Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

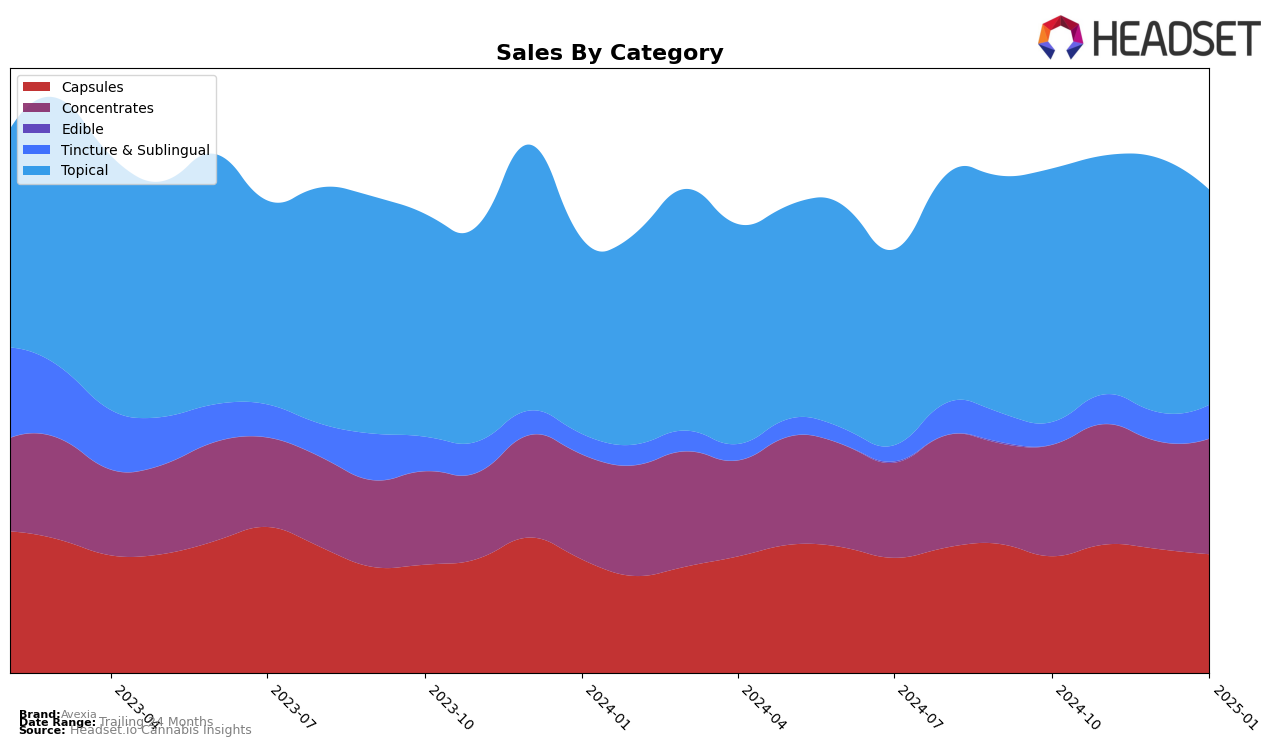

Avexia's performance across different states and product categories showcases a mix of consistency and variability. In Illinois, Avexia has maintained a stronghold in the Topical category, consistently ranking first from October 2024 through January 2025. This stability is mirrored in the Capsules category, where they held the second position throughout the same period, despite a noticeable dip in sales from December to January. However, their performance in the Concentrates category in Illinois has seen some fluctuation, with a slight improvement from 17th to 14th place by January 2025. In Massachusetts, Avexia's presence is less dominant, especially in the Concentrates category, where they failed to make it into the top 30 by December 2024, indicating a potential area for growth or re-evaluation.

In Maryland, Avexia shows a strong performance in the Capsules category, starting and ending in second place, with a brief dip to fourth in December 2024. Their Topical products also held the top position throughout the four-month period, despite a decline in sales. Interestingly, their Concentrates category saw an improvement, moving into the top 30 by November 2024 and maintaining a rank around the 20th position. Meanwhile, in Ohio, Avexia's Tincture & Sublingual products have been consistently ranked fourth since November 2024, while their Topical products experienced a slight decline from second to fourth place by January 2025. This suggests a stable yet competitive market presence in Ohio, particularly in the Tincture & Sublingual category.

Competitive Landscape

In the Illinois topical cannabis market, Avexia has consistently maintained its top rank from October 2024 through January 2025, demonstrating its strong market presence and customer loyalty. Despite fluctuations in sales, Avexia's leadership position remains unchallenged, with competitors like Nature's Grace and Wellness and Doctor Solomon's trailing behind. Notably, Nature's Grace and Wellness experienced a drop in rank from second to third place in November 2024, while Doctor Solomon's improved its position during the same period. These shifts highlight the dynamic nature of the market, yet Avexia's ability to consistently outperform its competitors in both rank and sales underscores its dominant position. This stability suggests a well-established brand loyalty and effective market strategy, making Avexia a formidable leader in the Illinois topical category.

Notable Products

In January 2025, Avexia's CBD/THC 1:1 Harmony Pain Relief Balm continued its reign as the top-performing product, maintaining its number one rank for four consecutive months despite a decrease in sales to 8,790 units. The CBD/THC 4:1 Relief Tablets held steady in second place, showing consistent performance across the months. The CBN/CBD/THC 1:1:1 Comfort Tablets also retained their third position, indicating stable consumer interest. Notably, the CBD/THC 1:1 Harmony Micro-Dosed Tablets climbed to fourth place in December 2024 and maintained this position in January 2025, surpassing the CBG/THC 1:1 Balance Tablets, which dropped to fifth place. Overall, Avexia's product lineup demonstrates strong consumer loyalty and consistent sales performance across its top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.