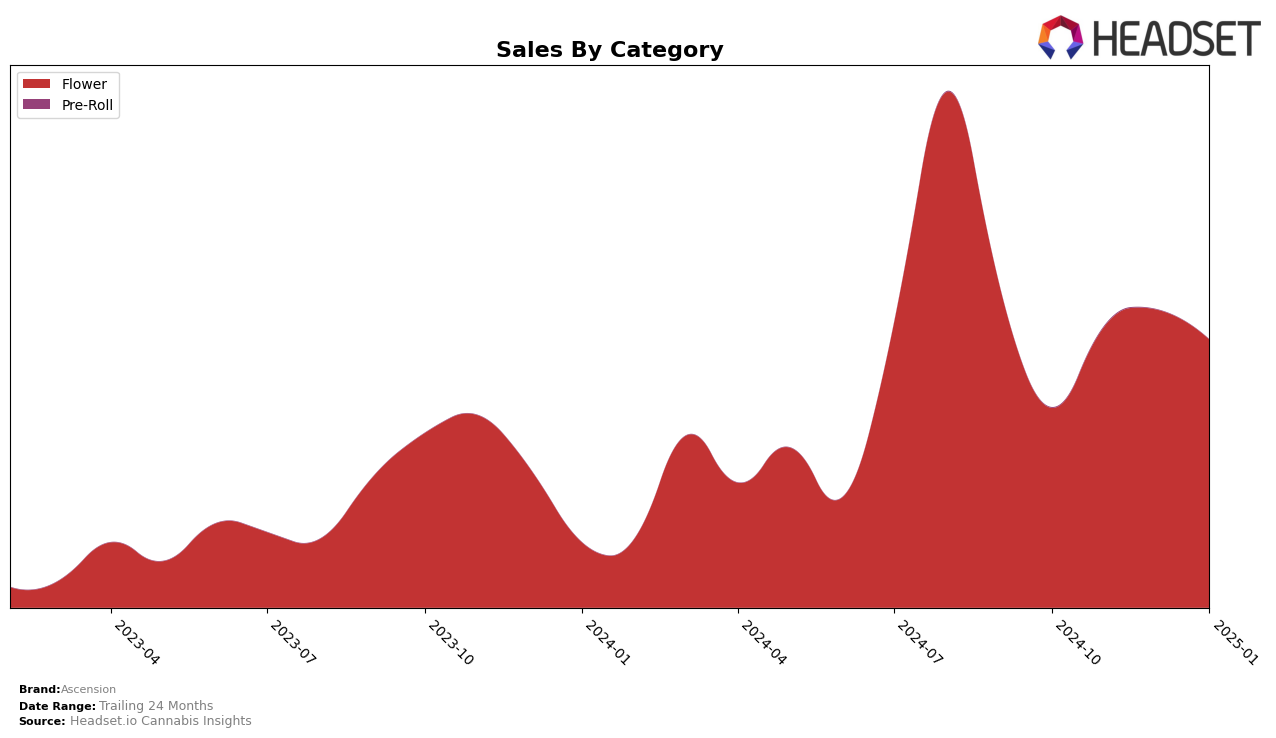

Ascension has shown notable fluctuations in its performance across various states and categories. In Ohio, the brand has demonstrated a positive trajectory in the Flower category. Starting from a rank of 35 in October 2024, Ascension improved its position to 28 by November and maintained a steady presence, closing January 2025 at rank 27. This upward movement indicates a strengthening market presence, as reflected in sales figures which peaked in December 2024. The absence of Ascension in the top 30 rankings prior to October suggests that the brand has successfully penetrated the Ohio market, potentially leveraging strategic initiatives or product innovations to capture consumer interest.

While Ascension's performance in Ohio is commendable, the brand's presence in other states and categories remains undisclosed, suggesting either a lack of significant market penetration or a strategic focus on selected regions. The improvement in Ohio might be indicative of a broader strategy that could be unfolding in other regions, yet the details remain sparse. The data does not show Ascension's rankings in other states or categories, which could be interpreted as either a challenge in gaining traction elsewhere or a deliberate focus on strengthening its foothold in Ohio. This selective visibility provides an opportunity for deeper exploration into Ascension's strategic market decisions and their implications for future growth.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Ascension has shown a steady performance, although it faces stiff competition from several brands. Notably, Neighborgoods consistently outperformed Ascension, maintaining a higher rank in most months, with a significant peak in December 2024. This suggests a strong consumer preference or marketing strategy that Ascension might need to analyze and counter. Meanwhile, Triple Seven experienced a decline in rank from October 2024 to January 2025, which could indicate an opportunity for Ascension to capture some of its market share. On the other hand, Ohio Clean Leaf showed fluctuating ranks but remained close to Ascension, suggesting a competitive parity that Ascension should monitor closely. Additionally, Willie's Reserve demonstrated a notable upward trend, moving from a rank of 37 in October 2024 to 24 in January 2025, which could pose a future threat if this momentum continues. Overall, Ascension's position in the market seems stable but requires strategic adjustments to improve its rank and sales against these dynamic competitors.

Notable Products

In January 2025, the top-performing product for Ascension was Waken Cake (2.83g) in the Flower category, maintaining its number one rank from the previous month with notable sales of 3254 units. Ice Cream Cake (2.83g) also showed strong performance, advancing to the second position from third in December 2024, with a significant increase in sales. Motor Cake (2.83g) entered the rankings for the first time in January 2025, securing the third position. Animal Mints (2.83g) dropped to fourth place from its second-place position in December, indicating a decrease in consumer preference. Do-Hi-Oh (2.83g) debuted in January 2025 at the fifth position, marking its entry into the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.