Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

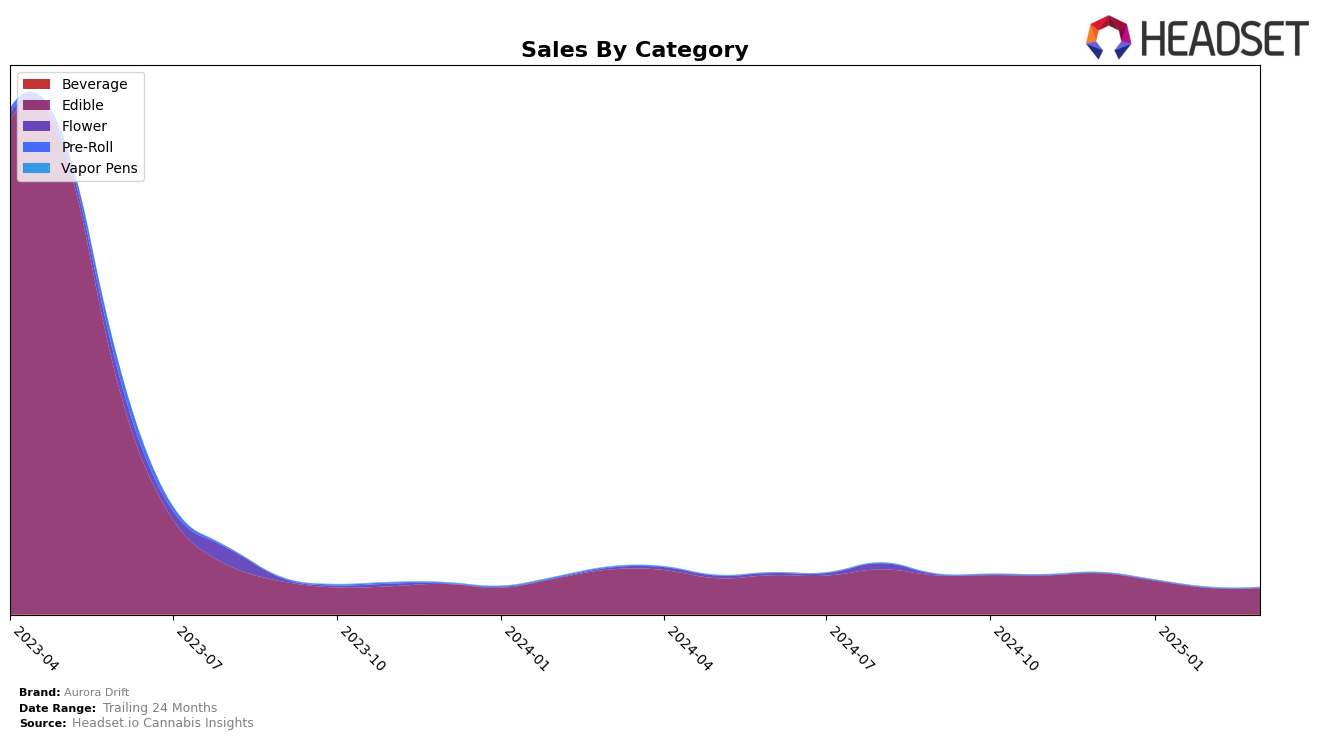

Aurora Drift's performance in the edible category across Canadian provinces has shown some fluctuations over the months. In Alberta, the brand has experienced a slight upward trend, improving from a rank of 15 in December 2024 to 14 in January 2025, dropping to 17 in February, and then climbing back to 14 by March 2025. This suggests a resilient presence in the Alberta market despite some volatility. Meanwhile, in British Columbia, Aurora Drift started strong with a rank of 12 in December but faced a gradual decline to 15 by March, indicating a need to address competitive pressures or consumer preferences in the region.

In Ontario, Aurora Drift maintained a consistent rank of 16 throughout the observed months, which could imply a stable but stagnant position in this market. The consistency in Ontario might be seen as a positive sign of reliability, yet it also highlights an area for potential growth or innovation to improve rankings. Notably, the brand did not appear in the top 30 in any other state or province outside these three, which may indicate limited market penetration or strategic focus. This absence from other regions could be a point of concern or an opportunity for expansion, depending on the company's broader objectives.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ontario, Aurora Drift consistently maintained its position at rank 16 from December 2024 through March 2025. Despite this steady ranking, its sales showed a downward trend, decreasing from December to March. In contrast, Fly North and Rosin Heads both ranked higher, at positions 15 and 14 respectively, with Rosin Heads showing a more robust sales performance, particularly in January and February. Meanwhile, San Rafael '71 and Glenn's trailed behind Aurora Drift, consistently ranking 18th and 17th. This suggests that while Aurora Drift has maintained a stable rank, its competitors are either closing the gap in sales or outperforming in terms of growth, indicating a potential need for strategic adjustments to bolster its market position.

Notable Products

In March 2025, Aurora Drift's top-performing product was the Glitch - Strawberry Lemonade Gummy (10mg), maintaining its number one ranking for four consecutive months with a notable sales figure of 18,276 units. The Glitch - Berry Cherry Gummy (10mg) secured the second position, consistent with its performance in February, showcasing stable demand. The Glitches- Pomegranate Berry Gummy (10mg) remained in third place, indicating consistent popularity among consumers. Raspberry Gummies 4-Pack (10mg) improved its ranking to fourth place, up from fifth, showing a positive trend in sales. Meanwhile, Glitches - Pomegranate Berry Chews 10-Pack (100mg) dropped to fifth place, indicating a slight decrease in consumer preference compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.