Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

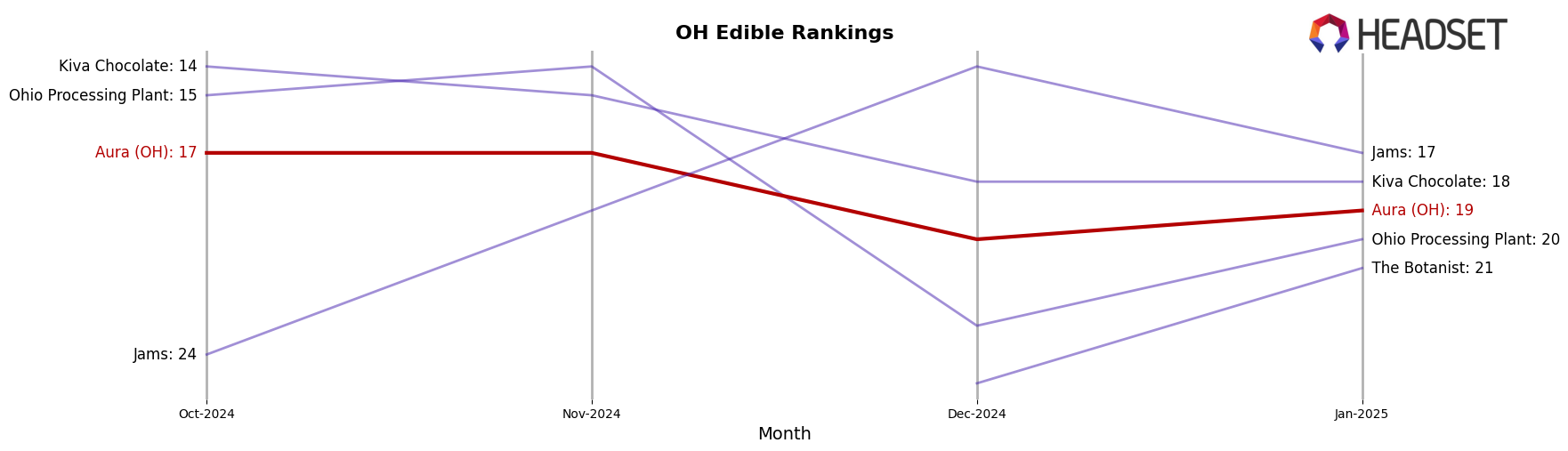

Aura (OH) has shown varied performance across different product categories in Ohio. In the Edible category, the brand maintained a steady presence, consistently ranking within the top 20, though it saw a slight decline from 17th to 19th place from October 2024 to January 2025. This movement correlates with a decrease in sales over the same period, suggesting potential challenges in sustaining consumer interest or competition from other brands. In contrast, the Topical category has been more stable, with Aura (OH) holding onto the 7th or 8th position, indicating a strong foothold despite a drop in sales figures. This stability in ranking suggests a loyal customer base or effective product differentiation in this category.

When examining the Vapor Pens category, Aura (OH) experienced a notable decline, slipping out of the top 30 by January 2025 after previously holding the 43rd position in October 2024. This drop-off could be indicative of increased competition or a shift in consumer preferences, posing a significant challenge for the brand in this segment. The absence from the top rankings in January highlights a critical area for potential strategic realignment or marketing efforts. Overall, while Aura (OH) maintains a strong presence in certain categories, the fluctuations in rankings and sales across others underscore the dynamic and competitive nature of the cannabis market in Ohio.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ohio, Aura (OH) has experienced fluctuating rankings from October 2024 to January 2025, reflecting a dynamic market environment. Aura (OH) maintained a consistent rank of 17th in October and November 2024, before slipping to 20th in December and slightly recovering to 19th in January 2025. This trend suggests a competitive pressure from brands like Jams, which improved its position significantly, moving from 24th in October to 14th in December, before settling at 17th in January. Meanwhile, Kiva Chocolate and Ohio Processing Plant showed a downward trend, with Kiva Chocolate dropping from 14th to 18th and Ohio Processing Plant from 15th to 20th over the same period. The Botanist, although not present in the top 20 until December, made a notable entry at 25th and improved to 21st by January. These shifts highlight the competitive challenges Aura (OH) faces, particularly from emerging and improving brands, which may impact its market share and necessitate strategic adjustments to maintain and enhance its position in the Ohio edible market.

Notable Products

In January 2025, the top-performing product from Aura (OH) was the CBC/THC 3:1 Strawberry Crunch Gummies 11-Pack (110mg THC, 330mg CBC), which climbed from fourth place in December 2024 to secure the first position, with notable sales of 600 units. The Blue Raspberry Crunch + CBN Gummies 12-Pack (110mg) maintained its strong performance, ranking second, although its sales decreased from previous months. The CBD/THC 1:1 Watermelon Crunch Gummies 11-Pack (110mg CBD, 110mg THC) entered the rankings at third place, showing a promising start. The CBG/THC 1:1 Grape Crunch Gummies 10-Pack (110mg THC, 110mg CBG) experienced a significant drop, falling from first place in December 2024 to fourth in January 2025. Lastly, the Blue Raspberry + CBN Crunch Gummies 10-Pack (110mg) debuted in the rankings at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.