Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

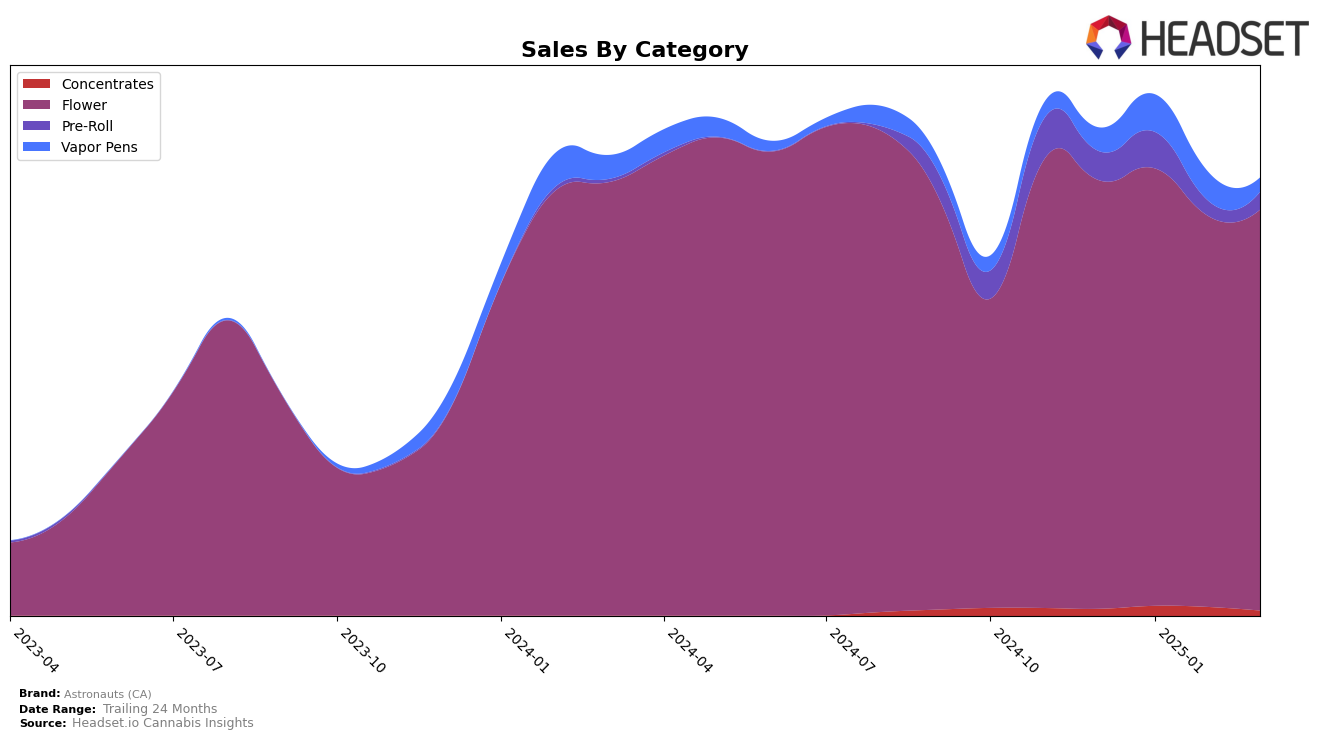

In the highly competitive cannabis market of California, Astronauts (CA) has demonstrated notable performance across various product categories, though with some fluctuations in their rankings. In the Flower category, the brand has maintained a consistent presence within the top 30, with slight movements from 24th place in December 2024 to 27th in March 2025. This consistency indicates a stable demand for their Flower products despite a minor decline in sales volume over the months. However, in the Concentrates, Pre-Roll, and Vapor Pens categories, Astronauts (CA) did not rank within the top 30, suggesting room for growth and increased market penetration in these segments.

Examining the broader trends, Astronauts (CA) seems to have a strong foothold in the Flower category, which might be their primary focus or strength. However, the absence of top 30 rankings in Concentrates, Pre-Roll, and Vapor Pens categories in California could be seen as a potential area of concern or opportunity, depending on the brand's strategic goals. It is essential for the brand to analyze these trends and possibly enhance their offerings or marketing strategies in these categories to capture a larger market share. The shifts in rankings and sales figures provide valuable insights into consumer preferences and the competitive landscape, which Astronauts (CA) can leverage to refine their approach and optimize their market performance.

Competitive Landscape

In the competitive landscape of the Flower category in California, Astronauts (CA) has experienced fluctuating rankings, moving from 24th in December 2024 to 27th by March 2025. This indicates a slight decline in competitive positioning, despite relatively stable sales figures. Notably, Yada Yada consistently outperformed Astronauts (CA), maintaining a higher rank throughout the period, peaking at 20th in January 2025. Meanwhile, Dab Daddy showed a significant improvement, climbing from 29th in December 2024 to 18th in February 2025, before slipping back to 29th in March 2025. This volatility among competitors highlights the dynamic nature of the market and suggests that Astronauts (CA) may need to innovate or adjust strategies to regain and improve its standing in the competitive California Flower market.

Notable Products

In March 2025, Space Lollipops (3.5g) from Astronauts (CA) maintained its position as the top-performing product, securing the number one rank with sales of 5,952 units. Space Gelato (3.5g) climbed to the second spot from fourth in February, showing a strong performance with an upward trend. Space Mamba (3.5g) experienced a decline, dropping from second to third place, indicating a decrease in sales momentum. Space Lemon Cherry (3.5g) entered the rankings at fourth, demonstrating a consistent presence after a brief absence in February. Meanwhile, Space Sour (3.5g) appeared on the list for the first time, debuting at fifth place, suggesting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.