Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

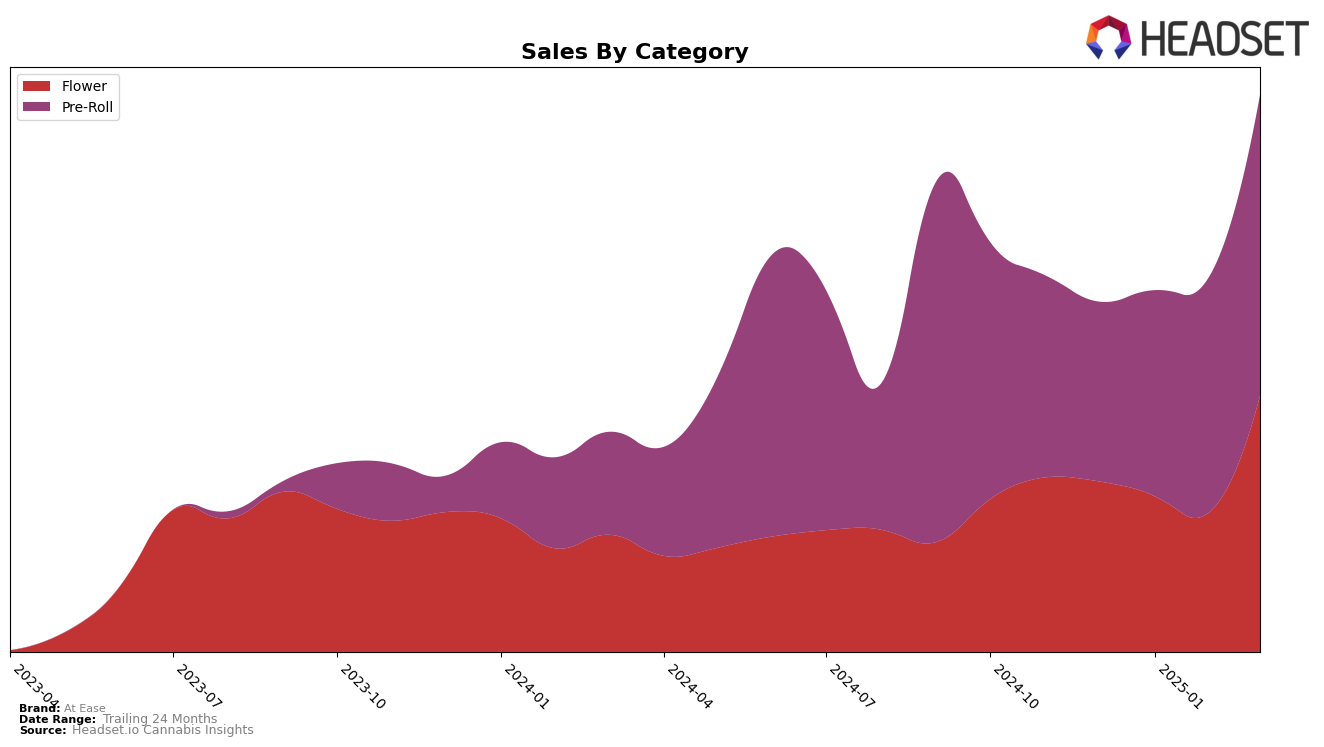

In the state of Massachusetts, At Ease has shown notable progress in the Flower category. From December 2024 to March 2025, the brand has climbed from a rank of 69 to 50, indicating a positive trajectory. This upward movement is particularly impressive given that they were not even in the top 30 at the start of this period. The sales figures reflect a significant increase, with March 2025 sales reaching a peak, suggesting a growing consumer preference for their Flower products. However, the brand's earlier ranks suggest there may have been challenges in gaining traction initially, which they seem to have overcome by March.

In contrast, At Ease has consistently performed better in the Pre-Roll category in Massachusetts. The brand has maintained a strong presence, improving its rank from 42 in December 2024 to 26 by March 2025. This steady climb into the top 30 highlights the brand's effective strategy in this category. The sales trend supports this positive movement, with each month showing an increase, culminating in a substantial sales figure in March 2025. The consistent improvement in rank and sales in the Pre-Roll category suggests a robust market strategy that could serve as a model for their efforts in other categories.

Competitive Landscape

In the Massachusetts Pre-Roll category, At Ease has shown a promising upward trajectory in terms of rank and sales over the past few months. Starting from a rank of 42 in December 2024, At Ease has climbed steadily to reach the 26th position by March 2025, indicating a consistent improvement in market presence. This positive trend is further highlighted by a significant increase in sales, with March 2025 figures surpassing those of December 2024. In comparison, Shaka Cannabis Company experienced a decline, dropping from 20th to 27th place, while Pioneer Valley also saw a downward shift from 15th to 23rd. Meanwhile, Farmer's Cut has shown volatility, moving from 44th to 24th, but with fluctuating sales figures. These dynamics suggest that At Ease is gaining traction and could potentially continue to improve its standing if the current trends persist, making it a brand to watch in the competitive Massachusetts Pre-Roll market.

Notable Products

In March 2025, the top-performing product from At Ease was Pineapple Express Pre-Roll (1g), maintaining its lead in the Pre-Roll category with sales of 2,726 units. Zsweet Inzanity Pre-Roll (1g) climbed to the second position, up from its previous rank of first in December 2024, achieving a notable sales figure of 2,596 units. MAC V2 Pre-Roll (1g) secured the third spot, showing a consistent performance with a slight increase from its second place in February 2025. Banana OG Pre-Roll (1g) improved its standing to fourth place from fifth in February, while MAC 1 Pre-Roll (1g) rounded out the top five, dropping slightly from fourth to fifth position. These shifts highlight dynamic changes in consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.