Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

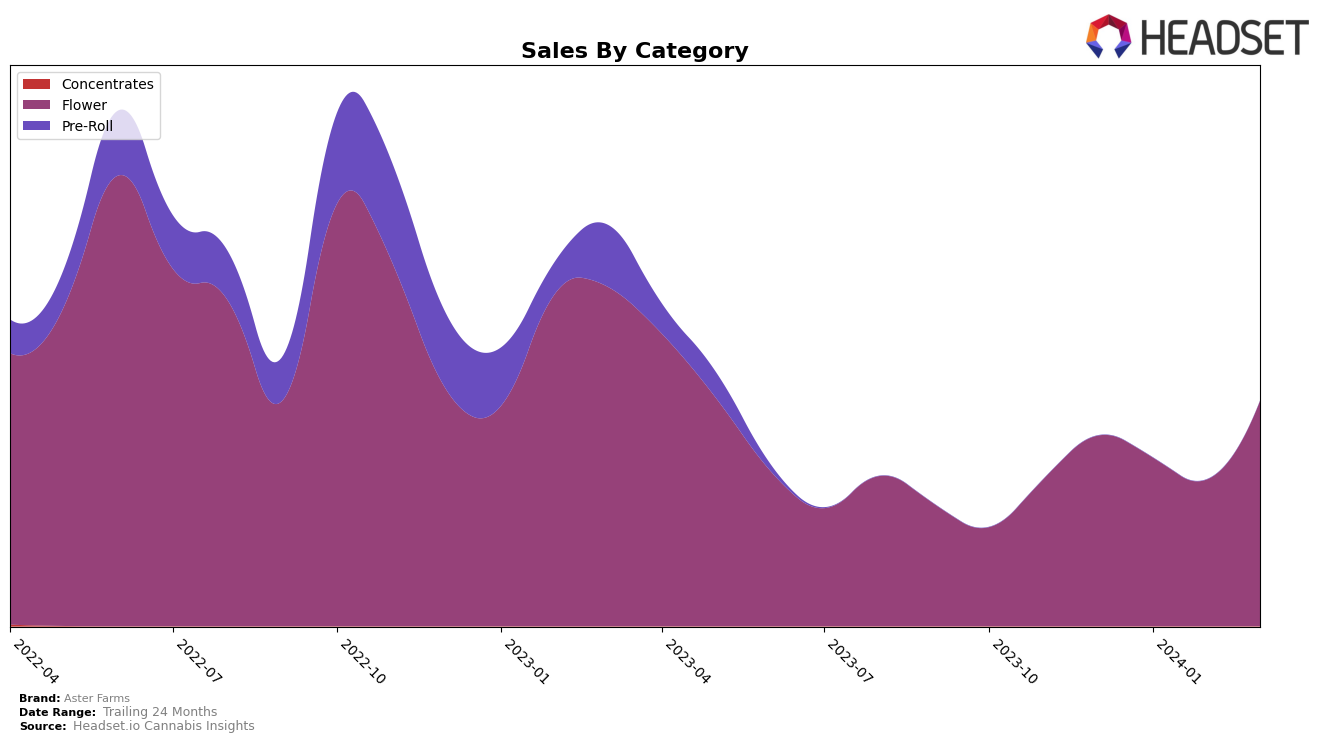

In the competitive cannabis market of New York, Aster Farms has shown a noticeable performance in the Flower category. Starting from December 2023, the brand was ranked 24th, indicating a solid presence within the top 30 brands for that month. However, there was a slight dip in their ranking in January 2024, where they dropped to the 30th position, barely holding onto their spot in the top 30. This decline continued into February 2024, where they unfortunately fell out of the top 30 rankings, indicating a period of struggle for the brand. Despite this setback, March 2024 saw a positive turnaround with Aster Farms climbing back to the 27th position. This recovery is underscored by a significant increase in sales from February to March, from 73,627 to 116,495, showcasing a potential resurgence in consumer interest and market positioning.

The fluctuating rankings of Aster Farms in New York's Flower category highlight the brand's resilience and ability to navigate the competitive landscape. Falling out of the top 30 in February 2024 could be seen as a low point, but the subsequent rebound in March 2024 demonstrates the brand's potential for recovery and growth. This journey through the rankings, coupled with the tangible sales increase in March, suggests that Aster Farms may be on an upward trajectory, adapting to market demands and consumer preferences. However, maintaining this momentum will be crucial for Aster Farms as they continue to compete in the dynamic and ever-changing New York cannabis market. The brand's ability to bounce back into the top 30, despite previous setbacks, is noteworthy, yet the challenge lies in sustaining this performance and climbing even higher in the rankings.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Aster Farms has experienced a fluctuating trajectory in terms of rank and sales from December 2023 to March 2024. Initially not in the top 20, Aster Farms saw a slight decline in rank from December to February before making a notable improvement in March. This is in contrast to its competitors, such as Aeterna and Rolling Green Cannabis, who consistently maintained their positions within the top 25 during the same period, with Rolling Green Cannabis showing a particularly strong performance in sales and rank. Meanwhile, Honest Pharm Co saw a significant drop in rank, falling outside of the top 50 in February, despite a recovery in March. High Priority (NY) demonstrated a remarkable improvement, climbing from not being in the top 20 to a higher rank than Aster Farms by March. The directional trends indicate that while Aster Farms is improving, the competition is stiff, with some brands showing stronger sales growth and rank stability, potentially affecting Aster Farms' market position and strategy moving forward.

Notable Products

In March 2024, Aster Farms' top-performing product was Forbidden Punch (3.5g) in the Flower category, maintaining its number one rank from February with a sales figure of 793 units. Following closely, Jelly Nectarine (3.5g) and Skin Contact (3.5g), also from the Flower category, secured the second and third positions, respectively, showcasing the brand's dominance in this category. Razzberry (14g) and Mango Haze (14g) rounded out the top five, indicating a strong preference for Flower products among Aster Farms' offerings. Notably, Forbidden Punch (3.5g) was the only product among the top five to have been ranked in the previous month, suggesting a significant shift in consumer preferences or inventory availability. This analysis highlights the dynamic nature of product popularity, with new entries making a strong showing in the latest month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.